On July 11, 2017, major changes to Puerto Rico’s Act 20 and 22 were approved. These changes make it much easier to qualify for Puerto Rico’s Act 20 tax holidays. Here’s everything you need to know about the changes to Puerto Rico’s Act 20 and Act 22.

As of July 2017, Puerto Rico has a tax deal that can’t be matched by any offshore jurisdiction. All the other tax havens might as well just close down…. Puerto Rico just hit it out of the park… did the best set ever and dropped the mic. Offshore tax havens are done.

The US territory of Puerto Rico is working hard to bring new business and high net worth persons to the island. As a territory, Puerto Rico can offer tax deals to US citizens that can’t be matched by any foreign country.

This is because US Tax Code Section 933 excludes Puerto Rico sourced income from US tax. When a US citizen moves to a foreign country, we pay US Federal tax on our business profits (less the FEIE) and US capital gains tax on our investment profits.

Residents of Puerto Rico don’t pay US Federal tax on their Puerto Rico sourced income. They pay only Puerto Rico tax on these profits and capital gains. And Puerto Rico is free to charge whatever tax rate they want, which is why Act 20 and Act 22 are possible.

To qualify for Puerto Rico’s Act 20 and 22 tax holidays, you must be a resident of Puerto Rico and spend a minimum of 183 days a year on the island.

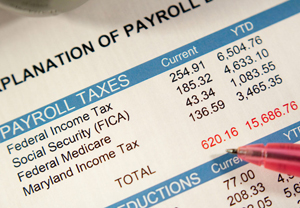

Puerto Rico’s Act 22 gives you a zero percent tax rate on capital gains on assets acquired after you move to Puerto Rico.

Puerto Rico’s Act 20 gives you a 4% corporate tax rate on any Puerto Rico sourced business income earned inside an Act 20 company. Puerto Rico sourced business income is earnings and profits from work performed in the territory.

This post will focus on changes to the law which were approved on July 11, 2017. You might also take a read through my article comparing Puerto Rico’s Act 20 with Panama (or any offshore jurisdiction). Just remember that this article does not include the changes described below.

For more on Act 20, see: Puerto Rico Eliminates 5 Employee Requirement

The primary changes to Puerto Rico’s Act 20 and Act 22 are:

- Adding eligible services of

- Hospital services and laboratories including medical tourism and telemedicine services

- Trading companies with no less than 80% of business in PR exporting business.This means Act 20 is no longer limited to online and service businesses.

- No minimum number of employees required for most Act 20 businesses. Some exceptions will apply based on regulations yet to be written by the Secretary of DDEC. It seems these regs will focus on call centers and telemedicine. We believe all service and tech businesses can operate with only one employee (the business owner).

- 30% of doctors at medical tourism and telemedicine facilities should be Puerto Rican residents.

- Annual filings and reports shall be be required.

Amendments to Act 22 include an annual donation of $5,000.00 per decree holder to a recognized Puerto Rican non profit organization.

Here is a loose translation of Puerto Rico’s Act 43, approved July 11, 2017, which modifies Puerto Rico’s Act 20 and 22. This is not meant as a legal translation and you should consult an expert before acting upon this summary.

We translated the full memo because I love the way it’s written. The current government is the blue party, which is the party that was in power in 2012. They couldn’t help but take a shot at the red party which was in power in 2015.

As you read this, you’ll see that the focus of Puerto Rico’s Act 20 is to bring business and employment to an island. You might also want to take a read through my article, How to benefit from Puerto Rico’s bankruptcy.

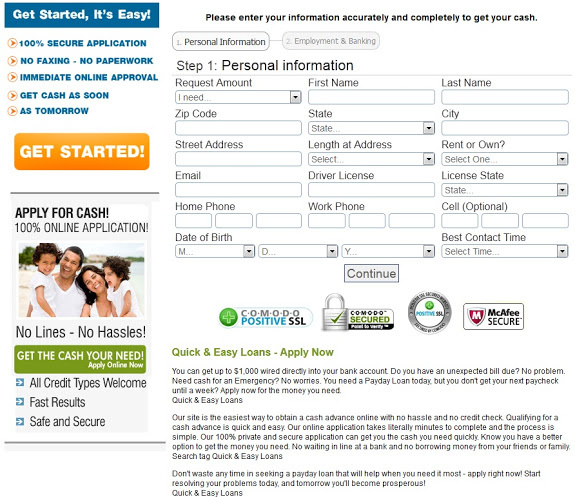

I’ll be happy to assist you to set up a business in Puerto Rico under Act 20 or qualify for Act 22 to eliminate capital gains tax on assets acquired after you become a resident and receive your decree. Please contact us at info@premieroffshore.com or call us at (619) 550-2743 with any questions.

