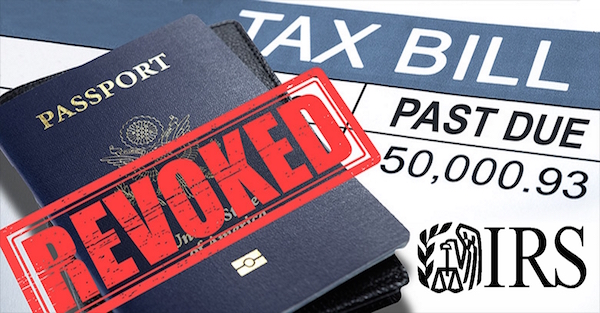

Warning: The IRS Can Now Revoke Your Passport

This is an urgent warning for Americans living, working, investing, or doing business abroad. The IRS now has the authority to revoke your passport. If you have unfiled tax returns or you owe more than $50,000, the government can take away your US passport. Also, the Service can now refuse to issue a passport to anyone owing more than $50,000.

On December 4, 2015, President Obama signed into law H.R. 22, a 5-year, $305 billion infrastructure spending bill to address the nation’s aging and congested transportation systems. Buried on page 1,113 of this massive bill was a chapter titled Revocation or Denial of Passport in Case of Certain Tax Delinquencies. This section gives the IRS control over your person and your right to travel, live, work, bank, invest, protect your assets, and conduct business outside of the land of the free.

The government tried this same back in 2012, but it was met with resistance from all sides. In fact, the suggestion never made it out of committee. This time around, things were different. The change to our tax code was tagged onto a bill that either no one read or no one had the guts to stand up to. Apparently the need for infrastructure improvement and the amount of pork it would bring to so many States, not to mention the need to increase revenues from the producers, trumped your right to travel, self determination, and to international commerce.

H.R. 22 adds section 7345 to the Internal Revenue Code. The law says the State Department can revoke, deny or limit passports for anyone the IRS certifies as having a seriously delinquent tax debt in excess of $50,000.

- I read this to mean that the IRS can revoke your passport if you owe back taxes or have unfiled returns. This is because failure to file typically results in returns being prepared by the IRS computers on your behalf, no human intervention or review required. These computer generated return create a balance due and then a tax debt. See SFRs below for more information.

The amount of $50,000 includes interest and penalties, so it’s a very low threshold. If your tax debt has been around for a few years, it’s common for 50% to 75% of the amount owed to be from interest and penalties.

The standard FBAR penalty starts $10,000 per year and can reach as high as $100,000. The same goes for Foreign Corporate returns. Specifically, IRC Section 6038(b)(1) provides for a penalty of $10,000 for each Form 5471 that is filed after the due date.

This is all to say, $50,000 is pocket change when it comes to a tax dispute involving an offshore company or business.

- To read the bill that takes away your freedom of movement, here’s H.R. 22 – Fixing America’s Surface Transportation Act, the “FAST Act.

Here’s how a tax debt gets “certified” without you ever being notified.

Let’s consider the word “certify” for a minute. As I said above, anyone the IRS certifies as having a seriously delinquent tax debt in excess of $50,000 is at risk. The IRS can “certify” a debt by simply printing out a report showing their internal processes were followed and that the computer says you owe money. No need to prove their case in court, get a judgment or collection order from a judge as is required in all other civil cases, audit the file, or even telephone the taxpayer and ask for an explanation. If the computer says you owe money, your passport can be revoked or refused.

Let’s say you’re living abroad and haven’t filed your tax returns for a year or two. The IRS computers get a report of your offshore accounts under FATCA and generate what are called Substitutes for Returns (SFRs). SFRs are prepared on your behalf using whatever data the computers has with zero deductions, exemptions, or expenses. The balance due from an SFR is always much higher than had you prepared a proper return.

Once the SFRs are entered into the system, a notice is mailed to your last known address informing you of the amount due. After a few notice, a final letter called a CP-504 is sent certified mail. If you don’t contest this bill in tax court within 30 days, the amount becomes final and payable.

The IRS can now “certify” the debt, file a tax lien, and revoke your passport. It matters not that you never received any of the letters. Their only obligation is to mail notices to your last known address using traditional US mail. If you’ve moved, or letters never reach you because you are abroad, that’s your problem. No one will search for you or call you at this stage of the process.

A warning for Expats:

I get calls all the time from people who assume they don’t need to file returns if their income is under the Foreign Earned Income Exclusion amount. They are living abroad, never set foot in the US, and make under $100,000. Americans abroad all to often think they aren’t required to file. They feel no sense of urgency because, once the forms are in, no taxes will be due. Why spend money on tax preparation?

Here’s the problem with that plan: As of January 1, 2015, your foreign bank account and income has been reported to the IRS under FATCA. This data can be used to prepare SFRs, create a debt, and then the IRS has you. The IRS will not give you credit for the FEIE when they prepare an SFR.

Here are other examples of erroneous tax debts that are frequently certified by the IRS.

Let’s say you are living in the United States and recently moved. You forgot to inform the Service of the move. Someone files a report of income (Form 1099, W-2 or K-1) in error.

If you have already filed your returns, the IRS will send you a Notice of Proposed Changes. If you fail to respond to this letter, the change will be made and a tax debt created. Again, it doesn’t matter if you participated in the process or had knowledge of what was going on.

This will also apply to someone whose identity is stolen. I can’t tell you how many cases I’ve had over the years where someone’s Social Security number was used by an illegal alien to get a job. The worker gets paid under your Social with zero withholding, a W-2 was issued tied to your account and the IRS comes after you for the taxes owed.

