Don’t Believe the Media Hype Around Offshore Asset Protection Trusts

Ever since the Panama Papers, bashing the offshore asset protection industry has been chic. Every publisher on the planet has put out articles on how the rich abuse the system, hide their assets in offshore asset protection trusts, and don’t pay their fair share of taxes. The problem is that very few writers truly understand the industry and the complex web of worldwide tax laws in play. They tend to focus on the laws of jurisdictions such as the Cook Islands and ignore how those laws interact with those of the client’s home country.

This results in one sided and naive articles by good writers who can’t get beyond the hype surrounding their subject matter. They see only the tip of the iceberg and miss the mountain lurking below the surface.

These articles create great risk for U.S. citizens who read them as “how to” guides rather than the tales of injustice and inequity they’re meant to be. They do harm to U.S. citizens who contact an offshore provider to “do as they read” and get crushed by the system.

I know this to be true because I get calls everyday from people who want to incorporate offshore. They want tax savings like Apple and Google or asset protection as described in The New York Times. They don’t want to do anything illegal, they just want to use these amazing trusts and corporations they read about.

In most cases, I tell them tax savings is impossible because their business is too small (unless they move out of the United States and qualify for the Foreign Earned Income Exclusion) and that it’s too late to protect their assets. That the horses have bolted, so there’s no need to lock the barn door.

Had they called an offshore provider rather than a U.S. firm, the answer they would have received would’ve been very different. They would’ve likely been told that their business won’t be taxed in Panama or that no one has ever breached a Cook Island offshore asset protection trust. Both of these may be true, but they ignore the realities of how an offshore structure will interact with U.S. law.

My purpose here is to separate fact from fiction and explain some of the limitations of an offshore asset protection trust. My comments are in response to an October 15, 2016 post in Business Insider on offshore asset protection trusts. The title of the article is A sociologist trained to become a tax-avoidance expert — here’s what she learned about how the ultra wealthy keep their money by Brooke Harrington.

Let me start by saying that I’m not saying Ms. Harrington’s article is factually incorrect. Her post is well researched and expertly written from an offshore perspective. In fact, much of it would make great marketing collateral for a Cook Islands Trust provider (an idea she probably finds repugnant).

However, because her article fails to take into account how the laws of the Cook Island interact with those of the United States, it gives the impression that a U.S. person can move their assets offshore with impunity. The fact that this will create confusion in a small subset of her readers is an unintended consequence of a lay person writing on offshore asset protection and publishing to a global audience.

For example, an American going through a divorce might read her article, call up a Cook Islands agent, be told what they want to hear, and move their assets out of the reach of their spouse. This will create a world of pain in the United States, no matter how the trust is viewed under Cook Islands law.

The author is not giving legal advice nor advocating for offshore asset protection trusts. I assume her purpose is quite the opposite – to expose inequity and argue against the availability of these structures. Nor is she writing only for Americans, though one of her three examples is a U.S. case.

However, by publishing on major platforms like Business Insider and The Atlantic, her words will reach those who can act upon them. People who will believe the hype to their detriment.

Here’s a little background: Brooke Harrington is an associate professor of economic sociology at the Copenhagen Business School. The article referenced here is soon to be a book published by Harvard University Press about elite occupational groups within finance and their impact on international law and stratification.

She’s spent 8 years researching the international wealth-management profession and was so committed that she trained to become a wealth manager. She wrote, “I spent weeks in hotel conference rooms in Switzerland and Liechtenstein learning about trust and corporate law, financial investment, and accounting. Ultimately, this earned me the “Trust and Estate Planner” qualification (TEP): an internationally recognized credential in wealth management, much like the CPA for accountants.”

- A CPA requires a 4 year college degree, though most in the United States go 6 to earn a master’s degree. A CPA also requires passing a difficult exam and 500 hours of documented work experience (usually for free in service of a CPA firm).

Even with all of that training, none of which was in the United States, she misses the elephant in the room: the fact that the laws of the settlor’s or defendant’s home country will often control the tax and asset protection benefits of their offshore structure.

If someone with this many hours of training can’t see the forest for the trees, what chance do less committed lay writers have? This is why so many get it wrong.

