Want to know which is the Best Offshore Company Jurisdiction for your business or your assets? Are you considering living, working or investing abroad? Then this offshore company guide is a must read.

Please note that, when I refer to the Best Offshore Company Jurisdiction, I mean the best jurisdiction for your offshore structure. An offshore company can be a corporation, LLC, Foundation, or the manager of an offshore trust. Please see www.premieroffshore.com for a detailed article on whether an offshore corporation or offshore LLC is better for your situation. “Offshore Company” is a general term while “Offshore Corporation” and “Offshore LLC” refer to specific types of entities with specific uses and benefits.

In order to determine the Best Offshore Company Jurisdiction, you should consider a number of factors, including: (1) privacy and protection, (2) professional services and investment management options available, (3) international banking options, (4) for a business, available work force, (5) tax filing and payment obligation, (6) locals audit or reporting requirements, (7) world image/perception, and (8) countries that offer specialized structures (niche markets). I will consider each of these in turn.

Best Offshore Company Jurisdiction for Privacy and Protection

When new clients ask me which is the Best Offshore Company Jurisdiction, they usually mean which is the most secure – which offers the most privacy and protection for their assets. As you will see throughout this article, privacy and protection are important, but certainly not the only consideration.

After 10+ years in the industry, it’s my opinion that Belize and Nevis offer the best offshore company laws for the basic corporation or LLC. Both of these countries have one year look-back statutes, so, after the year is up, it becomes near impossible to attack a structure in these jurisdictions.

Belize and Nevis both have laws which are “client” or “business” friendly rather than “creditor” friendly. In the U.S. legal system, the emphasis is on paying any creditor who can come up with the most basic excuse to separate you from your savings. In Belize and Nevis, laws protect you from all claims except those where the transfer is deemed fraudulent.

- A fraudulent conveyance is when you transfer money or assets out of the U.S. to keep them out of the reach of an existing or reasonably anticipated creditor. If you injure someone with your car today, and send all of your assets out of the U.S. tomorrow, that is probably a fraudulent conveyance. If you setup and fund an offshore company in Belize today, and injure someone six months from now, that transfer should be respected/protected.

I say Belize and Nevis are the Best Offshore Company Jurisdictions for basic formations because nominee directors and other advanced planning are not required. You can form an offshore corporation or LLC in these countries with one person – the beneficial owner. This makes them perfect for single member offshore companies, as well as for LLCs owned by U.S. IRAs or other types of retirement accounts. This also means these formations are less expensive to form and maintain lower government fees and no nominees to pay.

The benefit Nevis has over Belize is that anyone wanting to sue a Nevis company must put up a $30,000 bond before they can get in to court. If the plaintiff loses, this is used to pay the defendant’s legal fees.

While Belize doesn’t require a bond, they have the most modern corporation, LLC and trust statutes available. Also, lawyers are not allowed to work cross on contingency (getting paid only when they collect from the defendant). High retainers and legal fees in Belize have much the same chilling effect on litigation as bonds do in Nevis.

Another advantage Belize has over Nevis is a quality offshore banking sector, lead by Caye Bank and Belize Bank. While it is often recommended that you plant multiple flags offshore, and thus use a bank in a country other than where you are incorporated, I prefer to begin with a structure and bank from Belize and then expand from there. This is especially true of IRA LLCs and structures owned by U.S. persons because the laws and banks of Belize are very experienced in these areas.

Note that I said Belize and Nevis provide the best in basic privacy and protection without the use of nominees. If you require max privacy regardless of cost, then I prefer a Panama corporation owned by a Panama foundation. Both the corporation and foundation may have nominee directors and the beneficial owner (you) is not listed in any public registry. The only people who know your identity are your incorporation (premier) and your banker.

An added benefit of the Panama corporation/foundation hybrid is that the foundation may act as a trust to deal with any estate planning, bequests and charitable giving you wish to do with your foreign assets. Depending on your age and the size of your estate, this may provide significant estate tax benefits and giving options.

One drawback of Panama is that it does not have an LLC statute. This means U.S. retirement accounts can’t incorporate these. However, you may form an IRA LLC in Belize and then invest in to a Panama corporation. This corporation now can open accounts or buy rental real estate in Panama.

Best Professional Services for Offshore Companies

If you are looking for more than a checking account offshore, quality professional services may be important and often hard to find. Here is how I divide up the offshore investment management industry:

The best low risk higher return CD rates are in Panama. So are some of the best real estate, gold storage and mid-market investment management services. CDs at 3.25% are common from solid banks and loans are readily available to facilitate real estate investment.

