In this post, I’ll look at why international banks in Puerto Rico are in the Pandora Papers. While the left-leaning journalists try to spin these banks as somehow sinister, the truth is much more mundane. Here’s what you need to know about why Puerto Rico banks are in the Pandora Papers.

The Pandora Papers dwarf the Panama Papers and include more than 11.9 million records for a total of 2.97 terabytes of data. These records were stolen from 14 different incorporation firms, with the largest being Trident Trust. These files provided information on people from 200 countries, including more than 330 politicians and 130 Forbes billionaires, and several celebrities.

The Pandora Papers included information on only a few international banks in Puerto Rico. Though, I can tell you that most of the banks in Puerto Rico were structured using an offshore holding company. They may also have an offshore broker-dealer, EMI license, or some other international processing company or payment rail. So, basically, all international banks in Puerto Rico could have been in the Pandora Papers.

There are a few reasons why banks in Puerto Rico must use offshore companies when setting up. The first is for the payment of dividends to non-US shareholders. The second is because many of these banks offer cross-border payments or non-USD accounts, so need access to foreign payment rails.

Puerto Rico Banks in Pandora Papers – Holding Companies

International banks in Puerto Rico with IBE licenses pay 0% tax and those with IFE licenses pay 4% in tax. There is no withholding tax on dividends paid to non-US persons or offshore holding companies. Dividends paid to US persons are taxable in the United States.