Here are a few of the sections of the article that might mislead a U.S. citizen:

Quote: “Looking at a costly divorce? No problem—just hire a wealth manager to put your assets in an offshore trust. Then the assets are no longer in your name, and can’t be attached in a judgment. Even if a foreign court sought to break your trust, if you have a clever enough wealth manager, you can be made effectively judgment-proof. Consider the case of the Russian billionaire Dmitry Rybolovlev, who has just settled what has been termed “the most expensive divorce in history.”

Although a Swiss court initially awarded half of Rybolovlev’s roughly $9 billion fortune to his ex-wife, Elena, an appeals court later ruled that most of those assets are untouchable in the divorce settlement because they are held in trust or are otherwise inscrutable to the law. (The amount of the agreed-upon settlement has not been disclosed.)”

Answer: Americans, don’t get it twisted. You’re NOT Russian oligarchs free to do as you like. Putin doesn’t have your back (unless your name is Trump or Snowden).

You’re a U.S. citizen and subject to our laws first and foremost, no matter what your offshore estate planner tells you. If you set up an offshore trust to cut out your current spouse, you’re more likely to end up behind bars than on a beach in the Cook Islands. Here’s why:

Anytime you convey an asset in order to delay a creditor, you’re engaging in fraudulent conveyance. If you’re aware that your assets are at risk and should be used to satisfy a legal obligation and you move that asset out of reach, you have NOT committed a crime. Exceptions would be if there is actual fraud or crimes related to hiding assets from a bankruptcy court.

However, moving community or joint property out of the United States without your spouse’s consent, or to prevent a court from administering a division of assets, can be a crime. You may be charged with theft, embezzlement, etc.

Rather than going through all the trouble of charging and convicting you of a crime, a judge can simply hold you in contempt until you return the assets.

In most divorce cases, the judge issues a “standing order” instructing each party not to do certain things, such as take each other’s money. If you violate that order by sending community / joint property offshore, you can be held in contempt of court, fined, and jailed.

And don’t think that the “impossibility defense” will save you from a contempt charge. While impossibility is a defense to civil claims, self-created impossibility is not a defense to fraudulent conveyance. Nor will a judge accept this defense in a divorce case. After a few weeks or months of cooling off in the local jail, you’ll probably see your way clear to instructing your offshore trustee to bring the cash back to the U.S.

Note that there are legitimate uses of offshore asset protection trusts in divorce cases. For example, to hold separate property that you came into the marriage with and both parties agree will remain separate. If you’re already married, you might use a transmutation agreement to separate your assets and then fund an offshore trust.

Quote: “No litigant on earth has been able to break a Cook Islands trust, including the U.S. government, which has repeatedly been unable to collect on multi-million-dollar judgments against fraudsters convicted in federal court. These include infomercial king Kevin Trudeau, the author of a series of books on things “they” don’t want you to know, as well as an Oklahoma property developer who defaulted on his loans from Fannie Mae.

Since 2007, the two have owed Uncle Sam $37.5 million and $8 million respectively, and they have employed some clever wealth-management strategies to avoid paying those judgments. With their fortunes secure in Cook Islands trusts—on paper, at least—there is no way for the U.S. government to force payment unless it wants to send a legal team on the 15-hour journey to Rarotonga (capital of the Cook Islands), where the case would be argued under local laws.

Needless to say, those laws are not very favorable to foreigners seeking to access the assets contained in local trusts.”

Answer: The concept that “no litigant on earth has been able to break a Cook Islands trust,” is very dangerous. Going into battle with the U.S. government with that mindset will be disastrous. It may be true that your assets are safe in the Cook Islands, but your most important asset will likely be sitting in jail.

When I (a U.S. practitioner) write about the strength of an offshore asset protection trust, I say that the Cook Island Trust gives you maximum protection against future civil creditors. It’s not intended to protect you from the IRS, SEC, or other government creditors. Nor is it meant to protect against current or reasonably anticipated creditors.

Using the trust to protect assets from current or reasonably anticipated civil creditors creates the fraudulent transfer issue mentioned above. The quickest way to break an offshore trust is to hold the settlor in contempt until the money is returned to the U.S. The court doesn’t need to break the trust when it can break the defendant.