In most cases, banks in Panama offer private banking services to accounts of over $500,000. I call this mid-market because other jurisdictions like Cayman start these accounts at $2.5 to $5m.

Don’t get me wrong. Panama does have some excellent high dollar private banks. In my opinion, the best of these is Andbanc where accounts begin at $2.5m and, while the parent bank is in Andora, the trading desk is in Panama, and thus provides maximum diversification and protection.

For the rest of us non-millionaires, Belize offers a wide range of investment products, multi-currency accounts, gold and metals, as well as investments that lead to residency in a variety of countries.

I’ve found the best of these is Caye Bank and Georgetown Trust. This bank does not have a minimum account size and Georgetown has investments at all price points. I suggest managed accounts should begin at $250,000, but some of their best returns are on items like Teak that requires about $15,000 to get in the game.

At the other end of the spectrum is Cayman Islands. Banks and investment advisors in this jurisdiction focus on the largest trusts, hedge funds, and high dollar private wealth management/family offices. I won’t take up space here rambling on about Cayman, but I can assure you they offer the best offshore investment management services. Please see my recent article on Cayman for additional information and baking information.

I note that not all banks and countries treat companies from other jurisdictions fairly. For example, I believe that the best offshore company jurisdiction in most situations is Belize. Well, Cayman makes it very difficult for offshore companies from Belize to open accounts at its banks. Preference is given to countries who make it into Cayman’s “Category III” list. This includes the U.S., U.K., and Cayman companies (obviously), along with Panama. While other countries make the list, I’ve found that, if you don’t want to pay the fees to incorporate in Cayman, the Best Offshore Company Jurisdiction to do business in Cayman is Panama.

Other countries have taken similar steps to protect their incorporation industries from low cost competitors like Nevis and Belize. For example, the make a Belize LLC eligible to do business in Panama costs thousands of dollars and requires a lot of effort. For this reason, Belize LLCs usually form Panama corporations if they wish to do business there. (IRAs require and LLC, so the Belize/Panama combo is common for retirement accounts).

Best Offshore Company Jurisdiction for Businesses with Employees

When selecting the Best Offshore Company Jurisdiction from which to operate a business, give very careful consideration to the cost, quality and availability of labor. I’ve seen many set up in beautiful tax havens or in the very lowest cost markets available only to find out it isn’t the right place for them.

Let me start with an example of what not to do:

I once had a high net worth client who wanted to start an offshore call center business. Money was no object and he was debating between Cayman Islands and Panama. He chose Cayman because it’s one of the most beautiful places on earth (certainly true). I advised him in the strongest terms possible that this was the wrong offshore company jurisdiction for a call center but he decided to go his own way.

After buying a home for $1.5m, leasing expensive office space, investing significant money in IT, and hiring a few employees, he began to understand how difficult it is to open a business in Cayman as a foreigner. First, the employment laws require a certain number of Cayman citizens per foreign employee. These locals come at a high cost and, in my client’s experience, low productivity. Next, he found that the cost of labor in Cayman was higher than the equivalent hire in Los Angeles. Finally, he quickly learned that lower cost call center sales people are just NOT available.

Combine this with requirements to have local partners and that operating costs turned out to be 35% higher than in California, and he was back at my door licking his wounds within six months of opening his doors in Cayman.

At the other end of the spectrum, several large and experienced companies in the offshore world have found it more efficient to move out of the lower cost regions, such as India, and in to Panama. For example, Dell, a pioneer in outsourcing tech support, has moved much of its operation to Panama Pacifico, which is about 40 miles outside of Panama City.

While wages are higher in Panama (call center workers earn about $13,000 per year), Panama offers a number of tax incentives to cover the difference. Also, it’s very easy to get work visas for foreign workers, qualified local labor is plentiful, and you get to operate in the same time zone as your U.S. clients. Gone are the days of working until 3AM only to have Americans get angry when they hear an Indian accent on the other end of the tech support line.

As you’ve probably figured out by now, I believe Panama is the Best Offshore Company Jurisdiction for a new business with employees. And I’m not alone in this opinion. Companies like Citibank, HSBC, MasterCard, and too many bio-tech firms to count, have all made the same choice – move to Panama City for quality lower cost labor, business friendly laws, and tax incentives.

Of course this influx of jobs has pushed up the cost of labor. What would cost you $800 per month two years ago is now about $1,000 per month (with an annual bonus of one month’s salary, this becomes $13,000 per year). You will be also find that office space in the best parts of the city will cost about the same as a large U.S. market. In fact, rents in Panama are higher than in my home city of San Diego.

