Blood in the Streets Offshore Tax Planning

You’ve heard the adage of investing when there’s blood in the streets… to buy when all hell is breaking loose and the market is at bottom. Well, now is your opportunity for some offshore tax planning while there’s blood in the streets. An offshore tax planning opportunity that will cut your corporate rate to 4%!

- Baron Rothschild, an eighteenth century British nobleman, is reputed to have said, “The time to buy is when there is blood in the streets.” Those words are so true today in Puerto Rico and their offshore tax planning deal.

If you have not been reading the papers lately, PR is broke and the Federal Govt doesn’t want to bail them out. Specifically, the GOP says no way to a Puerto Rico bailout.

So the Feds have allowed Puerto Rico to create a Tax Incentive Strategy to try and bail out PR by offering a 20 year deal where companies only pay 4% on their retained earnings.

Yes you read that correctly only 4% – that is lower than what many very large corporations are presently paying to Ireland 12.5%. It’s the best offshore tax planning deal available to US citizens.

If you’re a small to medium sized internet business, or one that can spin off a division like marketing, call center, or similar group, here’s your chance to pay only 4% on your profits. Here’s how to make an offshore tax planning deal with a desperate government to defer tax offshore like the Apples and Googles of the world.

In fact, you can negotiate a offshore tax planning deal far better than the big guys. Most of their tax contracts in Ireland and Luxembourg are at around 12.5%.

The US government is offering you an offshore tax planning contract that allows you to live in the United States and cut your corporate tax to 4%. No need to move abroad, uproot your family, etc. It’s akin to the offshore tax planning tool generally referred to as a corporate inversion. These inversions have become all the rage where the business operations are outside of the U.S. but the headquarters and business executives remain here.

Here’s how this unique offshore tax planning opportunity works:

The U.S. territory of Puerto Rico is broke. The island is essentially bankrupt – owing creditors over $70 billion with no chance of repayment and a US bailout seems unlikely. But, as territory, PR is prohibited from declaring bankruptcy. As of December 1, 2015, they are out of cash.

Puerto Rico’s laws are a mixture of US Federal statutes and local ordinances. And that is where your opportunity exist: Income earned in a Puerto Rican corporation or as a resident of Puerto Rico is exempt from U.S. taxation. See: 26 U.S. Code § 933 – Income from sources within Puerto Rico.

In order increase employment, motivate investment, and benefit from it’s unique position in the US code, the island offers two tax deals:

1. Start a business in Puerto Rico with at least 5 employees, apply for an Act 20 tax contract, and receive a 20 year agreement with a corporate tax rate of 4%.

or

2. Move to Puerto Rico, be approved for an Act 22 contract, and pay $0 capital gains tax on assets purchased after you become a resident and sold during your time on the island.

Act 22 requires you to live in Puerto Rico for at least 6 months of the year. Act 20 does not. In this article I’ll focus on the Act 20 offshore tax planning contract for business owners.

If you don’t require 5 employees, we can create a joint venture company that will share costs and benefit the group. For example, if 2 partners come together in a “captive” internet marketing firm, they could license one business under Act 20. Different classes of stock and separate bank accounts could protect each partner’s interests.

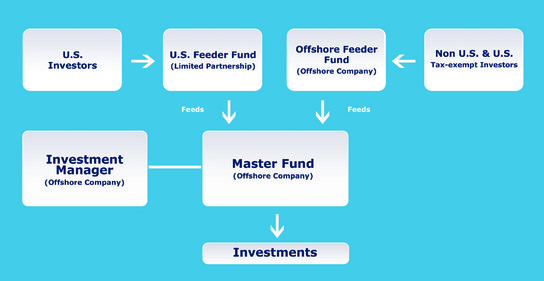

To qualify under Act 20, your business should be providing a service in Puerto Rico to corporations or individuals outside of Puerto Rico. Internet marketers, website developers, investment advisors, hedge funds, call centers, and any other type of “portable” business are good candidates.

- No matter your industry, if you can spin-off a division into a Puerto Rico corporation, you can benefit from an Act 20 contract. For example, I recently assisted a manufacturing company setup a web marketing group on the island.

Next, you need to hire at least 3 full time employees in Puerto Rico. These workers must be earning the minimum wage (currently $7.25) or better, be W-2 employees and not independent contractors, come into the office each day, and work at least 40 hours per week (full time).

Then, you, as the owner and operator of the business, must draw a fair market salary from the Puerto Rican company. This salary is taxable in the U.S. because it’s earned from work you did while living in the States.

The remainder of the income you earn in Puerto Rico is taxed at 4%. In other words, net profits in excess of your salary are taxed at 4%. You may retain these profits in your Puerto Rican corporation indefinitely tax deferred… an absolutely amazing offshore tax planning deal!

This gets you to a similar place as the Microsofts of the world… low cost offshore tax deferral. In fact, you’ve out maneuvered these giants by securing a deal at 4% rather than the typical 12.5%.

Puerto Rican profits must be left in the corporation, or can be moved to an offshore subsidiary. They can be used to grow the business and generally managed as corporate capital. You may not borrow against them or otherwise personally benefit from these retained earnings. They belong to the corporation until taken out as a distribution or dividend.

Now, here’s where things get really interesting in the Puerto Rico offshore tax plan:

With a typical offshore tax plan, profits are locked in the corporation. When taken as a dividend or distribution, they come out at ordinary income rates. Lower qualified dividend rates do not apply to distributions from a foreign corporation.

Puerto Rico provides a path to tax free dividends not available in other offshore tax plans. If you decide to move to Puerto Rico after a few years of operating the business, and qualify as a resident under Act 22, dividends from your Puerto Rican corporation will be tax free.

Of course, you’re not required to move to Puerto Rico to cut your corporate tax rate to 4%. You may leave the money in the company tax deferred, take it out years or decades later and pay the tax, or continue to use it to grow the business.You can hold the Act 22 card in your back pocket should you decide to play it.

We can assist you to implement the Puerto Rico offshore tax plan in two ways.

- We can setup your corporate entity, negotiate an Act 20 contract in Puerto Rico, and write a custom a game plan / opinion letter on how to operate your Puerto Rican business in compliance with PR and US tax laws.

or

- Provide a turnkey solution in Puerto Rico with office space, employees, etc. to maximize the benefits of your offshore tax plan.

Our turnkey solution includes analysis, tax and business planning, tax opinion letter with “action plan,” Act 20 application and negotiation, Act 20 license, and opening a PR bank account. It also includes sourcing and negotiating an office lease, hiring 3 qualified employees, 12 months of employee management, and 12 months of tax and business consulting service.

- We will locate and hire 5 employees to your specifications. You can interview them by Skype or in person. We will also replace these employees if they resign or are not pulling their weight, manage their time, and handle all office and employment matters.

- Our turnkey solution is intended to cover all first year costs related to setting up shop in Puerto Rico except salary, payroll taxes, and office rent.

I hope you have found this article on the offshore tax planning benefits of Puerto Rico helpful. For more information, please send an email to info@premieroffshore.com or give me a call at (619) 483-1708.

For more information, you might read my post comparing the Puerto Rico tax deal with the Foreign Earned Income Exclusion.