This article is to clear up issues concerning employment and payroll under the tax incentive programs in Puerto Rico. These requirements for the tax incentive programs are to be used in determining how much salary you must take (taxed at ordinary rates) vs. how much corporate profits the entity can make (taxed at 4%).

Keep in mind that all employees of Puerto Rico Act 20 and 273 companies are required to take a “reasonable” salary. This salary is taxed at ordinary rates of about 35% in Puerto Rico. The 4% tax incentive rate is then applied to corporate net profits after all salaries are paid. For more on the various tax incentive programs, see: A Detailed Analysis of Puerto Rico’s Tax Incentive Programs.

It’s because of these salary requirements that I suggest small businesses, earning less than $300,000, are better off operating offshore. When you live abroad, qualify for the Foreign Earned Income Exclusion, and operate a business through an offshore corporation, you can earn up to $102,100 in salary tax free. If both a husband and wife are working in the business, they can earn a combined $200,000 tax free.

Puerto Rico’s tax incentive programs are basically the opposite of the FEIE. Your salary is taxed at ordinary rates and the profit after that salary is taxed at 4%.

If your business nets $100,000 or less offshore, you pay zero tax. If your business nets $200,000 offshore, and both spouses are working in the company, then you pay zero US tax..

Let’s say your business nets $200,000 in Puerto Rico. If you operate in Puerto Rico, you might pay yourself a salary of $100,000 (to compare apples to apples). That salary is taxed at 35%, or $35,000. Then the excess is taxed at 4%, for a total bill of $39,000. This is basically the same tax deal you have available offshore through the FEIE (you pay zero on the first $100,000 and ordinary rates on the second $100,000).

Puerto Rico’s tax incentives really begin to make a big difference as your net income increases. Let’s say you net $1 million. You pay yourself a salary of $100,000, taxed at ordinary rates, and then $900,000 is taxed at 4%. Your total tax bill is $71,000.

If that same business was operated offshore, with one employee, you would earn $100,000 tax free and pay ordinary rates on $900,000 at 35%. In this case, your net tax paid is $315,000. As your net profits increase, so do the benefits of Puerto Rico’s tax incentive program vs the FEIE.

Here’s a summary of the salary and payroll requirements under Puerto Rico’s tax incentive programs. Keep in mind that the $100,000 referenced above was simply an example… an easy way to compare Puerto Rico to the FEIE.

In 2015 the government determined that all companies under an Export Service Tax Incentive Program decree must pay a fair market salary to owner / operators. This only applies to top tier executives, and for regular level positions labor law changed in 2017, and employee requirements also changed entirely in Act 20 regs.

The following specifies how the government views top tier owners/shareholders who actively work for their tax exempt company in Puerto Rico.

Official-owner means any shareholder or partner who maintains at the end of the tax year a beneficial interest in an eligible service exporting company that:

- dedicates no less than 80% of their time to the activity eligible under the export service laws and

- is a resident of Puerto Rico during the taxable year

Any partner or shareholder, who is an employee of a company with a tax exemption decree under Act 20 / Act 273 / Act 399. All official-owners shall have a reasonable annual salary that clearly reflects their income from services rendered to the Eligible Services Company, in which they maintain a proprietary interest at the end of the taxable year.

For the purposes of the provisions of Section 1040.09 of code, a maximum limit of $ 350,000 of annual salary will be established. Therefore, in those cases in which an Official- Owners earns an annual salary of less than $350,000 for his services rendered to the company, in which he maintains a proprietary interest at the end of the contributory year, the Secretary, in his discretion will evaluate the reasonableness of said income, in comparison with the services rendered by the Official Owner, and may impose additional salaries up to a maximum of $350,000 per year in order to clearly reflect the income of Official-Owner.

The evaluation will be based on the facts and circumstances of each case considered but not limited to the economic reality of the company, the functions performed by the Official-Owner within the company’s organizational structure and the salary trend of the market in comparable positions.