Because the alien claimed 20 dependents, there was no withholding… no money paid to the IRS for taxes due against the wages earned. Add to this the fact that it takes several years for the IRS to come after you, and that interest and penalties are added to the balance, and you will see that $50,000 is a very low threshold.

- There were almost 2 million suspected tax identity theft incidents in 2013, the most recent data available. This compares to about 440,000 in 2010 according to the Treasury Inspector General for Tax Administration. Cases of tax identity theft are on the rise in 2014 and 2015. Click here for a list of IRS prosecutions for identity theft in 2015.

Just like in the examples above, a tax debt that involves identity theft is created and certified without the taxpayer having any idea what’s happening. This situation takes months of hard work to unwind… work that can only begin after the you find out there’s a problem. It’s now possible that the first you hear about the debt is when you are being forcibly returned to the US, your passport shredded, and your reputation destroyed.

Here’s what happens when the IRS revokes your passport:

If your passport is revoked, and you don’t have a second passport in hand, you will be prevented from traveling outside of the United States. If you’re abroad when the hammer comes down, you will be forced to return to US.

In addition to the travel issues, it will be impossible to open bank or brokerage accounts abroad, create asset protection structures, operate a business, or invest outside of the land of the free without a passport.

It matters not to Uncle Sam that forcing you to return to the US without notice will cause you significant financial harm. There is no process for an appeal… you are simply put on the first plan to the US and told to go deal with the IRS. The only good news is that the flight home is free. The bad news is that you don’t get to chose your travel date or the US city in which you are deposited (usually a major hub).

- You’d better hope to God your credit cards are working or you’ll be sleeping on the street in Miami or Houston until someone sends you money.

If you don’t have a second passport, there is no right to an appeal, to speak with an attorney, plead your case to a judge in your country, nor any way to stop the airport from sending you back to face the Service. Without valid travel document you are in legal limbo and have no recourse or rights.

You see, the IRS will revoke your passport while you are in transit. They know when you are flying from one country to another and will revoke your passport while you are in the air with a few keystrokes.

When you land and attempt to enter your destination country, you find your passport’s invalid. The airline is now required to return you to the country that issued your passport. You have no right to an attorney, no right to enter the country to fight the claim of a certified debt, and no right to an appeal.

You will be held in the transit area under guard until being put on the next flight. Think of Tom Hanks in The Terminal (2004) and Edward Snowden. Unless Mr. Putin comes to your rescue, you are headed back to the States.

Being denied admission to a country is not the same as being extradited. Once you are in a country, you have all the rights conveyed by their legal system and courts. When you’re in transit, you have no rights… you are at the mercy of the country whose passport you hold. If you don’t have a valid travel document, your only choice is to return to your home country.

Here’s what you can do to protect your freedom:

Your best defense against H.R. 22 is a Second Passport. With a second passport in hand, you are in control. You can leave the US, do business abroad, access your foreign assets, open bank accounts, and generally live your life where you wish.

If you are caught at an airport, and you have a second passport, you can’t be forcibly removed to the US. You do have a valid travel document and must be allowed to continue on your way.

Even if the country you were attempting to enter sides with the US and denies you entry, you can pick any departing flight to a country that allows visa free travel on your second passport. For this reason, we value second passports based on the number of visa free countries they offer.

You can only be forced to return to the US if you don’t have a valid travel document / second passport in hand. For this reason, it is the first, best, and possibly the only defense against the Internal Revenue Service.

There are four ways to get a second passport:

- By heritage. If your parents or grandparents were born outside of the United States, you may be eligible for citizenship from their original country. If you would like us to review your heritage options, please send an email to info@premieroffshore.com.

- By marriage. Most countries grant residency and then citizenship to the spouse of a citizen.

- By investment or cash payment. You can make an investment and/or pay cash to get a second passport immediately. If you don’t qualify for a second passport by family lineage, and have the money to spend or invest, we can help.

- Earn citizenship through residency. In some countries, you can become a resident, contribute to their economy and culture, and earn the right to apply for citizenship after a few years.

Several quality countries will sell you a second passport for the right price. Cash offers start at about $300,000 all-in and will exceed $1 million for a top tier EU passport (Malta and Austria). For a list of countries and programs, see: 10 Best Second Passports.

As you can see, second passports are expensive and not for everyone. The next best thing is to residency with a path to citizenship. For example, if you qualify, you can become a resident of Panama for about $8.600. Once you have residency, you can enter Panama using your visa and identification card.

Also, as a resident you have more rights to contest an attack by the IRS. A tourist has little or no standing, but a resident has been given status by the fact that he or she is a lawful member of the community.

Finally, a resident may stay in a country as long as they wish. A tourist must usually travel outside the country every four or six months, putting them at risk each and every trip. Also, if you’re caught overstaying your tourist visa, you can be removed from the country… something that is common in Latin America.

Most importantly, some forms of residency lead to citizenship after a few years. For example, if you’re a resident of Panama for four years, you can apply for citizenship. With citizenship comes a second passport.

Just about every country has a residency program but few lead to citizenship. The lowest cost residency options are Panama and Belize. Belize does not have a path to citizenship. A passport from Panama is an excellent travel document, so I recommend that program for anyone that wants to “earn” citizenship over a number of years rather than purchase it. For more information, please checkout our post on The Panama Friendly Nations Visa.

I hope this article has been helpful. For more information on second passports and residency programs, or to see if you qualify for citizenship through family heritage, please send an email to info@premieroffshore.com or give me a call at (619) 483-1708.

Leave a Reply

Want to join the discussion?Feel free to contribute!