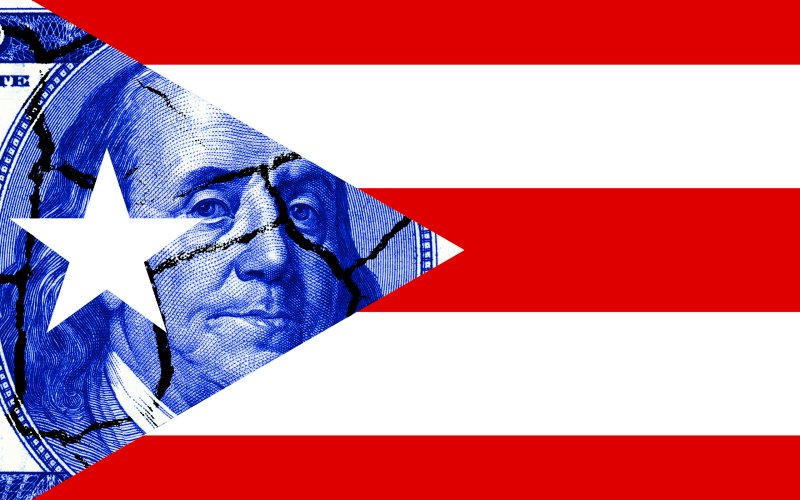

How to Maximize the Tax Benefits of Puerto Rico

The tax benefits of Puerto Rico for Americans are incredible. Puerto Rico is by far the best deal available if you’re willing to move you and your business to the island for a few years. Even if you move only the business, while you remain in the United States, the offer is hard to pass up. Here’s how to maximize the tax benefits of Puerto Rico.

First, here’s a summary of the tax benefits of Puerto Rico.

Act 20 is the business tax holiday offered by cash strapped Puerto Rico. Under Act 20, a service business with 5 employees on the island will pay only 4% tax on Puerto Rico sourced income. Good candidates include businesses (or divisions of a business) which provide sales and support, internet marketing, graphics design, product research, financial advisory, loan servicing, website and network design and support, call centers, and almost any other “portable” business.

The catch is that you must have 5 full time employees in Puerto Rico. These workers can be at any salary or skill level, but they must be working full time and creating Puerto Rico sourced income. The purpose of Act 20 from the government’s perspective is to offer training and jobs to its people.

It’s possible for the owner of the Puerto Rico business to live in the United States and operate the business remotely. In that case, you (that owner) will draw a salary at fair market value from the Puerto Rico corporation and pay tax in the US on your income. Only profits attributable to the workers in Puerto Rico is Puerto Rico sourced income.

If the owner of the business is living in the US, you get to defer US tax on the profits of your Puerto Rico company (less the 4% tax paid to Puerto Rico). When you take the money out of the company you will pay US tax on the dividend. If you are a resident of Puerto Rico, you won’t pay tax on that dividend.

Act 22 is the personal tax holiday. If you move to Puerto Rico, become a legal resident, buy a home there, and sign up for Act 22, all dividends from a Puerto Rico corporation to a resident of Puerto Rico are tax free. In addition, you will pay zero tax on capital gains. That’s right, the tax rate on assets acquired after you move to Puerto Rico will be zero.

Those are the basics and there are a number of additional Puerto Rico tax holiday programs that are beyond the scope of this article. For example, Act 73 covers IP development and holding companies. Using this statute, you can get to a tax rate of 4 to 8% on income from IP. Also, a number of tax credits are available.

For an article on this, which briefly compares Act 73 to Act 20, see PWC Summary of Puerto Rico Tax Credits and Incentives. Also, here’s an article about Microsoft using Puerto Rico for IP (from 2013) and another on Puerto Rico and the Pharmaceutical Industry.

Then there’s Act 273 that allows you to setup an “offshore” bank in Puerto Rico and pay only 4% in tax on profits. This is by far the lowest cost offshore banking license available. For more information, see Puerto Rico Offshore Banking License.

This is all to say that Puerto Rico is working hard to become the offshore center for American entrepreneurs. If your business provides a service or is portable, you should give Puerto Rico a look.

Here’s how to maximize the tax benefits of Puerto Rico.

To truly maximize the tax benefits of Puerto Rico, you need to move you and your business to the island. If you can combine Act 20 with Act 22, you will have a tax deal unmatched by any other jurisdiction.

You will pay only 4% on your business profits (Puerto Rico sourced active business income) under Act 20. Then you will then withdraw those profits as a tax free dividend at the end of the year under Act 22.

So, Act 20 gets you tax deferred profits held in a Puerto Rico corporation. Act 22 allows you to take those profits out of the corporation tax free.