Explanatory Memorandum on Changes to Puerto Rico’s Act 20 and Act 22

Beginning in the 1970s, the economic development of Puerto Rico has focused on the promotion of foreign industries through granting Federal and state tax incentives. Since that time, the Puerto Rican economy has fallen upon hard times, as federal incentives were removed, over which the local government of Puerto Rico had no control resulting in conflict with the strengthening and development of new local companies.

The deterioration of the Puerto Rican economy became more defined when the government incurred expenses that exceeded over receivable income, which in turn led to more taxes and high fees for local businesses, as well as the whole island, later lead to a reduction in local economic activity. With the exception of fiscal year 2012, since fiscal year 2007, there has been an economic contraction of fifteen percent (15%). Since then, the Gross National Product of the Commonwealth of Puerto Rico has been in negative numbers.

Puerto Rico looks to become more competitive in achieving their economic development goals in a globalized and interconnected economy. According to the Global Competitiveness Report 2016-2017 World Economic Forum, competitiveness is defined as the set of institutions, policies and factors that determine the level of productivity of an economy, which in turn, marks the level of prosperity that a country can attain.

It is imperative to revert, as a matter of urgency, the negative of our economy and return to the path of prosperity. For this, we need to make a paradigmatic change in the way we conceive the function of our public institutions and our model of development economic. Precisely, the Plan for Puerto Rico that the People endorsed on November 2016, includes measures to achieve fiscal responsibility and economical development of the island. This administration has been active and, in less than 50 days, has passed more laws than on any previous occasion. At the beginning of a four-year term, more than a dozen laws that seek to promote development of our economy and to tackle the fiscal crisis. See Laws Number 1-11 of 2017.

In order to achieve the development and growth of our economy, during the administration of ex-governor, Hon. Luis Fortuño, the Government of Puerto Rico identified the need to encourage the export of services. He approved Law No. 20-2012 (Act 20) to find ways to encourage the development of local companies, also for those that want to move to the Island to expand their capacity to export services and help insert Puerto Rico, in better conditions, into the global economy.

A study carried out by the company “Estudios Técnicos”, published in December 2015, revealed that by November of that year 360 decrees had been issued under Act No. 20-2012; That companies operating under the law created about 3,350 direct jobs, 2,160 indirect jobs and more than 1,500 achieved, for a total of 7,000. This shows that Act 20 has been essential in fostering the economic development of Puerto Rico.

In fact, this Law was endorsed by the Garcia Padilla Administration, through former secretary of Economic Development and Commerce, Alberto Bacó Bagué, who became its main promoter. He stated that Law No. 20-2012 has been an economic stimulus tool that has generated thousands of opportunities for well-paid jobs and has avoided a greater exodus of professional Puerto Ricans.

However, during the last four years, Act No. 20-2012 was amended by the past administration to establish restrictions which, instead of stimulating the service industry, discouraged growth. It is time to put aside “not my problem” politics and take into our hands the course of economic development started by the Fortuño Administration, which was depleted by the lack of interest of García Padilla Administration.

Certainly, Puerto Rico’s greatest asset is its human resource. We count with a high level of quality of professionals, technicians, advisers, consultants and service providers, who have the talent to offer from Puerto Rico their services to other jurisdictions with the greatest guarantee of success. It is a commitment of this Administration to help push our workers forward and all those that see Puerto Rico as an economic investment destination.

In order to promote the export of services, the public policy that Puerto Rico must be focused on developing the growth of the services sector in its economy. At the same time, these incentives should promote sustainable economic development and creation of employment in the island. We have a bicultural and bilingual population and a strategic relationship that serves as a bridge between Latin America and the continental United States.

