Eliminate UBIT in Your IRA by Investing Offshore

Are you paying Unrelated Business Income Tax in your IRA? Want to eliminate UBIT in your IRA? Is your retirement account invested in U.S. mutual funds or hedge funds? Are you thinking of taking control of your retirement account with an offshore IRA LLC and are concerned with UBIT? Do you have no idea what the heck UBIT is? Here are the ins and outs of UBIT in your IRA or other retirement account structures.

Let me start with the basics: Unrelated business income tax is a 35% tax paid on certain types of income earned by a retirement account. Regardless of whether you are a ROTH or a traditional, a 401K or a SEP, UBIT can apply to you…but it is simple to eliminate UBIT in your IRA, go offshore!

- If your retirement account is invested in traditional stocks and bonds, or just about any type of passive investment, you don’t need to worry about UBIT.

The most common forms of UBI in an IRA is income from leverage or profit distributions from an active business. For example, if you purchase a rental property in your ROTH and 50% of the money comes from your retirement account and 50% from a non-recourse bank loan, then 50% of the profits generated will be taxable at 35% as UBI and 50% will flow through to your ROTH tax free.

Another example is a leveraged brokerage account. If you use leverage in the trading account held by your IRA, then income generated by that leverage is taxable. If you leverage the account 10 times, then the majority of your income will be taxable and only that portion attributable to your original deposit will be tax free.

Finally, if you invest in an active business, or in to a U.S. hedge fund that invests in active businesses, then you might end up paying 35% tax on all profits generated. This is because the business or fund passes income to you, often on Form K-1, which is taxable as income not related to typical investing.

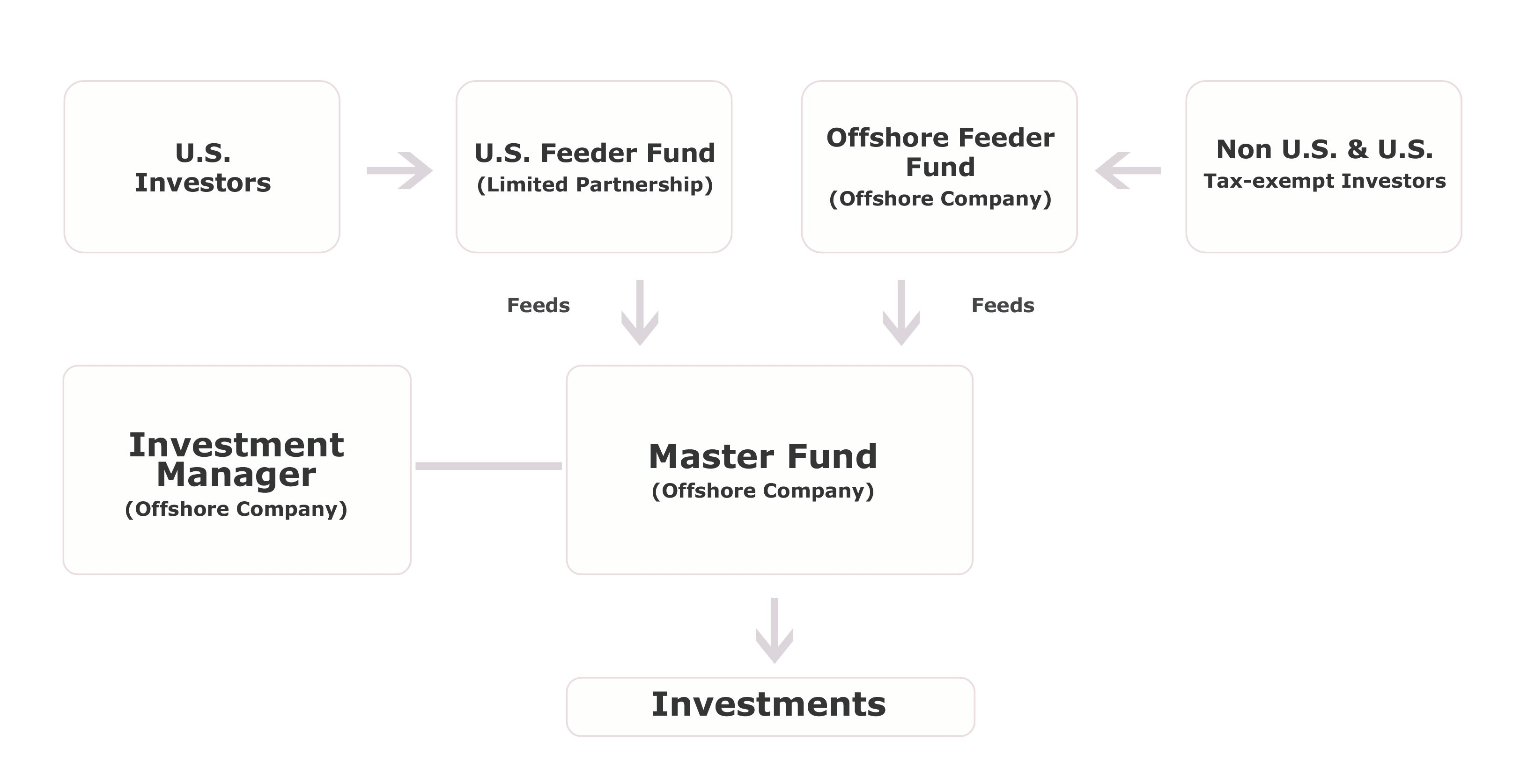

The solution for UBIT from investing in U.S. funds is simple – DON’T DO IT! A tax preferred investor should never be talked in to a U.S. fund that will generate UBIT. If the fund is structured properly, it will have an offshore feeder component. By investing in the offshore feeder, rather than the U.S. LP or LLC, you completely eliminate UBIT.

As shown below, traditional U.S. investors should come in to a fund through a U.S. structure while foreign and tax preferred investors (retirement accounts, pension funds, etc.) should come in through an offshore corporate entity. If the fund you are being sold does not have a structure for retirement accounts, you can be assured they will also be dazed and confused when it comes to reporting and tax compliance, so don’t get involved.

So, the costs and planning to avoid UBIT in a mutual fund or a hedge fund (should) fall on the administrator of that fund. If you are running your own investment account using leverage, or investing in real estate through leverage, you need to create your own offshore structure to deal with the tax.

Smaller retirement account investors are generally told they can’t use leverage. Accounts that are with private banking divisions, or with professional trading platforms, are allowed to access leverage at their own risk. In other words, the broker or bank won’t help you when it comes tax time.

To eliminate UBIT in your retirement account you need to 1) take that retirement account offshore in an LLC and 2) form an offshore UBIT Blocker Corporation under the LLC. This offshore corporation is the entity that holds the trading account or purchases the property. Income flows to the corporation, then the LLC, and then in to your IRA.

Here’s the trick: UBIT applies to income from leverage or ordinary income received by the IRA. By sending that money first in to an offshore corporation, and then in the LLC as a dividend, you eliminate the UBI character of the transaction and thereby jettison UBIT.

If you would like more information on the IRA LLC structure, please check out my Self Directed article.

For more information on investing in an active business, please read Can I Invest in a Business with my IRA?

As always, please post general questions in the comments below or contact me at info@premieroffshore.com for a confidential consultation.