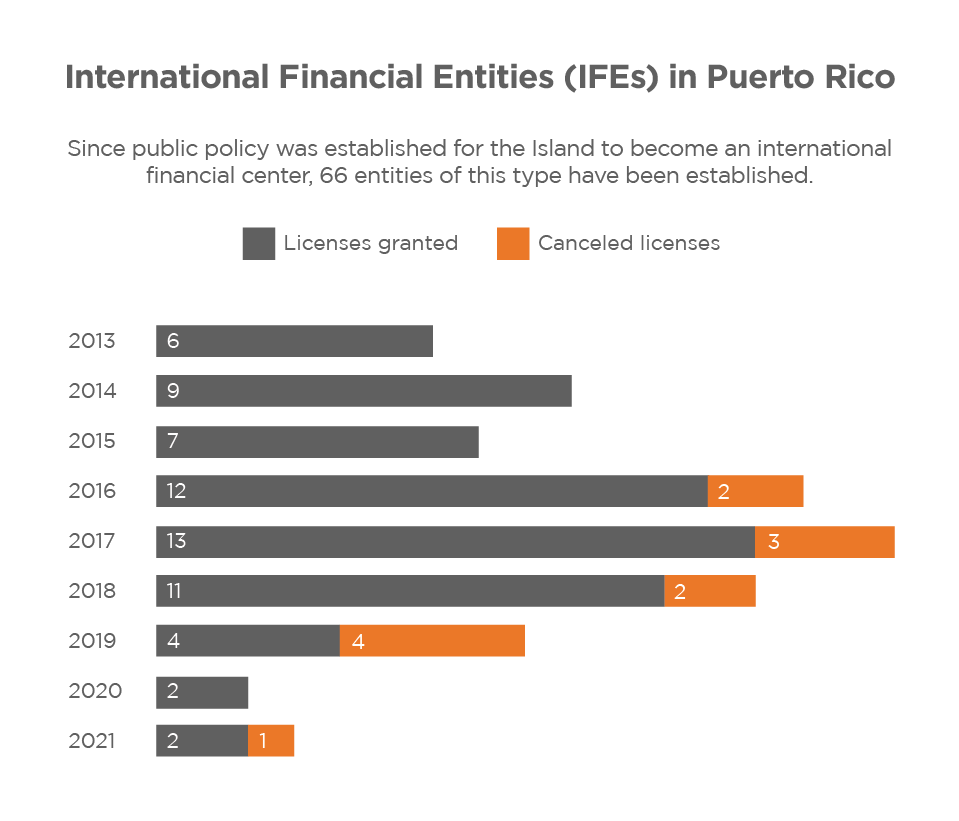

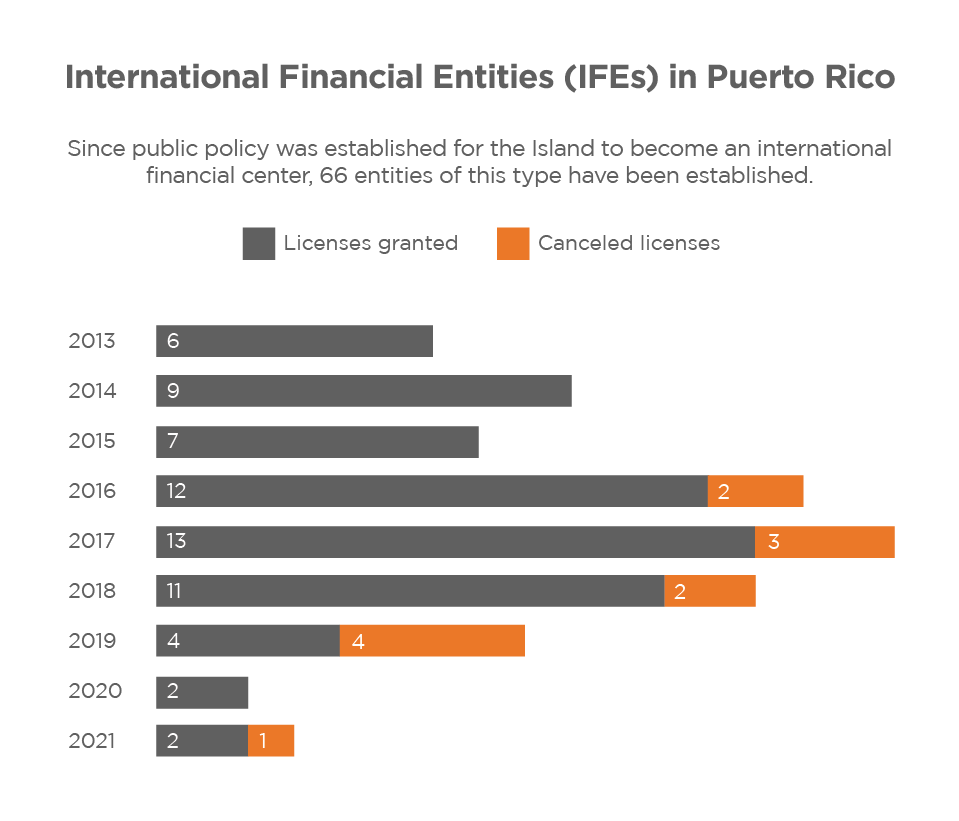

- IBE licenses were issued between 1989 and 2012 and the first IFE licenses were issued in 2013. The IFE law replaced the IBE law, increasing the tax rate to 4%.

IFEs and IBEs in Puerto Rico with non-US shareholders, or those that want to court foreign shareholders, require an offshore corporation. The international bank pays 4% tax on its net profits and pays out a tax-free dividend to the offshore holding company. Those dividends are held at the holding company or paid out to the shareholders per their wishes and in a tax-efficient manner.

There is no tax benefit to US shareholders in using an offshore holding company. US persons pay tax on dividends when they are distributed. Therefore, US shareholders prefer profits to be retained in the bank tax-deferred while foreign shareholders prefer that dividends are paid out as soon as possible.

Of course, dividend payments are governed by the capital requirements and operational requirements of the IFE or IBE. For more on this topic, see: Puerto Rico Bank Capital Requirements.

For more on the topic of tax planning for an international bank in Puerto Rico for US shareholders, see: Puerto Rico Tax Incentives for Bank Owners.

Puerto Rico Banks in Pandora Papers – Payment Rails

Most international banks in Puerto Rico focus on international customers. Others focus on US clients with international transactions. For this reason, IFEs and IBEs need access to international payment rails. Most banks in Puerto Rico offer FX services along with accounts in USD, GBP, CHF, and other currencies.

Also, many of these Fintech banks are looking to provide cost-effective cross-border payment services. This requires multiple correspondent accounts and other licensed or unlicensed structures which are typically held in an offshore company.

For more information on setting up a bank in Puerto Rico, see: Start a Bank in Puerto Rico in 10 Steps

For information on purchasing a bank in Puerto Rico, see: Process to Purchase a Bank in Puerto Rico

Puerto Rico Banks in Pandora Papers – Broker-Dealer License

Again, banks in Puerto Rico typically focus on international clients. IFEs and IBEs provide banking and custody services to people from China, Latin American, and around the world. For more on custody services, see: International Banks in Puerto Rico May Provide Global Custody Services

Also, banks in the United States and Puerto Rico are prohibited from providing brokerage services. They are allowed to provide custody services, but can’t execute the trades. For this reason, banks in Puerto Rico will set up a separate broker-dealer in a jurisdiction such as the British Virgin Islands.

Why don’t they set up the BD in the United States? First, the costs of operation are much higher in the US. Second, most clients are not US persons, so a US BD is not going to accept them as clients and will not be an efficient option.

For more on how to structure an international bank in Puerto Rico, see: How to Set up an Offshore Bank in 2022.

Puerto Rico Banks in Pandora Papers – Client Companies

The article below, which inspired this post, identified various non-US persons with offshore companies and accounts at various international banks in Puerto Rico. In fact, many non-US persons form offshore companies in order to open business accounts at banks in Puerto Rico.

While US persons are taxed on our worldwide income, most other persons and companies are not. There are many legitimate tax and business reasons a non-US person would form an offshore company and open an account in Puerto Rico. Also, there are several legitimate business reasons US persons might do the same.

For example, if a US person wants to invest in a foreign or offshore fund, they’ll need an offshore structure. Also, if a US person is selling into foreign countries, they will need an offshore company to facilitate that business. This would include using the bank in Puerto Rico for their cross-border payments for salaries, purchases, shipping, etc.

Why Target Puerto Rico Banks in the Pandora Papers?

So, why are banks in Puerto Rico the target of journalists writing on the Pandora Papers? Because they can get great headlines that make it appear that these banks are doing something nefarious. In fact, international banks in Puerto Rico are required to use offshore structures, but none of these “investigators” bother to mention that. Anyone associated with the offshore industry is guilty until proven innocent.

The bottom line is that these Pandora Paper articles get clicks for the author. It doesn’t matter if the use of an offshore structure is 100% legitimate. It’s easy to cast anything with the word “offshore” in the name in a disparaging light.