Even with these higher rents, the cost of operating in Panama can be 50% or less than in the U.S. One client of mine, also in Panama Pacifico, traded U.S. salaries of $135,000 per year for high-end computer programmers in Los Angeles for Panamanians earning $4,500 per month or $58,000 per year. After running the Panama office for a year, he tells me his quality and efficiency is the same or better than it was in Los Angeles.

Tax Issues for Offshore Company Formations

When looking for the Best Offshore Company Jurisdiction, a country with low or no tax should be at the top of your checklist. For U.S. tax purposed, it matters little where you incorporate, where you hold your investments, and where you operate your business from.

The bottom line on U.S. taxation is:

- If you are living in the U.S., offshore company formations are generally tax neutral. They should not increase nor decrease your U.S. taxes.

- If you move an IRA offshore, profits should be tax free (ROTH) or deferred (traditional), just as they would be in the U.S. For advanced IRA investors, a VBIT blocker corporation may provide significant planners opportunities.

- If you live outside of the U.S., qualify for the Foreign Earned Income Exclusion, and operate a business through and offshore corporation, you may be able to defer or eliminate all U.S. tax on active business profits. Significant planning is required.

So if you’re living in the U.S. and investing abroad, you want the most efficient structure that will ensure you pay no local (non U.S.) tax on profits. As I’ve said before, I believe Belize and Nevis provide the best protection with zero tax and the most efficiency available in an offshore company.

- If you do pay tax in your country of incorporation or country where you are investing, the U.S. Foreign Tax Credit should eliminate any double tax.

If you are buying real estate in an offshore company, you probably require a company where the property is located. Want to buy land in Columbia? Trying to do this with a Belize LLC can be a nightmare… you need a Columbian company.

If you want to invest abroad with your IRA, you must use an LLC. The only countries I know of with compatible LLC statutes are Nevis, Belize, Anquilla, and Cook Islands. Of these, Belize is the best suited to the management of retirement accounts.

What if you want to buy real estate in Columbia with your offshore IRA? You will need both an offshore IRA LLC from Belize and a corporation from Columbia.

This extra entity will make life much easier and provides other benefits. For example, you can distribute out the share of the Columbian companies, rather than the underlying real estate, when you hit age 70 ½. This can reduce U.S. tax on a traditional IRA in an offshore LLC. Please see my various offshore IQA LLC articles for more detailed information on this, as well as how the corporation can act as a UBIT Blocker if you buy the property with IRA money and a non-recourse mortgage.

For the active business, I’ve made the case for Panama. However, the Best Offshore Company Jurisdiction for a business in Panama, especially one with employees, might not be Panama. (Confused yet?)

Let’s say you are running a website in Panama that sells books to people living in the U.S. We can call this business Amazonian.com. If all the income and profits come in to a company incorporated in Panama, local tax authorities may want to tax your business income.

To eliminate tax in Panama, form an offshore company in Belize and a company in Panama. The Belize IBC will bill your Amazonian clients and earn most of the profits. The Panama company will invoice the Belize IBC for its expenses such that it breaks even in Panama and minimizes taxes there. Of course the Belize IBC will pay no tax in Belize.

Now you are maximizing the benefits of both of the Best Offshore Company Jurisdictions… one for zero tax (Belize) and another to the best business laws and quality lower cost labor (Panama). You have also maximized the U.S. tax benefits of the Foreign Earned Income Exclusion and the ability to retain profits over and above the Exclusion in a tax free country (Belize).

Local Reporting Requirements

When I plan structures in the Best Offshore Company Jurisdictions, I try to avoid those with local reporting requirements. For example, all companies in Hong Kong must file audited financial statements each year. While this is an easy source of revenue for local accounting firms, I don’t see any benefit to the client. Therefore, I only incorporate in Hong Kong if I need an account on that island, want to do business in China, or to trade in RMB.

In most countries, such as Panama, Cayman and Belize, you are only required to file local (tax) returns if you have employees or are otherwise running a local business. Of course, of you open a bar on the beach in Belize, or operate a corporation in Panama with 20 employees, you will have local filing obligations. Otherwise, as an offshore company, you have no reporting requirements.

I note that, as an American living and working abroad, if you are using the residency test to qualify for the Foreign Earned Income Exclusion (as defined in various articles on this site), you should be filing a tax return in your country of residence. That doesn’t mean you need to pay tax, but you should be filing something.

World Image

There are times when the world image of your offshore company makes a difference. For example, someone doing business in Singapore, Taiwan and Hong Kong, might find their clients are more comfortable with a Hong Kong corporation than with a Nevis entity. This is especially true when the jurisdiction of your offshore corporation must be disclosed in contracts or marketing materials.