To achieve the objectives described here, this Administration believes it necessary to promote amendments to the “Law to Encourage the Export of Services.” For this reason, it is included as part of the services eligible under Law No. 20-2012, medical tourism services and telemedicine facilities. This broadens the range of eligible services to allow foreign or local investment to have an incentive to develop in Puerto Rico an economic component predicated on the export of medical services. This, in turn, together with the medical incentives approved under Act No. 14-2017, will help our doctors to expand their services in this area, and decide to remain in Puerto Rico.

It is a principle of this administration, included in the Plan for Puerto Rico, that the role of government must be based on encouraging and facilitating economic development, developing the financial capital to attract service companies and large institutions to Puerto Rico, and to encourage local companies to export services outside the island.

This commitment contemplates the implementation of a development model based on the global principles of competitiveness and sustainability that allows the private sector to be a protagonist and leader of our economic development. This Government is committed to eliminate any obstacle so that Puerto Rico can compete favorably with other jurisdictions.

Amendments to Act 20: articles 3, 10, 12 and 13:

Section 1.- Amendment are made to subsection (k) Article 3 of Act 20-2012 as follows:

Article 3: Definitions;

(k) Eligible services include the following:

(xvi) Hospital services and laboratories including medical tourism and telemedicine facilities;

(xxi) Companies dedicated to international trading (known as trading companies) – Trading companies will mean any entity that produces no less than 80% of gross income from the following:

(a) sales to any persons or entities that are outside of Puerto Rico, for use, consumption or disposition outside of Puerto Rico, of products which have been manufactured inside or outside of Puerto Rico and have been bought by the eligible business for resale;

(b) from commissions derived from sales of goods for consumption and use outside of Puerto Rico; stipulating that none of the income derived from selling and reselling of products be used or consumed in Puerto Rico will be considered industrial development income. The property used for this income is not used for other activities not authorized under tax decree;and

(c) Other eligible exportation services as described under this law

Section 2.- Eliminating subsection (a), amending subsection (b) and renumbering as (a) as well as renumbering subsections (c) to (f) and (b) to (e) of Article 10 of Act 20-2012 as follows:

Article 10: Procedures-

(a) Ordinary procedure:

(i) Tax Decree applications. –

Any person that has established or proposes to establish an eligible business in Puerto Rico can apply for all the benefits provided by law through a sworn application before the Exemption Office.

The secretary will establish through administrative orders or regulation the criteria to be used in the evaluation process of applications, including as part of the evaluation criteria benefits that the business will generate to Puerto Rico’s economic development.

Criteria includes but is not limited to:

(i) job creation;

(ii) investment of capital;

(iii) direct or indirect contributions to the economy.

The secretary may require in the decree, that if a business requires employees or independent contractors to operate, a certain number of those employees must be Puerto Rican residents or performed by local entities in the industry or business in Puerto Rico.

However, in case of telemedicine services, the Secretary will require that 30% of doctors contracted must be Puerto Rican residents. If there are no qualified professionals to provide such services, then doctors can be outsourced from any other jurisdiction. All businesses that have an approved Act 20 Tax Decree or has submitted applications pending approval, that had direct employees under contract, cannot dismiss employment contracts hereafter of the amendments established under this act which eliminates the employee requirement.

Section 3.- Amendments for subsection (f) of Article 12 of Act 20-2012 as follow:

Article 12. – Periodical reports to Governor and Legislative Assembly.-

(f) The Secretary, along with the support of the Industrial Development Office and Treasury Department will establish an electronic database that will provide information on the businesses with approved tax decrees and will allow access to pertinent government agencies to review information, with the precautions of safeguarding confidentiality of all information provided.

The information will be used for compliance purposes for all businesses that have been granted tax decree and will be used to develop an intelligence promotional program by Department of Economic Development to identify and help eligible businesses that are in precarious situations.

Section 4.- Amendment to subsection (d) in Article 14 of Act 20 are as follows:

Article 13. – Reports required for exempt business and stockholders or shareholders:

(d) All eligible businesses which has been granted an Act 20 tax decree will file an annual reports at the exemption office, with copies to the Secretary, Treasury Department Secretary and Executive Director, no more than 30 days after income tax returns have been filed. This report will include an authenticated statement from either the President, administrator or authorized agent, that business has complied with all terms and conditions provided in tax decree. The report will include, but is not limited to the following areas: average employment, services provided as per decree and any other information that is required by regulations. This report will include filing fee established under regulation and payable to Secretary of Treasury. Information provided in this report will be used for statistical purposes and economic study. The Secretary of Economic Development Department will be auditing every two (2) years compliance of terms and conditions stipulated and granted under tax decree.