Remember that the government of Puerto Rico views these tax incentive decrees is a way attracting capital. Many company owners are not reporting substantial income. So, this is just a way to assure that some form of tax is paid from even though it would be miniscule.

If you’re considering forming an Act 20 company in Puerto Rico, there’s a lot of opportunity through these tax incentive programs. This is truely tax planning while there’s blood in the streets. Due to mass loss of public service jobs in the last month ($ 500 million in budget cuts for government jobs). The peculiar political status of the island makes for a different type of professional.

The literacy rate in Puerto Rico is higher than all of the US (with Puerto Rico registering 93.3% and the US with 86% literacy rate).

Also, Act 20 just changed the employment requirements so the gate are open for a huge private sector overhaul! (See Changes to Act 20 Tax Incentive Program). To motivate job growth, this year the Puerto Rican government changed labor laws to benefits employers.

Below is a outline of the Labor reform in Puerto Rico. After that you will see the a full breakdown of labor laws in Puerto Rico.

The first big change was the initial probation period, which was changed from 3 months to 9 months. This is significant because employers now have a lot more leeway with hiring and firing employees. Facilitating longer probation periods, makes it difficult for employees to apply for bonuses, significant reductions of vacation time, sick days and so forth.

Here are the labor laws for Puerto Rico. They apply to all companies doing business on the island, both tax incentive companies such as Act 20 and standard corporations.

Article 1.2 establishes that employees hired prior to the validity of this Law (January 1, 2017) will continue to enjoy the same rights and benefits as previously had, as expressly provided in the Articles of this. This clause was inserted in the amendments of the Senate and seeks to address the claim of who applies this law.

Article 2.20, which establishes as public policy in favor of alternative procedures for the settlement of disputes related to disputes arising from the application of the law to be approved, such as mediation and arbitration provided by the Department of Labor and Resources Human Rights, including its Office of Mediation and Arbitration.

Article 3.1 of the project establishes and defines what will be overtime. As proposed, overtime will be the hours an employee works for his employer in excess of eight (8) hours during any period on a calendar day rather than twenty-four (24) consecutive hours.

The next article states that the employer may establish an alternating weekly work schedule by means of a written agreement between the employee and the employer (flexitime), which will allow the employee to complete a work week not exceeding forty (40) hours with schedules Daily that will not exceed ten (10) hours per day of work. However, if the employee works in excess of ten (10) hours per day of work, he will be compensated for hours in excess of a time and a half (NO MORE DOUBLE TIME PAY) of the agreed wage rate for the regular hours.

The accumulation of vacations and sick days will be staggered in the following order:

The minimum monthly accumulation for vacation leave will be half (1/2) day during the first year of service. After the first year of service, up to five (5) years of work service, it will accumulate at three quarters (3/4) of a day. Accumulation of (1) day after serving five (5) years of service until fifteen (15). After fifteen years of service, it will accumulate at the rate of one and a quarter (1 1/4) of a day. This last computation is the one that is used today uniformly for all the employee who works more than one hundred and fifteen (115) hours per month. Basically for the first year instead of 2 weeks vacation traditionally per year you accumulate only 6 days after 1 yrs approx 9 day, and this only applies to those working 115 + hours per month.

The sick leave was amended and is now one (1) day per month.

Article 3.21 of the bill provides that, as regards Law 180-1998, all claims of this law shall be prescriptive within a term of one (1) year, thus amending the current term of three (3) years.

Regarding the proposed amendments to Act No. 80 of May 30, 1976, it establishes a probationary period of nine (9) and twelve (12) months in certain employees under the Fair Labor Standards Act.(NO MORE 3 MONTHS OF PROBATION)

As for the compensation of the unjustifiably dismissed employee, an allowance is established for three (3) months of salary and two (2) weeks for each year of service. However, the allowance will never exceed nine (9) months of salary without distinction of the years of service.

