2021 Foreign Earned Income Exclusion and Tax Rates

The Foreign Earned Income Exclusion is the most important tool expats and Americans living abroad have to reduce their US tax obligations. In this post, I’ll review the Foreign Earned Income Exclusion and explain how and when it can help you save on your tax bill.

In fact, since the Trump tax cuts, the Foreign Earned Income Exclusion may be the only way most expats can reduce their US tax. Because we are no longer eligible to hold business income tax-deferred in an offshore corporation, and all ordinary income is taxable as earned, the Foreign Earned Income Exclusion is the only way business owners can limit our tax exposure (the exception to the rule are those living in Puerto Rico).

Not so long ago, the Foreign Earned Income Exclusion was the trick for those earning around $100,000 a year. For larger businesses operated outside of the United States, we could hold the profits in the corporation in excess of the Foreign Earned Income Exclusion and only pay tax on that ordinary income when it was distributed as a dividend.

With the ability to retain ordinary income in the corporation eliminated, all we Americans abroad have left is the Foreign Earned Income Exclusion.

Before I get into the details, please note that this article is focused on ordinary income earned as a salary or as a self-employed person/business owner living outside of the United States. That is to say, I’m talking about ordinary income here and not passive or investment income.

There are two ways to qualify for the FEIE. You can be out of the United States for 330 of any 365 day period (physical presence test), or you can be a resident of a foreign country for a calendar year (residency test). Most expats use the physical presence test their first year abroad and then move to the residency test after they become legal residents of their new country. Those who don’t put down roots stick with the 330-day rule.

Also, the Foreign Earned Income Exclusion is the most help to those living in low or no-tax countries. If you live in a high-tax country, typically in Europe, you will probably benefit from the Foreign Tax Credit more than you will from the Foreign Earned Income Exclusion.

I should also note that Americans with income in excess of the Foreign Earned Income Exclusion might consider moving to Puerto Rico. US citizens who move to the US territory of Puerto Rico pay only 4% tax on certain types of business income and 0% tax on passive income earned from investments made after you move to Puerto Rico.

Standard Deduction for 2021

I start this area of the Foreign Earned Income Exclusion with the standard deduction. Why? If your income is less than the standard deduction, you probably don’t need to bother with the Foreign Earned Income Exclusion. You might be required to file a US return, but you probably don’t owe much in tax if the standard deduction eliminates most of your ordinary income.

The standard deduction for 2021 is $12,550 for individuals and married couples filing separately $18,800 for heads of household, and $25,100 for married couples filing jointly and surviving spouses.

Standard Deduction Amounts KPE/IRS

- For 2021, the additional standard deduction amount for the aged or the blind is $1,350. The additional standard deduction amount increases to $1,700 for unmarried taxpayers.

- For 2021, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer remains the same. It is cannot exceed the greater of $1,100 or the sum of $350 and the individual’s earned income (not to exceed the regular standard deduction amount).

Foreign Earned Income Amount for 2021

The Foreign Earned Income Exclusion for 2021 is $108,700. This is up from $107,600 for tax year 2020 and $105,900 for tax year 2019. This means that a husband and wife filing joint, where both live abroad and earn ordinary income, might save up to a total of $217,400 in US taxes using the Foreign Earned Income Exclusion in 2021.

Note that the Foreign Earned Income Exclusion is a “use it or lose it” exclusion. If you don’t file, and the IRS audits you, then you will probably not be allowed to use the Foreign Earned Income Exclusion and will pay 100% tax on your worldwide income.

I believe the Foreign Earned Income Exclusion is the only tax exclusion that can be lost if you don’t file. For example, you would be allowed to take the Foreign Tax Credit if you have failed to file, but not the Foreign Earned Income Exclusion.

