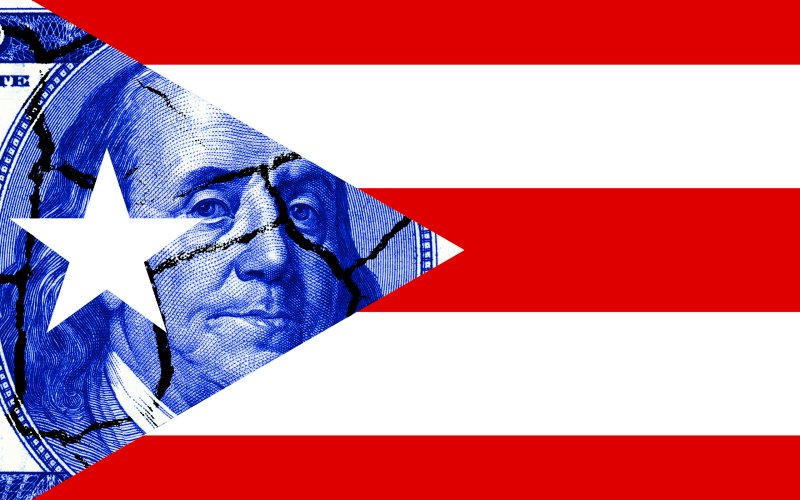

Puerto Rico’s Act 20 and Act 22 Residents and Hurricane Maria

The entire island of Puerto Rico has been declared a disaster zone by FEMA and power may be out for months. A major dam is failing, which will further reduce available drinking water. How will Hurricane Maria affect those in the Puerto Rico on Act 20 and Act 22? How will this affect your 183 day clock?

Hurricane Maria and its effect on Act 20 and Act 22 residents of the island is unique. A natural disaster which makes an entire state or territory inhospitable has never occurred in US history. Yes, large swaths of Texas, New Orleans and Florida have seen nature’s wrath, but never has an entire state been destroyed. Never has an entire state been without power for months. Never has entire state been without drinking water.

- The best picture’s I’ve found of Hurricane Maria’s destructive power are here.

And this is a major issues for those of us in Puerto Rico on one of the various tax incentive programs that requires we spend a minimum amount of time on the island. For you to be a resident of Puerto Rico under Act 20 and Act 22, you must make Puerto Rico your home base and should spend at least 183 days a year in the territory.

You can spend 30 days a year traveling abroad and count those toward your 183 resident days. So, that gets you to 153 days in Puerto Rico, 30 days abroad, and 182 days in the United States. The fewer days you spend in the US the better.

Keep in mind that Act 20 income is earnings and profits generated from work performed in Puerto Rico. Money made from work performed in the United States is US source and taxable by the IRS. Likewise, money earned abroad by a US citizen is usually US source and taxable in the United States.

Puerto Rico’s tax incentives are also relatively new. They were enacted in 2012, became popular in 2014, and really took flight from 2015 to the present. This means the IRS has not issued guidance on these topics and very few audits have been conducted.

The residency requirements for Act 20 and Act 22 are both untested and unique. You must spend 183 days a year, less 30 abroad, in Puerto Rico. That means you can’t spend more than 182 days in the United States.

This Federal tax issue doesn’t come up when we look at moving from one state to another. The 183 day test generally applies to which state gets to tax your profits. No matter where you live in the United States, Federal tax laws apply.

But, income earned in Puerto Rico is excluded from Federal tax under IRC Section 933. So, Act 20 and Act 22 in Puerto Rico are taking rules generally applied to multistate returns and using them to avoid Federal income tax… again, a set of facts and circumstances unique to Puerto Rico’s tax incentive programs. For more on this, see: Changes to Puerto Rico’s Act 20 and Act 22.

The problem is that Hurricane Maria has made it impossible to work from Puerto Rico. This natural disaster has also made it very difficult and possibly unsafe to live on the island for the remainder of the year to reach that magic number of 183 days.

The entire island has been declared a disaster area by FEMA. If you return to the United States, those days will count as US days. If you travel abroad for more than 30 days, those days might also count for US days.

The bottom line is that only days in Puerto Rico are guaranteed count toward your 153 minimum (assuming 30 days abroad on business). Any other allocation of days is a gamble.

If you’re out of Puerto Rico and out of the United States for a prolonged period, you’ll switch from being taxed by Puerto Rico under Act 20 and Act 22 to being taxed by the IRS under international laws (such as the Foreign Earned Income Exclusion).

If the IRS doesn’t agree with your claim of residency in Puerto Rico, the entire tax incentive value of Act 20, Act 22, or Act 273 will be lost. Considering that Puerto Rico is unique as a territory, and that the IRS has not issued direct guidance on these topics, we’re left to speculate on how the IRS will rule.

Unfortunately, we don’t see any good news when we review state rulings on the 183 day test or when we look at the history of the Foreign Earned Income Exclusion. Neither of these are controlling on Puerto Rico, but are a good indication of what could happen.

Let’s consider state rulings first.

Let’s say you’re moving from high tax California to tax free Nevada. To become a resident of Nevada, you should break as many ties to California as possible, create as many ties to Nevada as you can, and spend a minimum of 183 days in Nevada.

