How to Stop Paying Payroll Tax

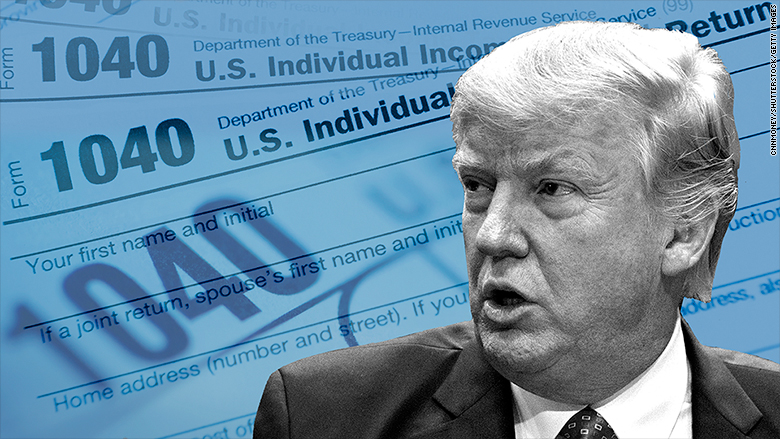

During the election,Trump claimed he’s paid “hundreds of millions of dollars” in taxes over the years. Yet, he probably didn’t pay any personal income taxes since 1995 because of a $916 million loss carryforward. How can both of these statements be true? Because most Americans pay more in payroll taxes than income tax!

In this article, I will explore how you can opt out of the US payroll tax and self employment tax systems by going offshore. How to stop paying into Social Security and other government programs that might not be there when you need them. How to create your own security blanket offshore that’s under your control.

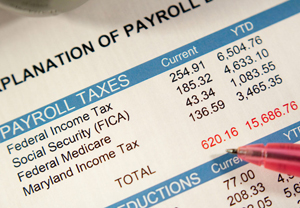

Federal payroll tax is about 15%, with half being paid by your employer and half being deducted from your check. In addition, most states charge a payroll tax of 1.5% to 7.5%, again with half coming from the employee and half from the employer.

Self employment tax is basically payroll tax for small business. If you operate without a corporation, and report your income and expenses on Schedule C of your personal return, you will pay 15% of self employment tax. This is intended to match up with the 7.5% paid by an employer and the 7.5% withheld from every paycheck.

- I’m using round numbers to keep it simple. For the precise cost of hiring an employee in California, see this great infographic.

- For purposes of this article, I’ll use the terms self employment tax and payroll tax interchangeably.

When the Donald says he’s paid hundreds of millions in taxes, he’s probably counting employment taxes paid by his many companies, plus payroll and other taxes he’s paid personally. Assuming a payroll tax cost of 10% for each employee, the numbers add up quickly and his boast is probably correct… even if he paid zero in personal income taxes.

About 66% percent of households will pay more in payroll taxes than they will in income tax. Only one in five households will pay more in income taxes than employment taxes. Those who do pay more income taxes than payroll taxes are at the very top of the wage scale. Middle income and low income taxpayers are paying far more in payroll than income tax.

Only 18% of US households pay neither payroll nor income tax. Of these, half are retirees living on their Social Security and have no other taxable income. The rest have no jobs and not much income. (source: T16-0129 – Distribution of Federal Payroll and Income Taxes by Expanded Cash Income Percentile, 2016, Tax Policy Center)

If you’re a business owner or an independent contractor, here’s how to stop paying payroll taxes… and income tax on your first $102,100 of salary in 2017.

Live outside of the United States, qualify for the Foreign Earned Income Exclusion, operate your business through an offshore corporation in a zero tax jurisdiction, and you will pay no payroll taxes of any kind.

In order to qualify for the Foreign Earned Income Exclusion, you must be out of the United States for 330 out of 365 days or be a legal resident of a foreign country and out of the US for 7 or 8 months a year. Any income earned while in the US will be taxable here.

As a legal resident, your new country should be your home base for the foreseeable future. If you move somewhere for a short term job, you’re not a resident for purposes of the FEIE. You need to move to a foreign country with the intent to live there indefinitely.

If you don’t want to go through the hassle of getting a residency visa, you need to be out of the US for 330 out of 365 days. While this version of the test doesn’t give you much time with friends and family in America, it’s far easier to prove should the IRS challenge your tax return.

If you live abroad and qualify for the FEIE, but don’t operate your business through an offshore corporation, you will still pay payroll taxes! You will eliminate income tax on your first $102,100 in 2017, but self employment tax will apply at 15%. So, a business that net’s $100,000 is basically paying a penalty of $15,000 for failing to incorporate offshore. A husband and wife who net $200,000, could pay a $30,000 penalty.

- If you run your foreign business through a US corporation, you will pay payroll taxes. If you don’t have any corporate structure, you will pay self employment tax.

What happens if you make more than $100,000 (single) or $200,000 (both spouses work in the business)? Any excess salary you take out of the business will be taxed at about 32% by the IRS. Still, no payroll or self employment taxes will apply.

If you’re operating through an offshore corporation, you may be eligible to hold those profits in the company and not pay tax on them until they are distributed. That is to say, you can hold income over the FEIE amount as retained earnings in your offshore corporation.

These retained earnings will basically create a giant retirement account or security blanket. Like money contributed to an IRA, this cash is untaxed until you take it out of the corporation. Unlike an IRA, there are no rules or age requirements forcing distributions.

So, if you want to stop paying payroll taxes and self employment taxes, move out of the United States, qualify for the FEIE, and operate your business through an offshore corporation.

For help on setting up a tax compliant structure, please contact me at info@premieroffshore.com or call us at (619) 483-1708. I will be happy to assist you to set up offshore.

Leave a Reply

Want to join the discussion?Feel free to contribute!