Trillion dollar coin: Evidence of a failing economic system

The president’s ability to print a trillion dollar coin or two to cover America’s debts is emerging as a surprisingly serious proposal and proves the absolute lunacy of our financial system. While such measures are unlikely, the fact that they are possible proves just how far we have come from the days when our currency was backed by gold.

As the result of a change in law from the mid 1990’s, the U.S. Treasury is allowed to mint as many coins made of platinum as it wants and can assign them whatever value it pleases. It is thus possible for the U.S. Mint to produce a pair of trillion dollar coins from platinum.

If such trillion dollar coins were minted, the president could have them deposited at the Federal Reserve and place their value added to the Country’s books. Magically, the Treasury suddenly has an extra $2 trillion to pay off its obligations — without needing to issue new debt. The ceiling is no longer an issue.

Oh, how far has the country fallen from the days when its currency had real value? From the days when a dollar was worth a fixed amount of gold and the U.S. treasury had real assets backing its issuances. As a reminder, here is a bit of history:

On June 5, 1933, the United States abandoned the gold standard, a monetary system in which currency is backed by gold. Allegedly in response to the public hording gold during the Great Depression of the 1930’s, Congress nullified the right of creditors to demand payment in gold. The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I, and has been printing currency at will ever since.

Soon after taking office in March 1933, Roosevelt declared a nationwide bank moratorium in order to prevent a run on the banks by consumers lacking confidence in the economy. He also forbade banks to pay out gold or to export it. Then, on April 5, 1933, Roosevelt ordered all gold coins and gold certificates in denominations of more than $100 turned in for other money. It required all persons to deliver all gold coin, gold bullion and gold certificates owned by them to the Federal Reserve by May 1 for the set price of $20.67 per ounce. By May 10, the government had taken in $300 million of gold coin and $470 million of gold certificates. In 1934, the government price of gold was increased to $35 per ounce, effectively increasing the gold on the Federal Reserve’s balance sheets by 69 percent. This increase in assets allowed the Federal Reserve to further inflate the money supply.

Current Price: The current price of gold is $1,659 per oz., which represents an 88% increase over the last 5 years.

The government held the $35 per ounce price until August 15, 1971, when President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus completely abandoning the gold standard. In 1974, President Gerald Ford signed legislation that permitted Americans again to own gold bullion.

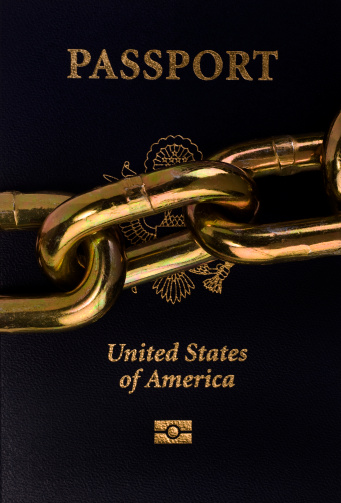

Now, with the possibility of a worthless dollar, and an economy in shambles, what can you do about it?

Unfortunately as individuals we have little control over the currency value and can’t print our own trillion dollar coin, but we can protect our ass(ets).

- Diversify investments away from those tied to US currency or economy

- Buy gold and related assets

- Diversify out of the USD and US banks

- Find ways to earn in foreign currencies, such as starting an international business

- Carefully monitor your buying power and buy in bulk items that will not perish but seem to be going up in price (relatively speaking as your dollar goes down in value)

- Spread your savings so not all in one bank, preferably with at least one foreign account

- Purchase real estate in those international markets with strong growth prospects, which are not dependent on the Untied States

Leave a Reply

Want to join the discussion?Feel free to contribute!