US Regulators to Issue First Federal FinTech Bank Licenses

US Federal regulators have begun issuing Federal FinTech bank licenses on a very limited basis to the most qualified applicants. I suggest that only the very largest FinTechs will be approved for the Federal FinTech bank licenses, at least in the next year or two. The purpose of the Federal FinTech bank license to allow companies like PayPal and eBay to get a national license rather than separate licenses in every state.

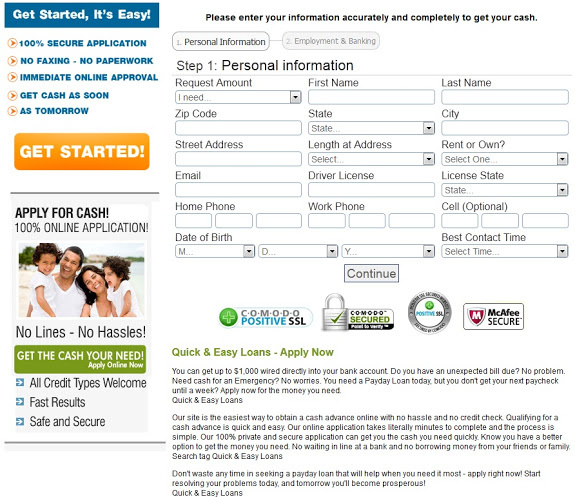

With a Federal FinTech bank license, the company will be allowed to paychecks, lend money, and hold deposits. This license is limited in scope and specialized on FinTechs. The stated purpose is to give more choices to consumers and recognize the value of FinTech businesses in banking.

For more on the logic behind these Federal FinTech bank licenses, see the US Department of Treasury report.

This Federal FinTech bank license gives top firms a path into the banking industry. FinTechs have limited options in the US, and many have had to partner with big banks. Being able to apply for the new Federal FinTech bank licenses will provide these companies with an opportunity to provide a full suite of online banking services to their clients

For example, Square is likely to be an early adopter of the Federal FinTech bank license. Major companies like this, with experience in compliance, KYC and AML are top candidates for a banking license.

I also note that Federal audits and compliance of these FinTech banks will be intense. They will be watched very closely to ensure the security of client funds. Regulation will be significantly more stringent than larger established banks.

So that’s the new Federal FinTech bank license. What if your company is not named Google, Alphabet, or PayPal? Is there a US FinTech bank license you can apply for? Yes, there is, the International Financial Entity license from the US territory of Puerto Rico.

A bank licensed as International Financial Entity in Puerto Rico can conduct all manner of banking business. The only limitation is that you can’t accept clients from Puerto Rico. To put it another way, you can do business with any person or company outside of Puerto Rico.

An International Financial Entity license in Puerto Rico is like the little brother of the Federal FinTech bank license. It’s more akin to a state bank charter and not a Federal charter and a Federal bank holding company is not required.

As such, an International Financial Entity in Puerto Rico is not a member of the Federal Reserve system, is not regulated by the Fed, and Federal Deposit Insurance does not apply. As there is no equivalent of FDIC in Puerto Rico, these banks do not offer deposit insurance.

These banks are referred to in the code as International Financial Entities. This is because the IFE statute can be used for many purposes. You might form a brokerage, cryptocurrency exchange, family office, hedge fund management company, or a bank. If you’ll offer accounts to the general public, you will be permitted to use the word “bank” in your name.

These international banks from Puerto Rico are going to be far more popular over the next two years compared to the Federal FinTech bank licenses. Puerto Rico is issuing 25 licenses a year and I’d expect to see 2 to 5 Federal FinTech bank licenses over the next calendar year.

Puerto Rico has a benefit that no state, nor the Federal Government can match. Form an international bank in Puerto Rico, and operate that International Financial Entity from Puerto and pay only 4% in taxes. Yes, only 4% total taxes. No Federal taxes and no other expenses so long as those operating the bank are residents of Puerto Rico or non-US persons living abroad.

For example, a group of 4 US citizens moves from New York to Puerto Rico and forms an International Financial Entity. Dividends from the IFE to those shareholders are tax-free. This would compare to a combined Federal and New York rate of about 40% on ordinary income from a Federal FinTech bank licensed business.

Likewise, dividends to foreign shareholders (who are not US citizens, green card holders, nor residents) are tax-free. The only tax paid on those corporate profits after salaries and other expenses is 4%. There is no withholding tax on dividends to foreign persons.

And an International Financial Entity in Puerto Rico can be formed at a fraction of the cost of a Federal FinTech bank license. Minimum corporate capital is $550,000, with $250,000 of this being paid-in capital and $300,000 being a CD held at a bank in Puerto Rico. We generally recommend you increase capital to $2.5 million over two years. For more, see: Lowest Cost Offshore Bank License is Puerto Rico.

The reason the US territory of Puerto Rico offers this International Financial Entity license is to bring jobs to the island. Thus, you’re required to have a minimum of 5 employees in Puerto Rico. These employees must be residents of Puerto Rico, which means they must be US citizens or otherwise permitted to work in the United States. That is to say, US employment and immigration laws apply to the territory just as they do to any state.

For more on building an international bank in Puerto Rico or elsewhere, see: The 8 Components of an Offshore Bank License

If you’re excited about the topic of international banks and Federal FinTech bank licenses, you might find my 300-page book interesting. See: Offshore Bank License Guide (Amazon Kindle edition).

I hope you’ve found this article on Federal FinTech bank licenses to be helpful. For more information and a quote to set up an IFE in Puerto Rico or an offshore bank in another jurisdiction, you can reach me at info@premieroffshore.com or call us at (619) 483-1708.

Leave a Reply

Want to join the discussion?Feel free to contribute!