So long as you create and fund the offshore trust well before the cause of action or debt arises, you will avoid the fraudulent conveyance issues. That is to say, a fraudulent transfer is one that is made after the harm has occurred. If you’re proactive, you can avoid the issue and your trust will hold up against civil creditors.

Going to battle with the United States government is a different matter. Just about any case can be escalated to a criminal charge, which makes transferring assets offshore or using an offshore trust very high risk. Also, a judge is more likely to hit you with contempt of court for refusing to pay the U.S. government than the average civil creditor.

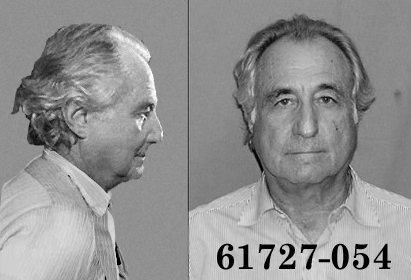

As noted in the article, Kevin Trudeau has about $37 million offshore and untouched by the U.S. government. The same goes for Mark Rich with $100 million in a Cook Island Trust and Allen Stanford with a “sizable” offshore asset protection trust on the island. Mr. Trudeau is serving 10 years, Mr. Stanford 110 years, and Mr. Rich was pardoned by Bill Clinton. All of them chose the Cook Islands to protect their assets.

Let’s focus on Ms. Harrington’s example of Kevin Trudeau. Mr. Trudeau was sentenced for criminal contempt for violation of multiple court orders and failure to pay a $37 million fine. The 10 years he got is extremely unusual for a contempt of court charge. Had he closed the trust and paid the bill he might have done a year or two, but certainly not 10.

Keep in mind that one of the primary reasons Mr. Trudeau is doing time is his Cook Island trust. He chose to do the time rather than pay the fine. I would never hold him out as the poster boy for the benefits of a Cook Islands asset protection trust!

You might be thinking that you’d trade $37 million for 10 years in a low security prison. Well, it’s unlikely Mr. Trudeau will ever see his money.

For example, all the revenues from his books and business are being taken by the court. As of October 2015, the trustee had collected $8 million in royalties from the sale of Mr. Trudeau’s books while he was incarcerated. It was used to give a partial refund to more than 820,000 people who bought his book, The Weight Loss Cure “They” Don’t Want You to Know About.

Assuming good behavior, he will do about 85% of the time, or 8.5 years. When he gets out, he’s looking at years of probation. He will not be allowed to travel internationally during this time and any money he makes will be paid to the U.S trustee overseeing his finances.

Let’s say he’s off paper in 2023. Now the U.S. government has a few more tricks up their sleeve. They may refuse him a passport or file additional contempt charges for refusing to pay his debt. Prosecutors can also make his life hell while on probation, causing him to violate and be returned to jail.

- A U.S. passport is a privilege and not a right. In 2016, the IRS and other government agencies have used passport revocations and refusals to renew as a weapon against tax debtors. If Mr. Trudeau can’t travel abroad, he won’t be able to spend his cash.

- For an article on the topic, see: Warning: The IRS Can Now Revoke Your Passport

So, it’s true that a Cook Islands Trust will protect your assets from the U.S. government. These trusts have never been broken and the United States seems unwilling to litigate on the Island. However, many Americans have been broken by U.S. judges over the years.

Unless you’ve made a sizable donation to the Clinton Foundation (Mark Rich), or are willing to do 10 years for your principals, I don’t recommend going to battle with the U.S. government with an offshore asset protection trust. While the trust will remain intact, the government will make an example of you as they did and will continue to do with Mr. Trudeau.

When the options are pay up or go to jail, most pay. For this reason, offshore asset protection trusts are the best protection available against future civil creditors. Don’t let the hype confuse you into thinking they’re a magic bullet protecting you from the IRS, FTC, SEC, or any other three letter agency.

I’ll leave you with this: You must hire an attorney in your country to form your offshore trust. The key to a successful asset protection structure is combining the laws of your home country with those of a more favorable and defendant friendly offshore jurisdiction. Only a U.S. attorney can advise a U.S. citizen on how to work within the system and maximize the value of an offshore trust.

I hope you’ve found this article on the hype vs. the reality of offshore asset protection trusts to be helpful. Please contact me at info@premieroffshore.com or (619) 483-1708 for a confidential consultation on this and other international asset protection and trust topics.