Proof You Should Diversify Your IRA Offshore Now

A record high stock market in the U.S. exposes the suckers! Don’t be one of them. Diversify your IRA offshore as soon as possible. This article offers statistical proof that you should diversify your IRA abroad. U.S. returns over the next 10 years will wipe out your retirement account.

While everyone is running to dump money in to the stock market, the smart investors are taking their profits and moving to investments with more upside. When a market is at an all time high, it means run… not invest more! If you wanted to get in to stocks, you should have been buying in 2009 after the market bottomed out. Now, you are just going to buy high and sell low. Even the most optimistic outlook is for slow U.S. growth. You will do far better to diversify your IRA in to foreign real estate or markets with significant growth potential.

What Alan Greenspan once called “irrational exuberance,” is back. I hear smart people… doctors and lawyers and such who’ve sat on the sidelines for the last four years and are all excited about investing in the United States stock market.

Remember, if you follow the herd, you’ll be left holding the bank, when the smart money gets out… and they will get out. Now is the time to diversify your IRA.

Please don’t get me wrong. I am not arguing against stocks or the U.S. market in general. If you have a 10 or 20-year plan, stick with it. Remember that the 2008 crash didn’t wipe out investor’s retirement accounts, it just delayed their plans. If you had stayed in the market, you would have made back your losses and then some.

What I’m saying is that now is the time to ignore the financial news and diversify in to international markets. Studies show that investors who received no news performed better than those who received a constant flow of good and bad news. Don’t get caught up in the reactionary cycle.

Statistical Proof That You Should Diversify Your IRA Offshore

Yes, the U.S. markets are at record highs. From here, “basic math suggests that U.S. asset prices have less room to rise. This means that the long-run outlook is for lower returns ahead.” This, according to Wade Pfau, Professor of Retirement Studies at American College for Financial Services, a Ph.D. economist, means you should diversify or reduce your IRA distributions.

Conventional wisdom says that you can withdraw 4% to 5% from your retirement account each year and have cash left over at the end of 30 years. If you are retired more than 30 years, you need to take out less. It also assumes you are 50% in stocks and 50% in bonds. This assumes you are earning 3.5% to 4% on your IRA. If this goes down, your withdrawal rate must also decrease.

Based on Pfau’s recent study of stock and bond returns since 1926, the amount you will be able to take out of your U.S. based retirement account is a function of your return on investment. Because this return is expected to be lower than the previous decade (because the market is at record highs), you’ll need to adjust your withdrawals or increase your returns. I suggest you focus on the second option and diversify your IRA out of the U.S.

Specifically, the amount you can safely take out of your retirement account has gone down from 4% or 5% to just 3%. To support his analysis, Prof. Pfau cites the U.S. Treasury markets. The historic yield has been 3.5% and is now only 2.6%. Current 10-year yields generally correlate to the total return you can expect over the next decade.

This, combined with earning ratios on the S&P 500, get you to an average return in the U.S. of 2.2% after inflation over the next decade… less than ½ of the historic average.

Assuming your IRA is $1 million, a 3% drawdown means you have only $30,000 a year to live on. With Social Security and other income, you’ll be lucky to end up with $40,000 before taxes. To me, this means I should consider living abroad… as well as investing offshore… where the cost of living can be a fraction of the U.S.

Prof. Pfau’s computer model indicates that pulling an inflation-adjusted amount of $40,000 (4%) per year from a $1 million dollar IRA ran the account dry in 57% of the simulations. Taking $30,000 in distributions crashed the account only 24% of the time and a 5% withdrawal emptied it 82% of the time within 30 years.

Where to Invest Your IRA

The solution is to use diversification to stretch your cash and extend your retirement. This is especially urgent when you consider the length of the average retirement. We are living longer, and our retirement years are more than 30, thus we are outliving our savings.

“Tell your dollars where to go rather than asking them where they went.” Roger W. Badson, 1875 to 1967