The same principles apply in the asset protection industry to large family trusts. Because of the availability of high-end asset managers, the largest and most complex trusts are created in Cayman Islands. Because Cayman does not have the strongest privacy and protection laws, many of these trusts have a “flight clause” that allows them to escape Cayman for a more secure jurisdiction, such as the Cook Islands, should they come under attack.

For those of us not in the 1%, not named Romney, and not running a business where world image matters to our clients, I again suggest that the Best Offshore Company Jurisdiction in which to plant that first flag offshore is Belize. If you are concerned that Belize may limit your choices for banking and investment advisors, I suggest that a Panama corporation owned by a Panama Foundation provides maximum privacy and is the most cost effective of the Category III countries. I also believe the Panama Foundation is the best asset protection entity available.

Offshore Company Specialists

A number of offshore company jurisdictions have become specialists in one niche or another of the incorporation industry. For example, the offshore asset protection trust, at least for Americans, was “invented” by the Cook Islands. This tiny country, just off of New Zealand, started the move offshore and out of the reach of U.S. judges who gave such deference to allegedly injured creditors.

To this day, the Cook Islands are the preeminent jurisdiction for asset protection trusts… not the largest in trusts by dollar value, but the best offshore trust jurisdiction for those focused on asset protection.

Side note: I’ve been working with Cook Islands Trusts for a decade and hold them in the highest regard. They’ve been thoroughly vetted through the U.S. legal system and are best for those expecting trouble or litigation. One reason for this assessment is that Cook Islands cases are heard in New Zealand courts. Therefore, you have legal experts and systems applying Cook Islands law, which means better quality legal representation and processes.

For those not anticipating imminent legal action, a Panama Foundation or Belize Trust may offer similar levels of protection at about half the formation cost and 1/3rd the annual maintenance.

In the niche of Offshore Foundations, the only options are Panama and Liechtenstein. Of these, Panama offers many advantages in term of banking, privacy and protection.

The Panama Foundation is a hybrid asset protection tool that provides many of the same benefits as a trust, including estate planning, privacy tools, such as the nominee foundation council, and of a corporation, such as the ability to open bank accounts and manage assets directly. Especially when combined with a Panama Corporation for further diversification and risk segmentation, the Panama Foundation is one of the best offshore company options for after tax investing abroad – I say “after tax” because a U.S. retirement account or IRA can’t be placed in a Foundation, only an offshore LLC.

Another offshore company niche is the captive insurance company. These are usually based in the Bahamas (the largest) or Cayman, and basically allow a U.S. business to self insure and deduct up to $1.2m per year on their U.S. taxes.

Offshore captives are a complex topic and are best suited to doctors or other self-employed high-net worth individuals who can put away at least $800,000 per year. If you would like more information on Offshore Captives, please send us a message to info@premieroffshore.com. All consultations are confidential and free.