Any day spent in CA, for work or pleasure, will count as a California day. The ONLY exceptions to this rule are:

- Being in California will not count against your days in another state if your presence is solely for the purpose of boarding a plane, ship, train or bus while merely passing through California for travel, and

- Being hospitalized in California does not constitute a day spent in California (outpatient days are treated as California days).

There is no precedent for any hurricane or natural disaster relief. Being in California due to a mandatory evacuation from a home in Nevada or elsewhere still counts as a California day.

When we apply this to Puerto Rico Act 20 and Act 22 persons, any day spent in the United States is a US day unless you’re connecting through on a flight or hospitalized. Not much help there.

When we look at international and FEIE guidance, things don’t get any better.

To qualify for the FEIE, you must be a legal resident of a foreign country with a residency visa and not spend more than 183 days a year in the United States or be out of the United States for 330 out of 365 days during any 12 month period.

The IRS has a procedure to allow you to prorate the FEIE if you’re forced out of a country because of war, civil unrest, or similar adverse conditions in that foreign country. Only countries on the list published by the IRS each year qualify. For tax year 2015, the list was published in Revenue Procedure 2016-21.

See the top of page 3 of this Rev Pro. The ONLY country exempted in 2015 was Burundi. Only the civil unrest in this African nation rose to the level required by the IRS. The many natural disasters and wars in 2015 didn’t even get a mention.

So, what’s a hardworking citizen attempting to qualify for Act 20 and Act 22 to do?

I’m telling client to:

- Spend as little time in the United States as possible, but never more than 183 days in the year.

- Break as many ties to your home state as possible and create as many new ties to Puerto Rico as possible. Pay more attention to these issues because of the new audit risks you’ll have.

- Spend as much time as is safe in Puerto Rico for the remainder of this year and 2018.

- Spend the rest of your time abroad.

- Build up an argument that you have moved to Puerto Rico for the foreseeable future and do not intend to return to the United States.

- Plan on spending extra time in Puerto Rico during 2018.

- Prepare for an audit by focusing on the “domicile test.”

Generally, an individual is a resident of a particular state if he or she is domiciled in that state (the substantive test) or is a statutory resident (the objective test).The 183 day test is the statutory or objective test and the test based on intent is the domicile or substantive test.

The statutory test is simple math. You’re either in Puerto Rico for 183 days or your not. The domicile test is based on your intent and includes a number of factors. As such, the domicile test is harder to prove but gives you more room to maneuver… more room to negotiate with the IRS when you’re incapable of meeting the 183 day test.

We always recommend our Act 20 and Act 22 clients use the statutory test. There’s often millions of dollars at stake and you should be willing to put in the time for that kind of a tax break.

However, if you’re unable to use the statutory test, you can use the domicile test. In this test, your intention is key to proving or arguing domicile.

To build your case, focus on proving your intent. Auditors will look at five factors to show intent. These are: (i) the size, value, and function of your homes; (ii) active business connections in the state; (iii) time spent in the state; (iv) the location of “near and dear” items; and (v) the location of immediate family members.

While there are no guarantees, we’ll attempt to help our clients prepare for an audit by increasing their ties to Puerto Rico and proving their intent to become and remain a part of the community for the foreseeable future (indefinitely).

The purpose of these planning steps being to negotiate an increase in your foreign days should you be audited. If you’ve already spent too many days in the United States, and have used up your international days, we’ll need to convince an IRS agent to increase your number of allotted foreign days by allowing the domicile test.

For many of us living and working in Puerto Rico under the tax incentives, time is short. You need to act quickly to improve your probability of success should you be audited in the next three years.

In my opinion, and it’s just guess as to how the IRS will treat this situation, if you spend more than 183 days in the United States during 2017, you’ll lose the tax benefits of Puerto Rico. If you spend more than 30 days abroad, you have a puncher’s chance in an IRS audit.

That is to say, no matter what you do, don’t spend more than 183 days in the United States in 2017. If you can’t be in Puerto Rico, spend more than 30 days abroad. While there’s no guarantee the IRS will allow the domicile test in this situation, it’s your best option. Once you spend more than 183 days in the United States, the game is over.

I hope you’ve found this article helpful. For more information on Puerto Rico’s tax incentive programs, please take a read through A Detailed Analysis of Puerto Rico’s Tax Incentive Programs.

For more information on setting up a business in Puerto Rico under Act 20, see: Puerto Rico’s Act 20.

For information on changes to Act 20’s employment requirements, see: Puerto Rico Eliminates 5 Employee Requirement.

For more on moving to Puerto Rico and avoiding US capital gains taxes, see: 3 Ways to Stop Paying Capital Gains Tax.

To compare the Foreign Earned Income Exclusion and Puerto Rico’s Act 20, see: Puerto Rico Tax Deal vs Foreign Earned Income Exclusion.

You can reach me at info@premieroffshore.com or call (619) 483-1708. We’ll be happy to assist you to setup a new business in Puerto Rico

Leave a Reply

Want to join the discussion?Feel free to contribute!