Offshore IRS Audit Statute

For most Americans, the IRS audit statute, the amount of time the IRS has to come after you once you have filed your return, is three years. Not so for those with foreign accounts and foreign assets. In most cases, the IRS has six years to audit your international investments.

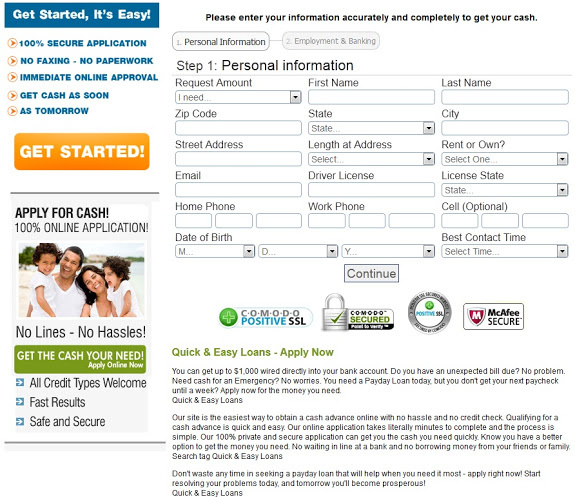

First, let’s review the IRS audit statute of limitations. Basically, it says that the IRS has three years to come after you once your file a tax return. If you never file, the IRS audit statute never starts… so file your returns.

There are several exceptions to this three year IRS audit statute of limitations. For example, if you omit more than 25% of your income, the three year statute is doubled to six years. Which is to say, if you have a substantial understatement, the IRS has six years to find it.

- It is common for tax preparers to allow returns with aggressive deductions that don’t exceed 25%.

Also, there is no IRS audit statute of limitations for fraud. If the IRS can prove fraud, which is tough for them to do, they can go back as far as they like. In practice, it is rare for the IRS audit statute to be extended beyond six years.

For U.S residents who keep their money at home, the IRS audit statute of limitations is linked to your income. If you make $100 million, and make an error of $10 million, the statute will not be extended to six years without a showing of fraud on your part… again, the IRS’s burden on fraud is high, and so it is not used too often.

For those of us living, working, or investing abroad, it’s a different story. If you omitted more than $5,000 of foreign income from your return, regardless of your total income, the IRS audit statute is doubled to six years.

That’s right… if you made $100 million, and inadvertently omitted $5,000 of foreign income from your personal income tax return, your IRS audit statute is six years. And, this increase applies to every aspect of your return, not just your foreign source income.

Even worse, and as I stated above, if you never filed a particular return, the audit statute never starts. So, even if you reported all of your foreign source income, but you did not file an offshore corporation return (IRS Form 5471) or an offshore trust return (IRS Form 3520 and/or 3520-A), the IRS audit statute for these foreign structures never started.

The same holds true for the Foreign Bank Account Report form, commonly called the FBAR. If you never file this form, the IRS can audit your offshore bank accounts as far back as they like… and impose penalties of up to $100,000 per year.

And this is one of the ways the IRS goes after expats and those with foreign assets even after the six years has passed. You might have included some, but not all, of your foreign income on your return and were just waiting for the three year or six year IRS audit statute to pass. Well, if you did not file the forms required in addition to your 1040, your clock never started to run.

I note that failure to file the FBAR, financial asset report and offshore company or offshore trust forms extends the IRS’s time to audit those forms, as well as add any tax due to your personal return.

In addition to the items above, which are specific to those of us living, working, and investing abroad, there are other ways your IRS audit statute can be extended. The most common is by mutual agreement between you and the IRS. If you are being audited and either side needs more time, you will be asked to sign an IRS audit statute extension.

Most of us in the tax representation game suggest you should extend the statute whenever asked. The reason is simple: if you don’t agree, the IRS assesses whatever additional income you have and disallows all expenses and deductions you took on your return. From here, you can fight it out with appeals and the IRS audit statute is not an issue… the audit is over.

Your IRS audit statute can also be extended by your filing an amended return. If you file a return with an increase in tax (balance due) within the three year audit statute, your statute is not increased. If you file a return with a balance due after the statute runs out, the IRS gets one year to revise it. So, file your amended returns with a balance due 60 days before the statute runs out and cut the Service off before they get to you.

- An amended return that does not have a net increase in tax does not extend the IRS audit statute.

Understanding the IRS audit statute can become a major issue and determine how far you want to push the envelope. It begins with you filing a return, so always send in your returns by certified mail or file electronically.

Note that this article is focused on the IRS audit statute. Your state may also treat your domestic and international source income differently. I will mention that my State of California has a four year audit statute rather than the more traditional three year period. You should check with your local office.