Article 4.12 of the draft amended article 11 of Law 80, in order to eliminate the text that established the presumption that in the case of a lawsuit for unjustified dismissal, the employer had the burden of proof. The bill provides that article 11 of Law 80 only establishes that in the cases arising from Law 80, “the court shall hold a conference no later than sixty (60) days after the response to the complaint or complaint is filed, Which parties will be required to appear or be represented by a person authorized to make decisions, including the transaction of the claim. During that hearing, the parties’ arguments will be examined, the essential disputes will be identified and the possibilities for an immediate settlement of the claim will be discussed. If the claim is not settled, the court will order the discovery to be pending and expedite the date marking to hold the conference in advance of the trial. “

Likewise, the “Puerto Rico Employment Security Act” (Act No. 74 of June 21, 1956) is hereby amended to allow for the gradual increase of unemployment benefits, so that effective July 1, 2019, The minimum weekly benefit increases to sixty (60) dollars and the maximum weekly benefit increases to two hundred forty (240) dollars.

As for the Christmas bonus, any employer employing more than twenty (20) employees for more than twenty-six (26) weeks within the twelve (12) months from October 1 of any year until September 30 of the subsequent calendar year, you must grant to each employee who has worked for at least 1,330 hours or more within that period, a bonus equivalent to two percent (2%) of the total salary earned up to the amount of six hundred dollars ($ 600.00).

Basically a new Act 20 company under Puerto Rico’s tax incentive program can hire up to 19 employees without paying the Christmas bonus.

We can assist you in get a tax exemption decree and draft employment contracts, help you plan an employment strategy to avail the benefits of the new labor laws.

Puerto Rico Tax Incentive Labor law:

Be it enacted by the Legislature of Puerto Rico:

Article 2. – (29 L.P.R.A. § 271)

Eight (8) hours of work constitute the daily legal working day in Puerto Rico, Forty (40) hours of work constitute the weekly working day.

[Amendments: Law 223 of July 23, 1974; Law 83-1995]

Article 3. – (29 L.P.R.A. § 272)

They are regular hours of work eight (8) hours during any working day and forty (40) hours during any working week.

[Amendments: Law 223 of July 23, 1974; Law 83-1995]

Article 4. – (29 L.P.R.A. § 273)

These are extra hours of work:

(a) The hours an employee works for his employer in excess of eight (8) hours during any calendar day. However, the employer may notify the employee of an alternate cycle of twenty-four (24) hours, provided the notice is in writing in a term not less than five (5) days prior to the start of the alternate cycle and there are at least eight (8) hours between consecutive shifts.

(b) The hours an employee works for his or her employer in excess of forty (40) during any one week of work.

(c) The hours an employee works for his employer during the days or hours in which an

establishment must remain closed to the public by legal provision. However, the hours

worked on Sundays, when by law provision if the establishment must remain closed to the public, will not be considered overtime for the mere reason of being worked during that period.

(d) The hours an employee works for his employer during the weekly rest day, as established by law.

(e) The hours that the employee works for his employer in excess of the maximum hours of work per day set in a collective bargaining agreement.

[Amendments: Law 223 of July 23, 1974; Law 1 of December 1, 1989; Law 143-2009; Law 4-2017]

Article 5. – (29 L.P.R.A. § 273a)

For purposes of computing overtime in excess of forty (40) hours, the workweek shall constitute a period of one hundred and sixty-eight (168) consecutive hours. It shall commence on the day and at the time the employer determines and notifies the employee in writing. In the absence of notice, the work week will begin at 12:01 am on the Monday of each week. Once the employer sets the beginning of the work week, any change will need to be notified to the employee at least five (5) calendar days in advance to be effective.

[Amendments: Law 83-1995; Law 7-2002; Law 4-2017]

Article 6. – (29 L.P.R.A. § 274)

The norms and requirements for the payment of overtime will be the following:

(a) An employer who employs or permits an employee to work during overtime shall be required to pay for each overtime a salary not less than one-and-a-half times the rate of pay agreed upon for regular hours. Provided that the employees entitled to higher benefits hired prior to the validity of the “Law of Transformation and Labor Flexibility” will preserve the same.

