How self employment tax works when you’re offshore

If you’re living abroad and paid by a US company, you’ll pay self employment tax on your earnings. If you’re living offshore and operating a business without an offshore company or LLC, you’ll pay self employment tax on your profits. Here’s how self employment tax works when you’re offshore and how to avoid it.

All Americans that are self employed or who business owners are responsible for paying self employment tax in one form or another. It doesn’t matter where you live or work… if you’re self employed and hold a blue passport, you must pay SE taxes.

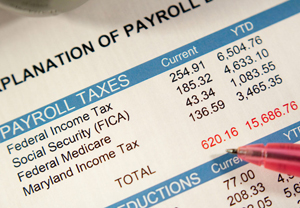

Self employment taxes are assessed as 15.3% of your net profits. The Social Security portion has a limit on how much of your income is taxed, whereas the Medicare portion does not.

The Social Security component of self employment tax is 12.4% and applies to the first $127,200 of SE income in 2017. The Medicare component is 29% and applies to all SE income.

I generally summarize it to say that an American earning $100,000 offshore will pay about $15,000 in SE tax. This is an oversimplification, but makes the math easier. I will also round off some numbers in this article, such as how to calculate payroll taxes.

Common types of income that are subject to self-employment taxes include:

-

- Income from home-based businesses

- Income from freelance work

- Income from work as an independent contractor

- Income from a business operated in the United States that has not been subjected to payroll taxes (reported on a W-2)

- Income paid to an expat from a US corporation

- Income paid to an expat that goes into her personal bank account rather than into an offshore corporation

- Any income from work you do while abroad that’s not a salary from a foreign corporation reported on IRS Form 2555.

Self employment tax is meant to target income from work that’s not otherwise subject to payroll taxes. As an employee of a US corporation working in the US, you pay about 7.5% in payroll taxes, which is matched by your employer. Thus, total payroll taxes are around 15%. When payroll taxes don’t apply, the worker gets to pay the full 15% as self employment taxes.

Note that the Foreign Earned Income Exclusion does not apply to self employment tax. The FEIE allows you to exclude your first $102,100 in wage or business income from Federal income tax. Self employment tax is not an income tax and not covered by the FEIE.

So, an American who spends 330 days abroad, earns $100,000 in salary, and is paid by a US corporation, won’t pay any income tax. However, they will get the joy of contributing $15,000 to our social welfare system.

Here’s how to eliminate self employment tax as an expat.

In this section, I’ll assume you’re an American citizen living abroad and that you qualify for the Foreign Earned Income Exclusion. This means you’re out of the country for 330 out of 365 days or a legal resident of a foreign country and don’t spend more than 3 or 4 months a year in the US.

This article doesn’t apply to Americans working abroad for the US Government or those working for foreign affiliates of US companies that have entered into a voluntary payroll tax agreement. For more information, see: Social Security Tax Consequences of Working Abroad

Self employment taxes apply to income paid to you from a US corporation or money that goes into your personal bank account. It doesn’t matter where that account is located… if money from labor goes directly into a personal account, it’s subject to US self employment tax.

Self employment tax does not apply to income paid to you as salary from a corporation formed outside of the United States. This company can be incorporated anywhere in the world… a high tax country like France or a zero tax country like Panama are equal in the eyes of the IRS for purposes of SE tax mitigation.

So, if your employer pays you a salary as an employee of his non-US corporation, SE tax doesn’t apply.

Likewise, if your clients pay into an offshore corporation owned by you, and you draw a salary from the net profits, this salary is not subject to self employment taxes. It doesn’t matter that you own 100% of the business.

The compliance key to eliminating SE tax is to report your salary on IRS Form 2555. On Part 1, section 5, you must be able to check box A for foreign entity or box D for a foreign affiliate of a US corporation. Box D is applicable so long as your employer hasn’t entered into a payroll tax agreement with the IRS, which is very rare.

The bottom line is that you should always form an offshore corporation to operate an international business.

You never want to use an offshore LLC treated as a disregarded entity.

Nor should you deposit business income into a partnership, trust, Panama foundation, or a personal bank account. B

Business income and expenses should be processed through a foreign corporation, with your salary moving from the corporation to your personal account each month. This salary is then reported on Form 2555.

If your US clients don’t want to pay into an offshore corporation, you might be able to form a US billing entity. Clients would pay the US corporation and the offshore corporation would bill the US company. This can effectively move taxable income out of the US corp and into the offshore corp with no US taxes due.

A US billing entity is only advisable for those with no US employees, no US offices, and no US source income.

I hope you’ve found this article on how self employment tax works when you’re offshore to be helpful. For more information, and to form an offshore business structure, please contact us at info@premieroffshore.com or call us at (619) 483-1708. We will be happy to set up your US compliant foreign corporation.