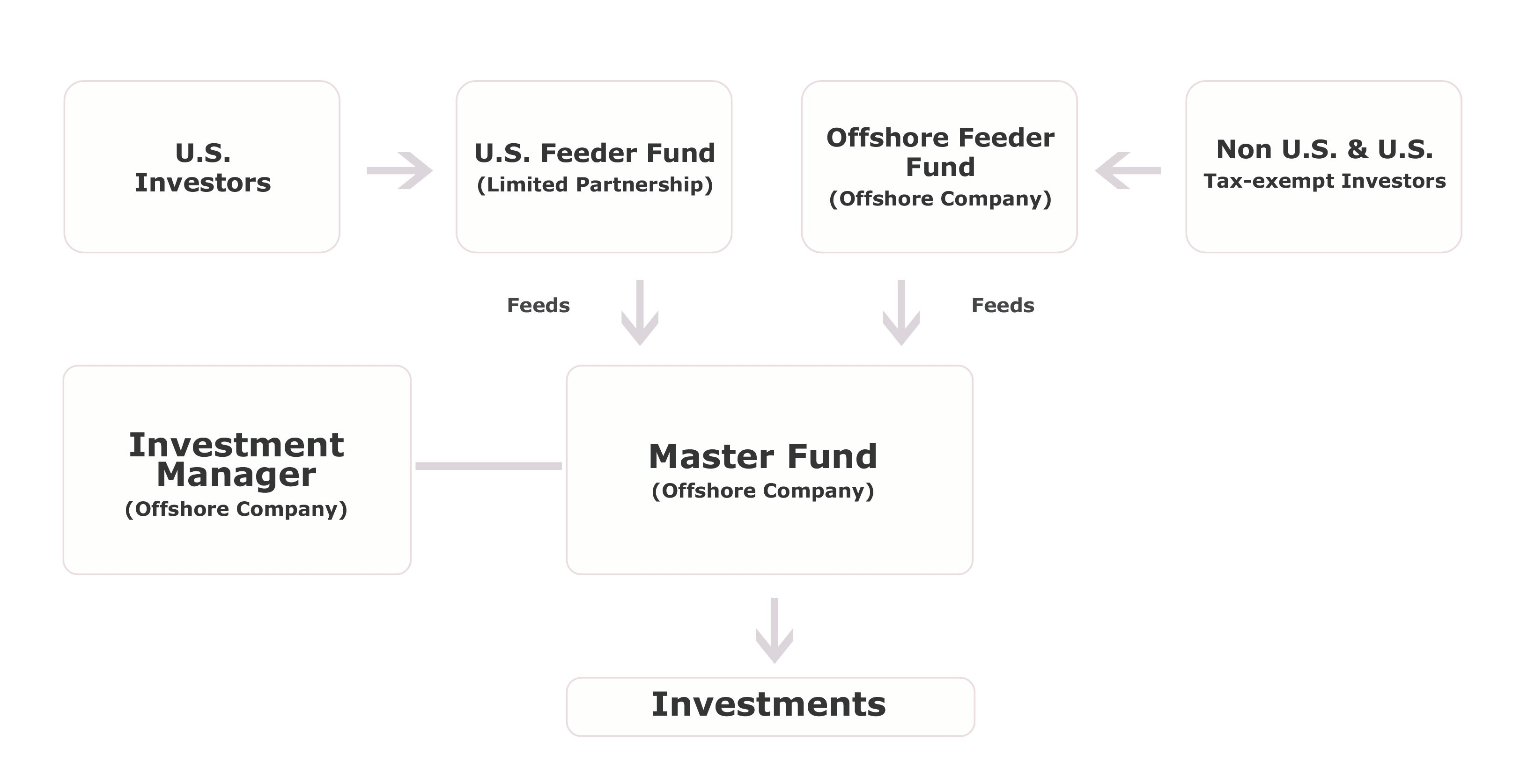

Another niche is the Offshore Hedge Fund. In this vertical, the Best Offshore Company Jurisdiction is the British Virgin Islands (BVI) followed by Cayman.

An offshore hedge fund is setup to allow foreigners (non U.S. persons) and tax preferred investors (IRAs, retirement accounts, pension funds, etc.) to invest in the United States without paying tax here.

For example, if a German citizen and resident were to invest in a U.S. fund or a small business, he would likely need to file and pay U.S. taxes as a result. If that same person invests in a fund structured in BVI, and the fund invests in the U.S. business, the foreign individual has no U.S. tax obligations.

The same is true of U.S. pension funds and retirement accounts. If they invest directly in U.S. funds, they will probably have to pay U.S. taxes on the profits. If they invest in a Cayman hedge fund that then invests in the U.S. business, they can eliminate these tax headaches.

- If you are wondering how big these “niche” segments are in dollar volume, take a read through my Cayman Islands business guide.

The last niche market segment I will mention is credit card processing and merchant services. By far, the Best Offshore Company Jurisdiction for merchant accounts is the United Kingdom. If you form a U.K. corporation, you will be able to access a much larger pool of credit card processors, including those in Europe and Australia, than you will with a Belize or Panama entity.

- If your business is based in Panama, and you have employees there, you will have access to many local merchant account options. If you have no presence in Panama, you will be limited to a few rather expensive providers, such as Multibank.

Of course, no one can compete with the low cost providers, including Pay Pal, of the United States. It might be said that the Best Offshore Company Jurisdiction for credit card processing is right here in America.

Yes, an account in the U.S. can be “offshore.” Let’s say you are living and working in Panama. Your parent company for billing purposes is in Belize (to minimize taxes in Panama). If you are a U.S. citizen with decent credit, have a U.S. mailing address and a U.S. bank account, you should be able to open a U.S. merchant account for about 1/2 or 1/3 of the cost of the same service offshore.

The proceeds of the credit card transactions will flow in to your U.S. bank account. You then invoice the U.S. Corporation that holds this account from your Belize IBC and wire the funds each month or quarter to Belize.

- Note that a U.S. corp. is required for the system above because no one will open an account in the U.S. for a foreign entity.

So long as the U.S. company has zero profits at the end of the year, you file your U.S. corporate return, you qualify for the Foreign Earned Income Exclusion, and you have no employees in the U.S. or other issues which create U.S. sourced income, this merchant account is basically an offshore tool. For additional information see my article on offshore merchant accounts.

I hope you have found this guide to the Best Offshore Company Jurisdiction to be helpful. Feel free to call or email for a confidential consultation on moving your assets or business offshore.