Benefits of an Offshore Company

One of the most confusing areas of going offshore are the benefits of the offshore company. Will going offshore reduce your taxes? The answer is a qualified maybe. Will an international corporation or LLC structure protect you from creditors? The answer is a resounding yes.

In this article I will attempt to describe the benefits of an offshore company for those living in the United States and for those living and working abroad.

Offshore Company for Those Living in the U.S.

The benefits of an offshore company for those living in the United States are simple: it provides some of the best asset protection available and allows you to diversify your investments internationally. Moving your assets in to an offshore company should not increase or decrease your U.S. tax bill.

This is the say that there should be no tax benefit to going offshore if you are living in the United States. Offshore asset protection should be tax neutral.

So, your offshore company might invest in gold bullion held in Panama or Switzerland, real estate in Belize or Colombia, and hold a brokerage account at any number of quality firms. It will allow your assets to escape from America and plant that first flag offshore.

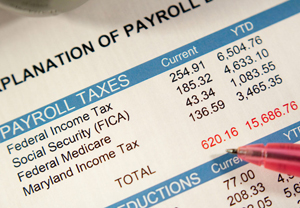

Protecting yourself with an offshore company will require you file a corporate tax return, IRS Form 5471, or a disregarded entity return, IRS Form 8858, and, if you move more than $10,000 out of the US, to report your international bank accounts on the FBAR form. For additional information on tax reporting, click here.

Offshore Company for Those Living and Working Abroad

Let me begin by noting that U.S. citizens are taxed on their worldwide income no matter where they live. Operating a business through an offshore company may significantly reduce the amount you must hand over to Uncle Sam…so long as you file all of the necessary forms each year.

If you are living and working outside of the United States, the benefits of an offshore company can be significant. First, it allows you to protect your business assets, increases privacy, and offers an unparalleled level of asset protection.

Next, an offshore company allows you to maximize the Foreign Earned Income Exclusion. If you were to operate a business without a corporation, or with a US corporation, then you must pay Self Employment tax or FICA, Medicare, ObamaCare, etc. This basically amounts to a 15% tax on your net profits.

If you were to roll the dice and operate a business offshore without an offshore company, unprotected from litigation, you would report your income on Schedule C of your personal return. When this happens, expenses on Schedule C reduce the value of your Foreign Earned Income Exclusion.

For example, if your international business grosses $400,000, and your expenses are $200,000, your expenses are (obviously) 50% of your gross. When this is reported on Schedule C and Form 2555, your FEIE is reduced by 50% and you only get $49,000 tax free…not the full FEIE amount of $98,000.

– The FEIE is actually $99,200 for tax year 2014 and 2015 has not yet been released. I usually round down to $98,000 to make the math easier to follow.

If this same $400,000 in gross profit and 50% expense is reported in an offshore company, on IRS Form 5471 and 2555, then you get the full $98,000 FEIE. If the business is run by a husband and wife, each may take the exclusion, and you will get $196,000 tax free.

Finally, by operating your business through an offshore company, you may retain earnings that are in excess of the FEIE. So, if your net profit is $200,000, you might draw a salary of $98,000 and leave the rest of the money in the business. Thereby, you will pay zero US tax on your offshore business.

So, the tax benefits of an offshore company can be major. When planned and structured properly, your offshore company may pay zero U.S. tax…while remaining in compliance and following all of the applicable laws.

For more detailed information on the benefits of an offshore company, please check out my Expat Tax and Business Guide.

Why So Much Confusion on the Benefits of an Offshore Company?

So, why is there so much confusion about the benefit of an offshore company? Why do I receive calls nearly every day from people who are mixed up on the tax benefits? I think there are two answers:

First, promoters located offshore, and out of the reach of the IRS, often give false information to make sales. If you call an incorporator in Nevis and ask about taxes, they will say something like, “no, you don’t need to pay tax on your profits. You can leave them offshore as long as you like and no one will know about them until you bring them in to the U.S.”

Well, this is true from the perspective of someone in Nevis. That island will not attempt to tax your Nevis IBC, nor will they require you to file any tax returns or report your business. But that is not what is important here…as a U.S. citizen, you are concerned with the IRS knocking down your door and not what Nevis thinks.

This is why all U.S. persons must use a U.S. firm that offers tax and business consulting services to incorporate offshore. The risks and costs associated with failing to keep in compliance will certainly outweigh any premium you pay for quality representation. If you don’t choose Premier to create your offshore company, make sure you use another U.S. tax expert!

Second, you read all the time how big companies like Google and Apple have billions of tax free dollars offshore. Why can’t you, the average guy or gal, setup an offshore company and do the same thing?

These big guys have business units with employees and other assets that are working and producing sales outside of the U.S. They don’t just form an offshore company and run revenue through it. They build an offshore division that makes money…and it is these profits generated by their offshore units that retain earnings offshore.

- Want to learn more about how big corporations operate? Read up on terms like “transfer pricing.” This is the foundation of the offshore corporate tax break for large firms.

Because small businesses can’t usually hire a bunch of employees in Panama and Ireland, and pay big money to tax lawyers to structure their worldwide affairs, we are left with the basics: the only way to emulate Apple and Google is to move you and your business offshore and qualify for the FEIE.

I hope you have enjoyed this article on the benefits of an offshore company. Feel free to contact me at info@premieroffshore.com for a confidential consultation, or post a question to this page in the comments.

Leave a Reply

Want to join the discussion?Feel free to contribute!