When you read these articles about Puerto Rico banks in the Pandora Papers, keep in mind that these are the most regulated international banks in the world. Yes, the regulator in Puerto Rico has just a few employees but uses a network of external auditors and banking experts (see the article below).

Next, many banks in Puerto Rico are regulated by the US Federal Reserve Bank. This is the toughest regulator there is, and these Puerto Rico banks follow all the same reporting and compliance requirements of the largest national banks.

Finally, all shareholders, investors, officers, directors, and key personnel of these banks go through stringent due diligence. They must provide three years of audited financial statements and complete a very rigorous background check which costs $6,500 to $15,000 per person depending on their nationality and other factors.

And the same is true for any corporation that’s a shareholder of the bank. These offshore corporations must either be newly formed or provide 3 years of US GAAP compliant audited financial statements. Any offshore company that appears in the Pandora papers has been fully vetted by regulators and a third-party due diligence provider such as Kroll or Berkeley Research.

When the Pandora Papers attack a shareholder of a bank in Puerto Rico because he was accused of wrongdoing in years past, you can be assured that this claim was thoroughly checked out by regulators and various investigative agencies. If he was allowed to become a shareholder, he was clean (see the article below).

As someone in this industry since 2003, I can tell you that no high net-worth person actively involved in a business is without his or her detractors. As the expression goes, you haven’t made it until someone sues you (until you have enough money for someone to bother trying to take it from you).

I’ve seen dozens of background reports, some over 100 pages long. I can tell you from experience that every successful person has a history of litigation and has some battle scars.

In fact, I’ve only seen one perfectly clean background report. And, as it turned out, that was an American who was fronting for some foreign investors. He was quickly found out and the bank purchase didn’t get past first base… but, my point is, if the report is perfectly clean, that’s when you need to be suspicious.

For more on how to structure an international bank in Puerto Rico, see: How to Set up an Offshore Bank in 2022.

Conclusion

I hope you’ve found this article on why Puerto Rico banks are in the Pandora Papers to be helpful. If you’re interested in forming an IFE in Puerto Rico or purchasing an existing bank in the territory, please contact me at info@premieroffshore.com. I will personally prepare your business plan and handle your license application.

Translation of Article on Puerto Rico Banks in the Pandora Papers

The following is a translation of the Spanish language article that inspired this post. For the original version, click here.

Note that this is an unofficial translation. Any grammatical issues, run-on sentences, poor or unclear writing, typos, or any other errors are mine. Any translations that I’m unsure of are in [brackets], as are my comments.

I’ve also deleted the names of the banks in the article and replaced them with XXXX. I don’t see any reason they need to be named here.

SMALL INTERNATIONAL BANKS FROM PUERTO RICO IN THE PANDORA PAPERS

The international research in the Pandora Papers allows access to documents that show how some of these entities facilitate the opaque businesses of foreign millionaires, known as offshore companies.

From an office in San Juan, XXXX International Bank provides “Swiss expertise” to its clients. It offers banking services to foreigners who are not residents of Puerto Rico: receive deposits, open offshore bank accounts, and carry out transactions in any type of currency.

Their website highlights that they are discreet. It also says that they comply with the law and are committed to a culture of compliance. That is, they verify the identity of their clients and question the origin of the money, “when appropriate.”

The owner of XXXX International Holding LLC – the bank’s parent company – is XXXX, a French banker who lives in Miami. His LinkedIn mentions that he chairs the Board of Directors of International Rollet Capital and ExPAM Capital, founded a bank in Dubai called La Trésorerie, and worked at Goldman Sachs. He doesn’t mention XXXX.

XXXX’s contact person in Puerto Rico is Rafael Blanco Latorre, former commissioner of the Office of the Commissioner of Financial Institutions (OCIF) from 2012 to 2016. Blanco Latorre told the Center for Investigative Journalism (CPI) that he is an external legal consultant and that he chairs the Board of Directors of one of the International Financial Institutions (IFE), although he did not want to mention the name. In October 2016, two months before ending his duties as commissioner, he signed the license that allows XXXX to operate in Puerto Rico.

Blanco Latorre refused to give an interview about his management as a civil servant in the OCIF and about the role he exercises in one of the entities that he supervised while he was in the Government, referring to the fact that he is now a private citizen.