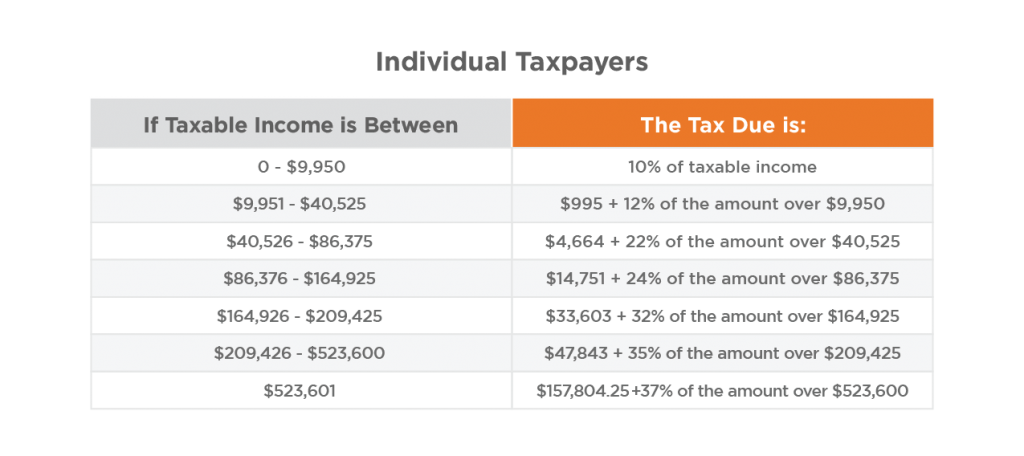

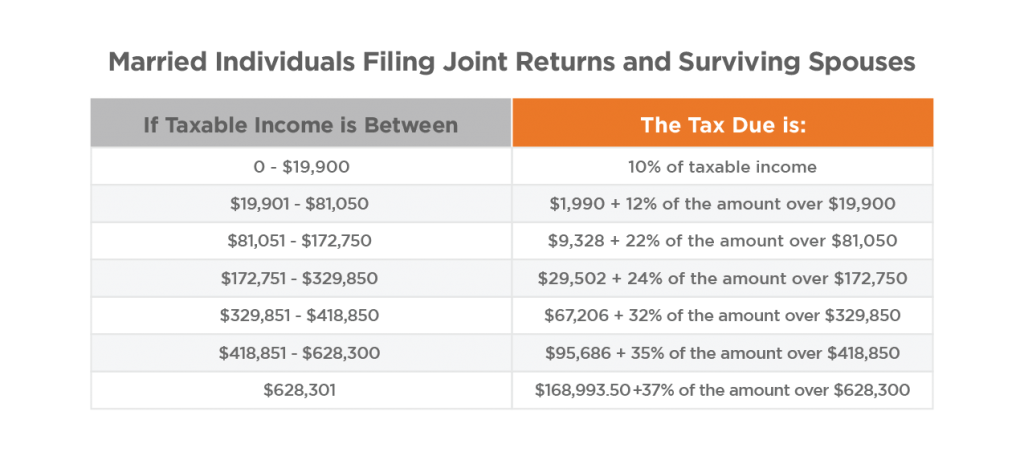

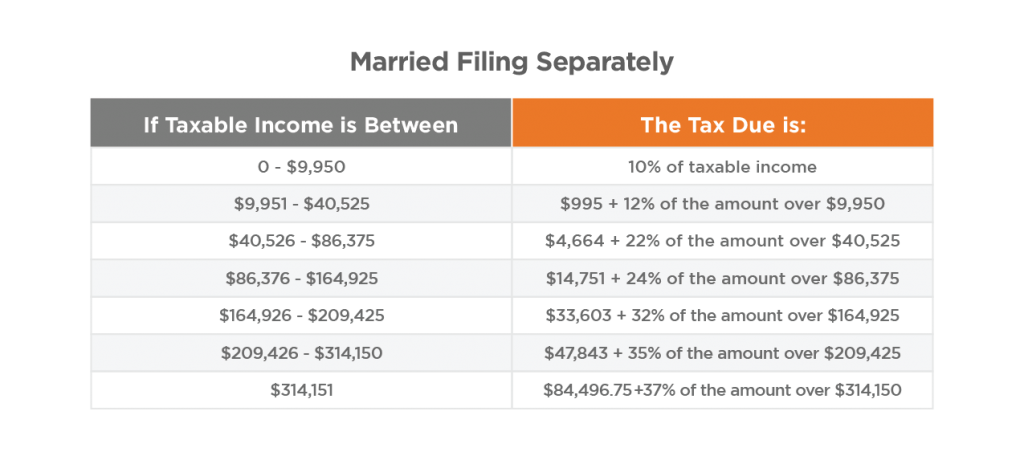

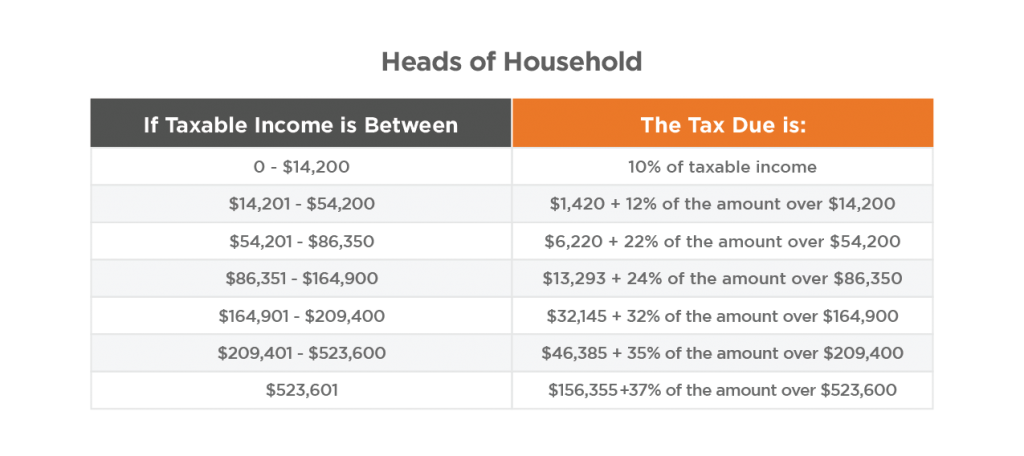

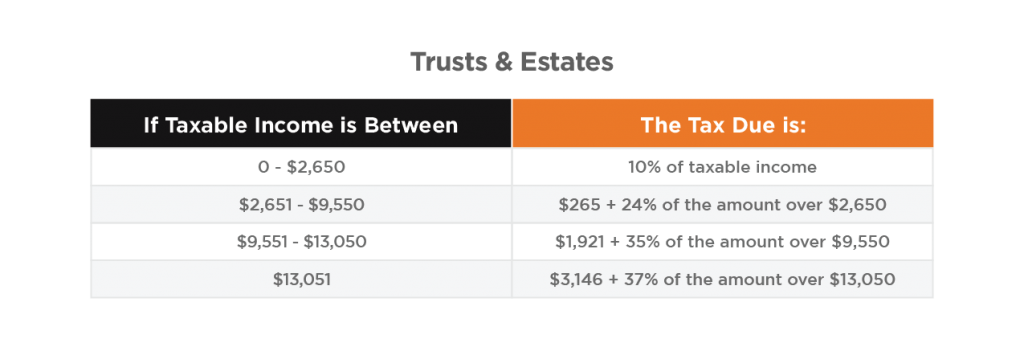

Tax Rates and Brackets for 2021

There are seven tax brackets for 2021. They are: 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Here’s how those break down by filing status:

Conclusion

I hope this article on the Foreign Earned Income Exclusion for 2021 has been helpful. As stated above, this is a use it or lose it exclusion. If you are a few years behind on your US tax filing obligations, please contact me at info@premieroffshore.com, and I’ll connect you with one of our international tax preparation experts.

Likewise, if you are being audited for an international tax matter, or your Foreign Earned Income Exclusion is being denied, contact me. I can introduce you to a US tax attorney who is an expert in these matters.