(b) An alternate weekly work schedule may be established by a written agreement between the employee and the employer, which will allow the employee to complete a work week not exceeding forty (40) hours with daily schedules not to exceed ten ( 10) hours per work day. However, if the employee works in excess of ten (10) hours per day of work, he will be compensated for the excess hours at a rate of time and a half of the agreed wage rate for the regular hours.

(c) Voluntary or approved weekly alternating work schedule agreements may be revoked by mutual agreement of the parties at any time. However, either party may unilaterally terminate the voluntary agreement after one (1) year of its adoption.

(d) Alternate weekly work itinerary agreements adopted pursuant to this Article may be continued by a third party acquiring the business, without it being necessary to establish a new contract.

(e) The employer may grant an employee request to replenish hours not worked in the week for personal reasons of the employee. The hours thus worked will not be considered overtime when they are worked in the same week of absence, do not exceed twelve (12) hours in a day, nor exceed forty (40) hours in the week.

[Amendments: Law 223 of July 23, 1974; Law 83-1995, Law 4-2017]

Article 7. – (29 L.P.R.A. § 275)

For the purpose of determining the compensation for overtime pay when no wage type has been agreed for the payment of regular hours, the daily, weekly, monthly or otherwise agreed wage shall be divided by the total number of hours during the same period.

[Amendments: Law 83-1995, Law 4-2017]

Article 8. – (29 L.P.R.A. § 276)

An employee may request in writing a change of schedule, the number of hours or the place where he / she should do his / her job. The employee’s written request will need to specify the requested change, the reason for the request, the effective date, and the duration of the change.

The employer shall be obliged to provide a reply within a period of twenty (20) calendar days counted from the receipt of said request. In the cases of an employer with more than fifteen (15) employees, the response will be in writing. If the employer meets with the employee within twenty (20) calendar days of receiving the change request, his / her response may be notified within fourteen (14) calendar days following such meeting.

In its response, the employer may grant or deny the employee’s request. A concession may be subject to conditions or requirements that the employer deems appropriate. A denial must contain the reasons for the decision and any alternative to the application submitted. The employer will treat with priority the requests by heads of families who have the sole custody or sole custody of their minor children. The provisions of this Article shall apply only to employees who regularly work thirty (30) hours or more per week and who have worked for the employer for at least one (1) year. In addition, they shall not apply to another application filed within six (6) months of receipt of the employer’s written decision or grant of change, whichever is greater.

Article 9. – (29 L.P.R.A. § 277)

The additional compensation established by this Law for overtime, except in the situations authorized in Article 6 of this Law, is hereby declared unenforceable. Any clause or provision under which the employee agrees to waive payment of the extra compensation for overtime fixed by this law. No judgment, award, award or other provision of a claim for compensation, right or benefit under any law, mandatory order, salary order, collective agreement or work contract, may be raised as a defense of res judicata by division cause of action, in order to defeat another claim, unless in the previous procedure had been expressly adjudicated, the same cause of action, for the same facts, between the same parties.

[Amendments: Law 83-1995; Law 4-2017]

Article 10. – (29 L.P.R.A. § 282)

Any employee who receives compensation lower than that fixed in this Act for regular hours and overtime work or for the period designated to take the food will be entitled to recover from the employer by civil action amounts not paid, plus an equal amount per concept of liquidation of damages, in addition to the costs, expenses and legal fees of the procedure. No employer may retaliate, terminate, suspend or otherwise affect the employment or employment conditions of any employee because he or she refuses to accept an alternate weekly work schedule authorized in Section 6 of this Act or for having filed a request for modification of the schedule, number of hours or place of work as provided in Article 8 of this Law. The employer who engages in such conduct may be civilly liable for an amount equal to the amount of damages that the act caused to the employee and if it is shown that the employer committed such conduct with malice or reckless indifference to the employee’s rights, a maximum maximum amount may be imposed as punitive damages equivalent to the actual damages caused. In order to determine the amount that should be imposed as punitive damages, the financial situation of the employer shall be taken into account, how reprehensible has been the conduct, duration and frequency of same, the amount of damage caused and the size of the company. In addition, it may be required that the worker be replaced in his employment and that he cease and desist from the act in question. Any employee who is affected in his tenure or employment condition as incurred by the employer in the conduct described in the preceding paragraph may file an appeal to the Court of First Instance. The Secretary of Labor and Human Resources of Puerto Rico may urge such action on behalf of and on behalf of the affected employee. In the ventilation of the resource the employer will have the weight of evidence to rebut the presumption that retaliation has been taken against the employee for not having accepted a flexible work schedule.