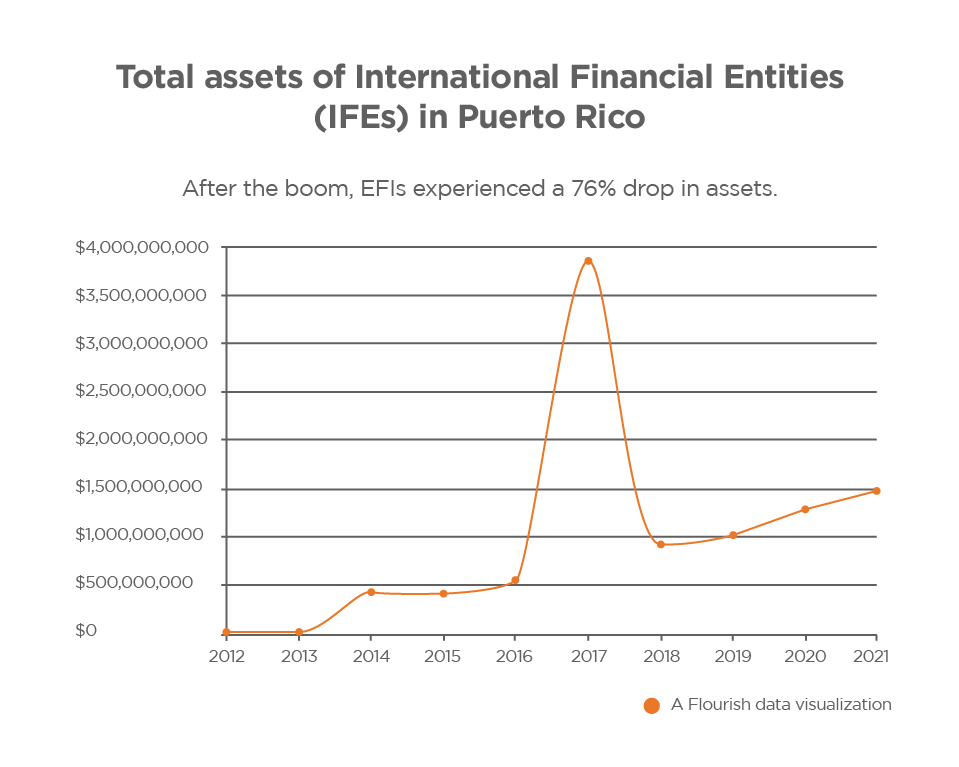

In 2012, under the government of Luis Fortuño, Puerto Rico [created the law which allowed the] island to become an international financial center. The Government offered tax exemptions of up to 45 years to anyone who set up a bank, insurer, subsidiary, or boutique firm dedicated to exporting financial services Act 20 [now referred to as Act 60]. The story is [standard]: capital would arrive, create thousands of jobs and generate economic development.