Act 45 Approved July 11, 2017

Amendments to Act 22: articles 3, 5, and 6:

Section 1.- Subsection (a) of Article 3 is eliminated and substituted by new subsection (a) in the Act 22 as follows:

Article 3. – Procedures.

a) In order to benefit from incentives provided by law, all individual resident investor that requests an Act 22 tax decree will be required to file a sworn application before the tax exemption office.

At the time of filing, the Director will collect the rights for the corresponding procedure that is provided by regulation. They will be paid in the manner and manner established by the Secretary. After the Exemption Office issues a favorable recommendation, the Secretary will issue a tax exemption decree, which will detail all the tax treatment provided in this Law. Decrees under this Act will be considered a contract between the concessionaire and the Government of Puerto Rico, and said contract will be considered law between the parties. The decree shall be effective during the period of effectiveness of the benefits granted in this Law, but never after December 31, 2035, unless prior to the expiration of said period the decree is revoked pursuant to section (b) of this Article. The decree shall not be transferable.

Section 2.- Subsection (a) of Article 5 of Law 22-2012, is amended, to read as follows:

“Article 5.- Special Contribution to Individual Resident Investor on Net Capital Gain.

(A) Assessments before becoming a resident of Puerto Rico.- The portion of net long-term capital gain generated by a Resident Individual Investor that is attributable to any valuation that had securities owned by them before becoming a resident of Puerto Rico, to be recognized after ten (10) years of becoming a resident of Puerto Rico, and before January 1, 2036, Shall be subject to the payment of a five percent (5%) contribution, in lieu of any other contributions imposed by the Code, and shall not be subject to the alternate basic tax provided by Subtitle A of the Code. If such appreciation is recognized at any other time, net long-term capital gain in relation to such securities will be subject to the payment of income taxes in accordance with the contributory treatment provided in the Code. The amount of this net long-term capital gain will be limited to the portion of the gain that relates to the appreciation of the securities while the Resident Investor Individual lived outside Puerto Rico. Provided that, for taxable years beginning after December 31, 2016, said capital gain shall be considered income from sources outside Puerto Rico for purposes of the income tax provided in the Code.

Section 3.- Article 6 of Law 22-2012, as amended, is hereby amended to read as follows:

“Article 6.- Reports Required to the Resident Investor Individual. – Any Resident Investor Individual who has a decree granted under this Law, will file an annual report in the Exemption Office, with a copy to the Secretary of the Treasury, thirty (30) days after filing the income tax return before the Department of the Treasury, including any extension. The Director of the Exemption Office may grant an extension of thirty (30) days in cases where it is requested in writing before the expiration of the period for filing the Report, provided that there is just cause for it and expressed in the request. In the case of the Report for the first year as a bona fide resident of Puerto Rico with a tax exemption decree under this Law, said report shall contain a list of data that reflect compliance with the conditions established in the decree for the immediately preceding taxable year At the date of filing, including, in the case of Resident Investing Individuals who were previously residents of other jurisdictions in the United States, evidence of filing Form 8898 with the United States Internal Revenue Service (IRS), or its equivalent in the case of Resident Investing Individuals who were previously residents of any foreign jurisdiction, giving notice of their intention to become a bona fide resident of Puerto Rico and, together with the reports to be filed annually, submitting evidence Of having made an annual contribution of at least five thousand dollars ($ 5,000.00) to non-profit entities operating in Puerto Rico and duly certified under Section 1101.01 (a) (2) of the Internal Revenue Code of Puerto Rico 2011, as amended, that is not controlled by the same person, as well as any other information that may be required by regulation, including the payment of annual fees. The rights will be paid in the form established by the Secretary. The information provided in this annual report will be used for statistical purposes and economic studies. Likewise, the Exemption Office must carry out a compliance audit every two (2) years with respect to the terms and conditions of the decree granted under this Law. “

Click here to read the law in Spanish (downloadable PDF on the government website)