Best IRA Investments for 2018

The best IRA investments for 2018 are all offshore. If you want higher returns in your retirement account, you need to invest offshore. If you want to move some of your IRA out of the United States, you need to invest your account offshore. With that in mind, here are the best IRA investments for 2018.

To start, let me note that you can only place a vested retirement account offshore. A vested account is usually one from a previous employer. If you can move the account from one custodian to another, it’s vested. If you can’t move the account because it’s held at your current employer’s custodian, it’s not vested.

Second, keep in mind that most custodians don’t want you to invest your IRA offshore. They want you to buy their mutual funds, annuities, and whatever else they make a nice commission on. When you invest offshore, your custodian makes zero on the buy/sell. They make nada on your gains and get no management fees.

With that in mind, here are the best IRA investments for 2018:

- Foreign real estate in countries with low capital gains rates,

- International ICOs,

- Crypto trades at foreign exchanges with better rates (difference in bid /ask),

- Investments that lead to foreign residency, and

- Leveraged investments no available in the United States.

The most popular international IRA investment for 2018 is real estate. Foreign real estate offers a higher yield compared to the United States and is a relatively low-risk investment. While other offshore IRA investments are higher risk with massive upsides (such as crypto below), real estate is true to the IRA mantra of steady and conservative.

Foreign real estate is the best IRA investment in 2018 for those willing to put in the time, effort, and expense to find deals. Yes, returns are higher abroad if you find the right area and the correct tax structure. But, finding these deals means hitting the streets to learn the target country, the city, and finally the neighborhood.

And the best IRA investment for 2018 will usually be in a country with a low capital gains rate. Because you won’t pay tax on the gain in the United States, you don’t care about the foreign tax credit. Therefore, you want to invest in a country that will minimize your worldwide tax costs.

When you invest non-IRA funds, you pay 20% to the US on long-term gains. If you invest in a country with a 20% capital gains rate, you pay zero to the US because the Foreign tax credit gives you a dollar for dollar credit on your US return. When you invest in a country with a 10% rate, you pay 10% to that country and 10% to the US.

When you invest using your IRA, your US rate is basically zero and the foreign tax credit doesn’t apply (in most cases). Thus, you want to buy in a zero tax country like Belize or a low tax country like Colombia (capital gains rate is 10% but the tax on rental income is 33%). For more, see: Where to Buy International Real Estate.

See also: Which Countries Tax Worldwide Income?

The second most popular category of foreign IRA investments for 2018 is cryptocurrency and ICOs. The United States has forced US exchanges to report all sales, creating a tax nightmare for many. Also, the US SEC is pushing the majority of ICOs offshore. If you want to get in on the ground floor of an ICO, before all the vulture capitalists have picked it clean, then you need to invest offshore.

For these reasons, the best IRA investments for those looking to get into crypto, smaller coins, and most ICOs, are offshore in 2018. For more see: Take your IRA offshore and invest in cryptocurrency.

The third most popular investment for your IRA is one that can be paired with residency or citizenship. In some countries, you can gain residency with an investment. If that investment can be held by your IRA, you can use retirement funds to secure residency.

However, you need to be careful. You can make the investment using IRA money. Then you need to pay all costs associated with the residency application with personal savings (not IRA money). If you were to pay for residency with IRA funds, this would be an improper benefit.

For example, you can get residency in Panama with a real estate investment of at least $350,000 or an investment in an authorized reforestation plantation of $20,000. For more on this, see Best Panama Residency by Investment Program.

The fourth best IRA investment for 2018 is only for very sophisticated IRA investors. It is any leveraged purchase or foreign real estate with a mortgage. This is because these investments are only possible outside of the United States.

When you invest your IRA in the US using leverage or a mortgage, you must pay Unrelated Business Income Tax at about 35%. That is to say, all gains from leverage or a mortgage are taxed at 35% before being passed through to your retirement account.

For example, you buy a house in California using your IRA. 50% of the money comes from your IRA and 50% from a non-recourse loan (the only type of loan an IRA can accept). When you sell that home, half the capital gain will be taxed at 35% and half will flow into your IRA tax-free.