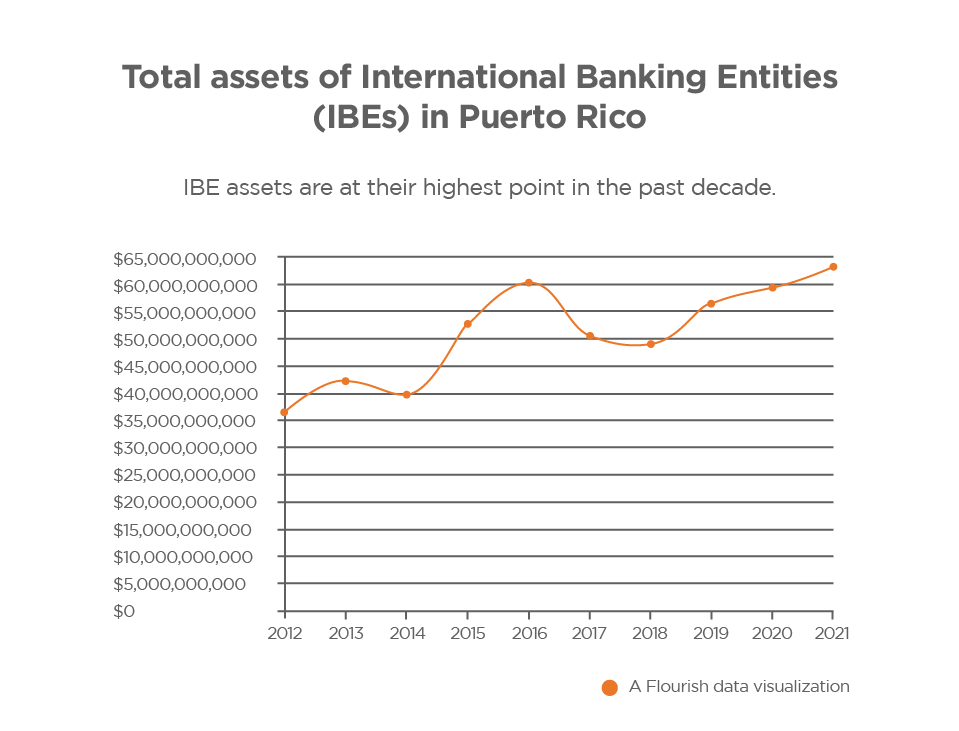

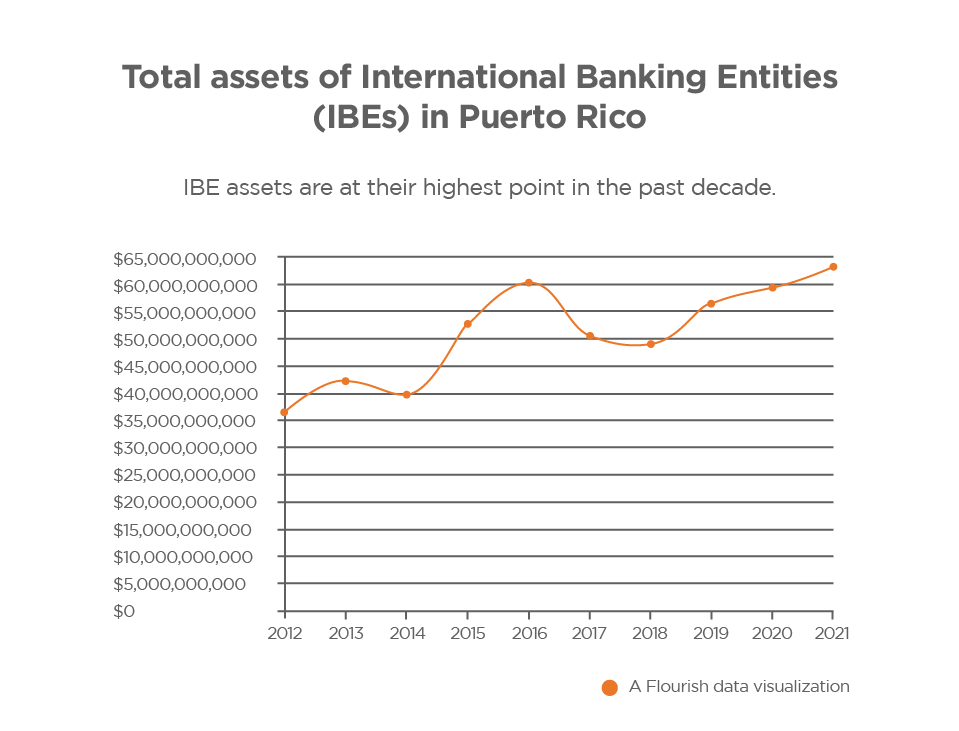

Since then, small banks have arrived in Puerto Rico that, by establishing themselves here, can open accounts directly with the Federal Reserve. This gives them direct access to the US market and facilitates transactions in US dollars. The owners of these entities are mostly foreigners and the law prohibits [IFEs and IBEs] from offering services to residents of Puerto Rico

Almost ten years later, the balance of this incentive has had a “modest” economic impact, less than 1,000 direct jobs according to OCIF, attracting the attention of federal and international authorities for money laundering and tax evasion cases, and a reputation as a [tax] paradise. These entities, whose owners often remain behind the scenes, can serve to hide assets from tax authorities or, in the worst case, money laundering and other illegal transactions.

Some of the directors, owners, and clients of these banks and international financial entities established in Puerto Rico appear in documents examined by the CPI are part of the Pandora Papers, a new delivery of 11.9 million documents from offshore companies obtained by the Consortium Investigative Journalists International (ICIJ). The leaked documents – most dated between 1996 and 2020 – come from 14 firms dedicated to incorporating and managing this type of business in tax havens. These include the Alemán, Cordero, Galindo & Lee (Alcogal) law firm, and the Overseas Management Corp. (OMC) law firm, both from Panama. In reaction to the ICIJ investigation, both companies stated that they are committed to compliance and that they act in accordance with laws and regulations.

The Pandora Papers reveal the financial secrets of 35 heads and former heads of state, more than 330 officials in more than 91 countries and territories, as well as fugitives, con artists, and murderers from around the world. It is the largest journalistic collaboration in history, with a team of more than 600 journalists from 150 media, led by ICIJ and including the CPI.

The leaked documents show how offshore entities have used some of these banking institutions to open accounts or transfer money.

Are these banks used in Puerto Rico to facilitate transactions between offshores, tax evasion or money laundering? The CPI asked Natalia Zequeira, Commissioner of Financial Institutions since January of this year.

“Doing business with‘ offshore ’companies is not illegal in itself. The vast majority of these companies are formed for legitimate purposes, among others, to hold shares or assets of other commercial entities, as well as to facilitate the transfers of assets and currencies ”, answered the lawyer.

She added that all financial entities in Puerto Rico are subject to different laws and regulations that include the obligation to report any suspicious transaction or activity that they identify. Failure to do so exposes the entity to sanctions and other penalties, Zequeira said.

Banks on Pandora Papers

In the case of XXXX, the CPI identified in the Pandora Papers Alcogal law firm documents related to the opening of accounts in this bank for the benefit of at least three offshore companies. XXXX did not respond to questions about their clients.

Another that appears in the Pandora Papers is XXXX, owned by Marcelino Bellosta Varady and Alejandra Bellosta Perea, according to a document presented to the Puerto Rico State Department.

Venezuelan businessman Carlos Marcelino José Bellosta Pallarés – Marcelino’s father – appears as a beneficiary of several offshore entities registered in the British Virgin Islands (BVI). At least three of them have bank accounts at XXXX, the leaked documents reveal.

According to the incorporator’s forms for registering companies, more than a dozen offshore entities, mostly from BVI, have bank accounts with XXXX.

XXXX assured the CPI that it is regulated by the OCIF and that it complies with all the laws and regulations that apply against money laundering and terrorism, among others. He said that he is continually working to improve his internal controls and that he has a bank officer who is dedicated exclusively to the compliance area.

XXXX did not answer questions from the CPI about the services it provides to the Venezuelan Bellosta family.

Marcelino has two brothers, Carlos José and Juan Manuel. Carlos José has had a decree of Act 22 since 2017 [now referred to as Act 60] and is listed as an official of Venequip Puerto Rico LLC, a supplier of equipment related to the energy industry. Juan Manuel manages several companies in Puerto Rico, including CH4 Systems, a technology provider with a decree of Act 20 since 2016 [now referred to as Act 60].

All these companies are registered at the same address as XXXX: Galería San Patricio B5 Calle Tabonuco, Suite 207-A, Guaynabo.