EDITORS NOTE: On July 11, 2017, the government of Puerto Rico did away with the requirement to hire 5 employees to qualify for Act 20. You can now set up an Act 20 company with only 1 employee (you, the business owner). For more information, see: Puerto Rico Eliminates 5 Employee Requirement

Above I said that the tax benefits of Puerto Rico are unmatched by any other jurisdiction. The reason for this is simple: even fiscal paradises like Cayman and Panama with zero tax rates can’t come close to duplicating the benefits for Americans available in Puerto Rico.

Yes, I know that a 0% tax rate in Panama and Cayman Island is less than 4%. But, because Puerto Rico is a US territory, it can offer a deal on dividend distributions that foreign countries can can’t match.

So long as you are a US citizen you will pay US taxes… unless you live in Puerto Rico.

An American living in Cayman or Panama will pay US taxes on all capital gains and dividends received. They will also pay US tax on any salary earned over the Foreign Earned Income Exclusion Amount of $101,300. They won’t pay tax to Panama or Cayman, but they will owe the IRS big time if they make more than $100,000 a year.

That same person living in Puerto Rico will pay tax on any salary earned, 4% on business profits, and then be eligible to withdraw those retained earnings from the corporation as a tax free dividend.

Let’s say you have a business with net profits of $2 million. You can set up in Cayman or Panama and take out a salary of $100,000 per year tax free. The rest of the money will stay in the corporation tax deferred. When you withdraw the $1.9 million, you will pay US tax at about 40% (Fed and State), or $760,000. You get tax deferral by operating offshore, but, one of these days, you must pay the piper.

If that same business were operated from Puerto Rico under Act 20 and Act 22, you would pay PR tax on your salary of $100,000 at about 30%. Then 4% corporate tax on $1.9 million for a total of $106,000. Your net effective rate is 5.6% and goes down towards 4% as income increases.

To sweeten the pot further, Puerto Rico’s Act 20 comes with a 20 year guarantee. Considering how the political winds are blowing against offshore tax structures, a guarantee from a US territory is very valuable.

As I said above, Puerto Rico requires 5 full time employees. If you don’t need that many people, or your profits are closer to $100,000 than $1 million, then a tax free jurisdiction offshore might be more efficient. Here’s an article on Moving Your Internet Business to Cayman Islands Tax Free.

I’ll close by considering how you might carry the tax benefits of Puerto Rico forward once you leave the island.

Ok, you’ve setup your business with 5 employees in Puerto Rico under Act 20. You also took the plunge and moved to Puerto Rico under Act 22. A few years have passed and corporation has $5 million dollars in retained earnings.

You’ve had enough of island life and this business venture has run its course. It’s time to stop the carnival, take your winnings, and return to the US of A.

- Sidebar: Don’t Stop the Carnival is one of my favorite books about expat life.

As I said above, you can take out that $5 million in retained earnings tax free. This is because you are living in Puerto Rico, qualify under Act 22, and the dividends are coming from a Puerto Rico company. The only tax paid was 4% to Puerto Rico for the right to operate your business from their jurisdiction.

You can now return to the US with your $5 million in hand with no taxes due to the IRS. The money is free and clear.

Of course, once you move back to America, giving up your Act 22 status, any interest or capital gains you earn from this $5 million in savings will be taxable by the Feds and your State.

There is one way to carry forward the benefits of Puerto Rico…

Invest some of that $5 million in to a single pay premium offshore life policy before you abandon Puerto Rico.

By moving your savings earned under Act 22 in Puerto Rico in to a tax deferred single pay premium life insurance policy you can continue to defer US tax on any capital gains generated by that money. Basically, you can create a multi-million dollar tax deferred savings account or a massive defined benefit plan without any of the retirement account rules.

Your cash will grow tax deferred inside the life insurance policy, just as it did in Puerto Rico. If you need to use some of that money you can borrow against the policy. Of course, your focus should be on building a tax preferred investment portfolio.

Should something happen to you, this life insurance policy will pass on to your heirs tax free (with a step-up in basis). In this way, it’s possible for you to provide a family legacy without ever paying more than 4% in US taxes.

I hope you have found this article on maximizing the tax benefits of Puerto Rico helpful. Please note that we at PremierOffshore.com are not investment advisers nor do we sell insurance products. I will be happy to introduce you to an expert in this area.

For more information on moving you and/or your business to Puerto Rico, please contact me at info@premieroffshore.com or call (619) 483-1708. I will be happy to work with you to build a tax efficient operation in Puerto Rico.

Leave a Reply

Want to join the discussion?Feel free to contribute!