These claims may be processed in accordance with the ordinary procedure or the complaint procedure established in Act No. 2 of October 17, 1961 [32 L.P.R.A. secs. 3118 et seq.] As it has been or is subsequently amended. The judicial claim may be made by one or more employees for and on behalf of themselves or of them and other employees who are in similar circumstances; Provided, that after the claim is filed, the claim may be compromised between the parties, with the intervention of the Secretary of Labor and Human Resources or any of the attorneys of the Department of Labor and Human Resources, appointed by said Secretary and the approval of the court . The Secretary of Labor and Human Resources will determine administratively which judicial or extrajudicial transactions will require his personal intervention, fixing the criteria that will govern to that effect through regulation or administrative order. Any extrajudicial transaction will be void on the payment of the salary corresponding to the regular hours, overtime, the period indicated to take the food or on the payment of the sum equal to the amount established by this law for liquidation of damages; Provided, however, that any transaction that is verified before the Secretary of Labor and Human Resources or any of the attorneys or officials of the Department of Labor and Human Resources designated by said Secretary shall be valid for the purposes of this law. Any extrajudicial transaction that is carried out through the intervention of mediators of labor-management conflicts of the Department of Labor and Human Resources, subject to the norms or criteria established by the Secretary for such purposes, shall also be valid regulation or administrative order [Amendments: Law 25 of April 26, 1968; Law 47 of May 19, 1976; Law 8 of May 10, 1982; Law 83-1995; Law 4-2017]

Article 11 – (29 LPRA § 283)

Every employer shall notify in writing to its employees the number of hours of work required each day of the week, the hours of commencement and termination of work, and hour in which the period destined to take the food inside the regular commando begins and finishes. The schedule thus notified shall constitute prima facie evidence that such work hours in the establishment constitute the division of the working day. The employer who requires or permits an employee to work for a period of more than five (5) consecutive hours without providing a rest period to take food, will have to pay to the employee the time worked by means of extraordinary compensation, as provided in this Article. In those cases in which the total number of hours worked by the employee during the day does not exceed six (6) hours, the rest period for food can be ignored. The period to take the food should begin to be enjoyed not before the end of the second or after the beginning of the sixth hour of consecutive work. An employer may not employ an employee for a period of work exceeding ten (10) hours per day, without providing the employee with a second rest period for food, except that total hours worked does not exceed twelve (12) hours. In cases where the total number of hours worked does not exceed twelve (12) hours, the second rest period for food may be waived, provided that the first period of rest for food is taken by the employee. food occurring within or outside the employee’s regular hours may be reduced to a period of not less than thirty (30) minutes, provided a written stipulation is made between the employer and the employee. In the case of croupiers,nurses, nurses and security guards and those authorized by the Secretary of Labor and Human Resources, the period of rest for food may be reduced up to twenty (20) minutes when a written stipulation is made between the employer and the employee, without requiring approval of the Secretary. However, the other provisions of this Article shall apply.

The stipulations to reduce a period of rest to take food will be valid indefinitely and neither of the parties, without the consent of the other, can withdraw its consent to the stipulated until one (1) year after the stipulation is effective. Said provisions shall continue in force when a third party acquires the business of the employer. An employer who employs or permits an employee to work during the period of time for the taking of the food shall be obligated to pay for such period or fraction thereof a rate equal to one and a half hours of the rate agreed for regular hours, provided that employees entitled to payment of a rate higher than the time and a half prior to the validity of the “Labor Transformation and Flexibility Act”, will preserve the same.