The Pandora Papers also mention Venezuelan Joan Manuel Fereira Rosillo, a businessman who received $2.2 million from the Brazilian company Odebrecht through his company Rote Energie, according to the multinational investigation into corruption Lava Jato.

According to a bank document on file with OMC, Fereira Rosillo maintains an account with XXXX Bank, a Puerto Rican IFE. [note that this is the third bank in Puerto Rico referenced in this article and not the same bank referenced above]

Agustín García Castilla serves as president of XXXX Bank, according to the bank’s website. García Castilla coincides with Fereira Rosillo in different companies in Florida and Panama, including one called XXXX Asset Holdings.

The CPI asked XXXX Bank if, according to the documents, it provides services to Fereira and if it owns the institution, but received no response. Fereira Rosillo, who also worked for the oil company PDVSA, is also listed with offshore companies in Aruba and the BVI.

[The section below refers to South Bank, which was closed by regulators in 2019. For more on this, click here (Spanish language only). For a list of current IFEs, click here. For a list of current IBEs, click here.]

Another bank featured in the leak is South Bank International. According to a reference letter prepared by the Alcogal law firm, one of South Bank’s clients was Tag Bank S.A., an investment bank registered in Panama. This entity is in the process of voluntary liquidation according to its website. Last August, the Brazilian Eduardo Plass, president of TAG Bank, was accused and arrested in Brazil for tax evasion, in relation to Lava Jato.

In 2019, the FBI raided the offices of South Bank International in Guaynabo after a federal judge found probable cause for fraud and money laundering crimes. The OCIF canceled his license that same year, after the intervention.

The offshore dilemma

Owning offshore assets or using paper entities to do cross-border business is not illegal.

“There is a distinction to be made between reducing the payment of taxes and avoiding taxes. Reducing the payment of taxes is a goal of everyone who pays taxes. There are thousands of ways to reduce taxes legally. What should not be done is to evade taxes, “said Eduardo Colón, president of the Association of International Banks of Puerto Rico.

But many use this system to manage, move and often hide their fortunes, proof that not all people play by the same rules when complying with their tax liability. Governments lose more than $800 billion a year due to offshore business, according to the International Monetary Fund. They are also used for crimes such as tax evasion and money laundering, and it is a mechanism generally used by the rich and powerful.

Colón recalled the Panama Papers, the ICIJ investigation published in 2016 that exposed the complex and dark offshore financial system.

“One of the important things about world-class financial centers is that they have a strong structure from a regulatory point of view and are well regulated because if not, they can collapse very easily, as happened with Panama and the Panama Papers”, Colón told the CPI.

In Puerto Rico, international banks and financial entities are subject to US federal laws and regulations such as the Bank Secrecy Act, the USA Patriot Act, and the Know Your Customer rule, an international standard for obtaining detailed information about customers. Regulations of the Office of Foreign Assets Control (OFAC) also apply.

But what different offshore forums and some of the banks themselves promote is the Common Reporting Standard, or CRS, of the Organization for Economic Cooperation and Development, which requires participating countries to share tax information from their clients.

This also makes Puerto Rico an attractive option for those seeking privacy in their businesses.

Trouble with the law

In February 2019, the European Commission added Puerto Rico to a list of countries highly prone to tax crimes, but it was later removed at the request of the US Treasury Department.

The CPI identified half a dozen cases of international banks whose shareholders, directors or clients have faced problems with the law or have been singled out in journalistic investigations for irregularities in their businesses.

Uruguayan bankers Marcelo Gutiérrez and Juan Ignacio Cabrera established the XXXX in Puerto Rico in 2015. They obtained an account with the FED, which facilitated transactions in US dollars. Three years later, in 2018, Gutiérrez was accused by the Florida Federal Prosecutor’s Office along with a group of businessmen of laundering $1.2 billion from PDVSA through a bank in Puerto Rico.

Later, a group of Chinese investors acquired XXXX Bank in 2018 and changed their name to XXXX International Bank. The new owners of the IFE said in 2019 that they have nothing to do with XXXX’s operations or with Gutiérrez or Venezuela.

In 2019, the Federal Reserve System (FED) stopped the opening of accounts from these Puerto Rican banks due to their use as intermediaries for Venezuelan businessmen connected to the Government of that country. That same year, the offices of two international banks – XXXX and South Bank – were raided by the FBI as part of investigations related to money laundering.

Regarding the latter, Colón said that there are few cases like these on the island, that crimes occur even in the largest banks and it means that the sector works as it should.

He also recognized that “the worst thing that can happen to a financial center is that one or more of those that are operating, are operating on the fringes or outside the law and that is found.”

The Commissioner for Financial Institutions, Natalia Zequeira, said that the FED has already lifted the restriction on international banks, which are in the process of complying with a new guide from the federal agency.

In an interview with the CPI, she revealed that the OCIF currently audits 100% of the entities with Venezuelan capital in Puerto Rico.

Since she came to the office in January of this year, she said that she seeks a “culture of compliance.”

“I want people who know the system, not people who take their license and start playing at the bank here. I am not saying that it has happened, but simply that under this administration, there is no space for that, ” said Zequeira.

For her, Puerto Rico is not a tax haven either. But she acknowledges that initially there was a trend of small banks and financial entities with few assets or no banking experience.