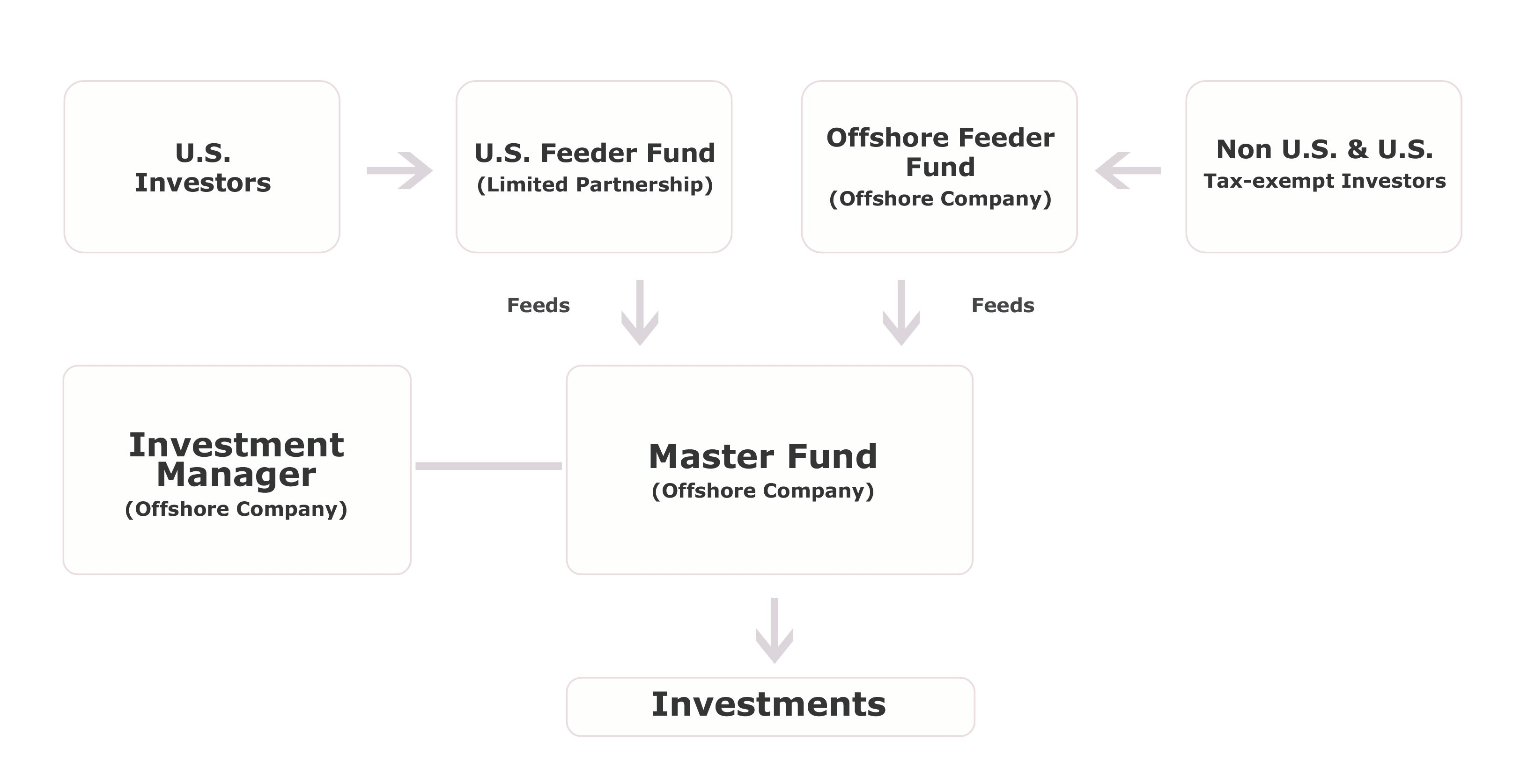

When you invest using a mortgage or leverage (maybe in a crypto account) outside of the United States, you can block and avoid this tax. Set up a UBIT blocker corporation along with an offshore IRA LLC and eliminate UBIT in your international IRA transactions.

I hope you’ve found this article on why the best IRA investments for 2018 are all offshore to be helpful. For more on converting your retirement account to a self-directed IRA or forming an offshore IRA LLC, please contact us at info@premieroffshore.com or call us at (619) 483-1708.