[Amendments: Act 121 of June 27, 1976; Law 88 of June 22, 1962; Law 223 of July 23, 1974; Law 27 of 5 May 1976; Law 61 of June 3, 1983; Law 83-1995, Law 4-2017]

Article 12. – (29 L.P.R.A. § 284)

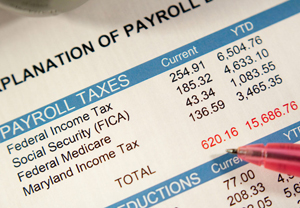

It shall be the duty of every employer to make, keep and keep the payroll of the persons employed by him, expressing the wages earned and the regular hours and overtime worked by each and other conditions and employment practices maintained by him . Payrolls shall be kept in accordance with the reasonable rules prescribed by the Secretary of Labor and Human Resources and shall be kept for the time they determine.

The Secretary of Labor and Human Resources, or any agent of his authorized, may examine in working hours the payroll of any employer in order to take data and reports for the statistics, studies, and investigations related to compliance with this Law.

[Amendments: Law 83-1995, Law 4-2017]

Article 13. – (29 L.P.R.A. § 285)

The provisions of this Law shall not apply to:

(a) administrators, executives and professionals, as defined by regulations of the Secretary of Labor and Human Resources;

(b) traveling agents, street vendors and external vendors, as defined by regulations of the Secretary of Labor and Human Resources;

(c) officers or organizers of workers’ unions when they act in such capacities;

(d) drivers and drivers of public and private motor vehicles working on a fee, fee or route basis;

(e) persons employed in domestic service who, however, shall be entitled to one day of rest for every six (6) consecutive days of work, in accordance with the provisions of Law 206-2016;

(f) Employees, occupations or industries exempt from the overtime provisions provided by the Fair Labor Standards Act, approved by the Congress of the United States of America on June 25, 1938, according to amended;

(g) persons employed by the Government of the United States of America, including each of its three branches and its instrumentalities or public corporations;

(h) persons employed by the Government of Puerto Rico, including each of its three branches and its instrumentalities or public corporations;

(i) persons employed by municipal governments and their agencies or instrumentalities;

(j) employees covered by a collective bargaining agreement negotiated by a workers’ organization, unless the collective agreement itself establishes that the provisions of this Law shall apply to the relationship between the parties. However, all overtime provisions provided by the Fair Labor Standards Act, approved by the Congress of the United States of America on June 25, 1938, shall apply.

amended;

(k) persons exempted by provision of a special law. [Amendments: Act 27 of May 5, 1976; Law 83-1995; Law 33-1996; Law 4-2017]

Article 14. – (29 L.P.R.A. § 286)

The Secretary of Labor and Human Resources shall be empowered to adopt and promulgate the regulations necessary to administer the provisions of this Act. These regulations shall be consistent with the “Fair Labor Standards Act,” approved by the Congress of the United States of America on June 25, 1938, as amended, and the regulations issued thereunder, as applicable to Puerto Rico, unless expressly provided otherwise by this Act.

Article 15. – (29 L.P.R.A. § 287)

Any employer who fails to pay the type of salary stipulated in this and for regular hours or overtime, or that allows, induces or compels an employee to waive, or to accept, or agree to waive, compensation based on a double rate of overtime wage, or not to carry the employee payrolls. wages as determined by the Secretary of Labor and Human Resources, or fails to provide the salary reports requested by the Secretary of Labor or Human Resources, or precludes the examination of said payroll by the Secretary of Labor and Human Resources or his authorized agents, or knowingly include false information in said payrolls or reports, or that violates any provision of this Act of the orders, rules or regulations issued by the Secretary of Labor and Human Resources as determined herein, or who dismiss or otherwise discriminate against any employee because he has initiated or initiated any procedure in accordance with this Law or related thereto, or that it uses any remedy, fraud, simulation or subtraction for not pay, cheat, deny or deprive any employee of the right to receive a double wage rate for overtime, shall incur a misdemeanor and, if convicted, shall be punished by a fine of not less than fifty dollars ($ 50) or imprisonment for a period of less than fifteen (15) days, or both penalties at the discretion of the court. In case of recidivism,shall be punished with a fine of one hundred ($ 100) to five hundred dollars ($ 500) or imprisonment for a term of thirty (30) to ninety (90) days, or both penalties at the discretion of the court.