“Before it was seen a lot that there was a person who maybe had a banking history in another jurisdiction, decided to set up a bank from scratch and what he had was a parent company with very few assets or an affiliate that were other personal assets of that individual. And little by little it became a bank for their family and friends, to have an account in dollars, because perhaps in an American bank they did not know how to open the account in dollars, or they could not because they did not have a passport or a Social Security number, among other things. Well, there was a [need or demand] for that type of institution, ” she said.

This type of entity is no longer endorsed, according to the commissioner.

[In addition, the capital requirements have been greatly increased, pushing out small and undercapitalized banks. See: Puerto Rico Bank Capital Requirements.]

They ask to increase the tax rate

There are two corporate models for establishing these banks. Although they provide the same banking services and work the same when handling deposits, international banking entities (IBE) and international financial entities (IFE) are different in some areas. IBEs are 100% tax-exempt, while IFEs only pay 4% in income taxes and 0% in CRIM and other municipal taxes.

[The IBE law was in place from 1989 to 2012 and the IFE law replaced the IBE law in 2012. The first IFE banks became operational in 2013.]

Regarding the public policy of encouraging these international banks, the study commissioned by the Government of Puerto Rico recommends increasing the tax rate of these entities from 4% to 10%. Also the minimum number of jobs required by law, from four new jobs to 10.

James Hickman has had an IFE since 2017 called XXXX Bank. A “safe, transparent, and responsible” entity, according to his website. The former US military and investor also has a decree of Law 22 [now Act 60]. He shares his time between Puerto Rico and Chile, where he has an agricultural company of blueberries and walnuts. He writes under the pseudonym Simon Black and his articles talk about obtaining passports in tax havens and “optimizing” the payment of contributions. He also discussed how to move to Puerto Rico and receive tax benefits as he did.

In a podcast, Hickman cautions that this type of business is not for everyone. The person concerned must have “a substantial level of wealth,” he says. Having a bank on the island requires more than half a million dollars in capital to operate. Still, Puerto Rico is one of the cheapest and most attractive jurisdictions to do so.

[$5 million is more realistic in 2021 and going forward].

At one point, Hickman recalls that a federal agency asked for changes to its corporate structure to be in compliance. But still, having a bank in Puerto Rico has been beneficial for him and his business, he says.

“I was actually pleasantly surprised at the amount of business that started coming to me just because people found out that I had a bank. People were saying, ‘Oh, now James has a bank. We’re going to call him and see if he wants to do this business, ‘” he said.

According to a document in the Puerto Rico Registry of Corporations, the XXXX Bank Board of Directors includes Gligor Tashkovich, former Minister of Foreign Investments of Macedonia. In 2020, in a lawsuit filed by the New York City Attorney’s Office against a supplier of anti-COVID masks, Tashkovich was named in a fraudulent sale to New York City. His attorney told The New York Times that his client did not participate in any fraudulent scheme and that he cooperated with authorities.

Carmen Szendrey, chief executive of XXXX Bank, told the CPI that the bank is subject to independent audits and that it invests money to ensure that “our institution does not serve as an instrument for criminal entities.”

On Tashkovich, she indicated that he is a “valued member of our Board” and that he has never been charged with any crime.

The executive did not answer whether Hickman continues to own the institution.

Eight OCIF employees to supervise 85 banks

OCIF’s 70 employees sit on the sixth floor of the Centro Europa building. The glossy dark wood furniture, the gold frames with black and white photos, the wine-colored cushioned chairs, take the mind back to the 80s. The most technological thing that there is at first glance is the machine that takes the temperature in times of COVID. From here the banks are audited.

“This year we requested an additional $1.2 million [of the operational budget] they granted us. That additional $1.2 million was divided into two priority projects that the Office has. One of them is a new system for the registry of securities because the operating systems of this office are from the 90s,” said Zequeira.

The second project he is proposing to do with the $1.2 million is to recruit more examiners. Currently, only eight OCIF employees are in charge of supervising the 85 financial institutions in Puerto Rico.

“While my examiners are with the FDIC seeing First Bank or Banco Popular with the Federal Reserve, at the same time they are running parallel on four or five exams to international institutions,” said Zequeira.

These people’s pay also stayed in the 1990s. Each examiner earns $24,000 annually and is required to have a bachelor’s degree in accounting or finance. It is not difficult to conclude that it’s an uphill battle for OCIF to ensure that all of these entities comply with the standards and the law.

The agency has never revoked a license after it was issued. Prior to 2017, there is no evidence of a single sanction issued against any IFE in Puerto Rico. Since then, OCIF has imposed 63 fines totaling $439,400.

[What? This article notes that South Bank’s license was revoked in 2019. I’m aware of two other licenses that were revoked and the chart above shows canceled licenses by year. Also, when a bank is in trouble, regulators will force them to sell and only cancel the license as a last resort. For a list of current IFEs, click here. For a list of current IBEs, click here.]

Financial and banking entities of all colors

The main banks with a historical presence on the Island have had IBE subsidiaries, including Banco Popular, Firstbank, Citi, Oriental, and UBS. But in addition to these financial institutions, there are other lesser-known faces in this industry. The multinationals General Electric (1996-present), GlaxoSmithKline (1998-2008), and Wyeth (2004-2010) have had IBEs in Puerto Rico, according to OCIF data. General Electric is the only one that still has an active IBE. OCIF indicated that it provides financing services for the purchase of household goods from people outside of Puerto Rico.

In the case of IFEs, the law allows them to do much more than an international bank. The list of activities allowed under IFE is extensive and flexible: investment management, financial advisory, real estate, metal buying, and selling, usurious loans [what??], insurance, and cryptocurrencies.

The first two IFEs established in Puerto Rico – PR Asset Portfolio 2013-1 International, LLC and PR Asset Portfolio Servicing International, LLC – are dedicated to the sale of delinquent loans in the real estate sector. Both belong to the same company, Caribbean Property Group (CPG), one of the main investors in Dorado Beach Ritz Reserve and Paseo Caribe. It also has three hotels and a corporate complex in Costa Rica.

Other IFEs in the same line of business include Blackheath, a subsidiary of the Blackstone Group, who owned the Ritz Carlton hotel in Isla Verde, VRM, owned by businessman Rafael Rojo Montilla, and Blue Water, registered under Jim Taubenfeld, owner of Me Salvé.

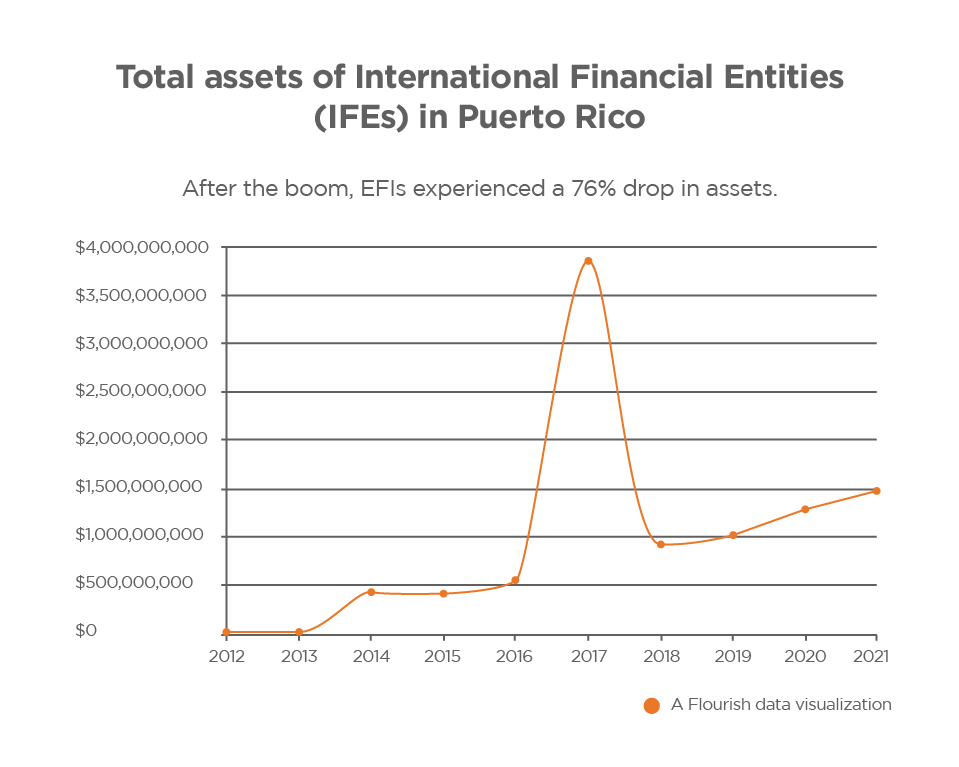

Between 2013 and 2018, OCIF issued 58 IFE licenses. And in just two years, 2017 and 2018, it approved 24 applications. Then the volume fell dramatically: in the last two years, only four licenses have been granted.

“I have seen a change in OCIF and the first specific change is the rigor they apply to applications for an IFE. At one point, many licenses were approved in a short period of time, ”said Colón.

Zequeira attributed the decrease to recent changes in tax rates that came into effect under the new 2019 Incentive Code and that apply prospectively.

In nearly 10 years, OCIF has only denied eight IFE requests, according to data provided by the agency. [Because they give unworthy applicants the choice to withdraw their application.]

There are also those who, despite obtaining their license, gave up on the idea.

In February 2014, Venezuelan David Brillembourg Capriles registered an international bank in Puerto Rico under the name Brilla Bank International LLC. It never complied with the annual reporting requirement and the State Department canceled the entity in December 2018. IFE’s license was canceled in 2016.

Brilla Bank also obtained a license on the island of Dominica, but it was revoked in 2017.

Asked by the CPI, Brillembourg Capriles said that he intended to open an investment bank in Puerto Rico, but that he never operated. Since 2018, he has a decree of Law 22 that exempts foreigners residing on the Island from contributions. He is also the developer of Loopland, a tourist-residential project for millennials in the old Roosevelt Roads naval base in Fajardo.

The Pandora Papers place the businessman as director of STG SA, a public limited company in Panama. Although the entity remains in force and appoints him as president, Brillembourg Capriles assured that he has not maintained any business in Panama for more than 10 years.

Brillembourg Capriles is also listed with offshore companies in Barbados, according to the Paradise Papers investigation. In 2017, he was sued by Luis Benshimol, who alleged that he created an “elaborate shell game” by using money from a hotel sale for his personal benefit. Brillembourg Capriles denied the complaint and the claim was dismissed for lack of jurisdiction.