Article 16. – (29 L.P.R.A. § 288)

In this Act, unless otherwise stated, the following definitions of words and phrases of the same shall be accepted.

(1) “Employee”. – means any natural person who works for an employer and receives compensation for his or her services. It does not include independent contractors as well as officers or workers’ union organizers when acting as such.

(2) “Patron”. – means any natural or legal person of any nature who hires and uses the services of an employee.

(3) “Employ”. – means to tolerate or allow to work.

(4) “Salary”. – includes salary, wages, salary, and any other form of pecuniary remuneration. It will not include that part of tips received that exceed the amount used to meet the payment of the legal minimum wage, nor the charges for services.

(5) “Tipping.” – means any gift or gratuity which it grants, directly or indirectly,

indirectly, a person who is not the employer to an employee in recognition of the services received.

(6) “Charges for services”. – means any amount of money added to an account, and required by an establishment, which is distributed in whole or in part to employees. It also includes charges negotiated between an establishment and a customer.

[Amendments: Act 11 of April 26, 1963; Law 223 of July 23, 1974; Law 27 of May 5, 1976; Law 61 of 3 June 1983; Law 83-1995; Law 4-2017]

Articles 17 – 19. – [Note: The subsequent amending laws renumbered Arts. originals of this Law]

Article 20. – (29 L.P.R.A. § 271 note)

If any clause, paragraph, article, section or part of this Act is declared unconstitutional, by a court of competent jurisdiction, said ruling shall not affect, impair or invalidate the rest of this Law, but its effect shall be limited to the clause, paragraph, article, section or part of the law that has been declared unconstitutional.

Article 21. – (29 L.P.R.A. § 2)

Law No. 49, approved on August 7, 1935, entitled “An Act to regulate the hours of work of persons employed in commercial, industrial and other lucrative businesses, and for other purposes, is hereby expressly repealed. “.

Article 22. – (29 L.P.R.A. § 271 note)

Any law or part of law that opposes the present, is hereby repealed; Provided, however, that the provisions relating to the duration of the workweek and to the payment of overtime that appear in mandatory decrees nos. 11, 16, 20 and 21, approved by the Salary Board Minimum under Law No. 8 of April 5, 1941, as amended, which would be of greater benefit to the employee, the

which shall remain in force until the corresponding provisions established in Section 8 of this law are more favorable to those established in said decrees, in which case the provisions of the law shall prevail; Article V of Mandatory Decree number 4 approved by the Minimum Wage Board under the aforementioned law, which provides a Minimum Weekly Compensation Guarantee, which is hereby modified to be an amount to the product that results in multiplying the type of regular salary per hour that the worker is receiving for forty; Law no. 73, entitled “Law regulating the work of women and children, and protecting them against dangerous occupations,” approved June 21, 1919, as amended; Act No. 230, entitled “Law to regulate the employment of minors and to provide compulsory attendance of children of Puerto Rico to public schools”, to repeal Act No. 75, adopted on June 20, 1921, as subsequently as amended, and for other purposes, approved May 12, 1942, as amended; Article 553 of the Penal Code, generally known as the “Law on the Closure of Commercial and Industrial Establishments”, as amended, and Act No. 289, adopted on April 9, 1946, as it has been or has subsequently been amended.

Article 23. – (29 L.P.R.A. § 2)

This Act, being of an urgent and necessary character, will take effect immediately after its approval.