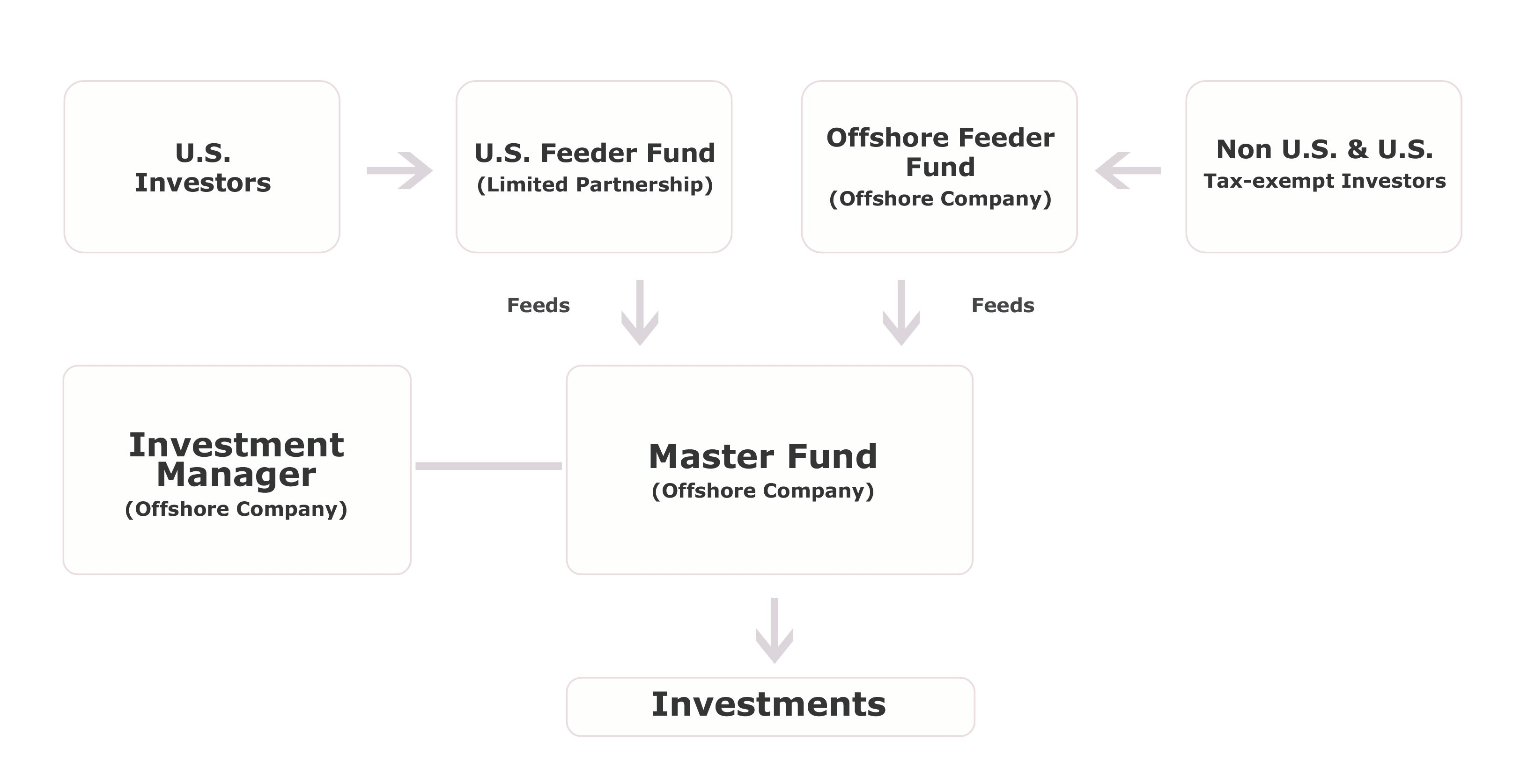

In order to diversify your IRA, the first step is to take control over your account by moving it in to an offshore IRA LLC. Once that is complete, you can invest in just about anything you like outside of the United States.

So, where might you put your investment dollars? If you consider only historic highs, most EU countries are well off their averages and a good buy. The concern is that many perceive currency and other risks because of the nature of the Union.

*To be honest, I’m not an expert on the EU. I’m focused on south of the U.S. of A.

My favorite countries for diversification are Mexico, Panama and Colombia. Most of the drug wars have come to an end in Mexico and they’ve rewritten the laws that limited investments in coastal real estate… or required you to use a banker’s trust or other convoluted structure. So long as you spend the time and get to know the city of Mexico you’ll invest in, I believe it is one of the best options available.

Those of you who read my columns regularly know that I’m a big fan of Panama and that my business and investments are centered there. I prefer Panama City to other areas, and now believe that the secondary districts of the city hold the most promise.

For example, if I were to diversify my IRA in to Panama today, I would avoid Punta Pacifica and Pitea. I’d look to San Francisco, around Park Omar, and parts of 50th Street. Most of the gringo dollars going in to Panama are flowing in to Pitea, around Trump Tower, so I’d focus elsewhere.

The same holds true for Colombia. My preferred city is Medellin and I’d stay away from the ever popular “golden mile.” I’d look for condos around parks and within walking distance to cafes and entertainment. For me, the prices within the mile are just too high.

Whenever you invest offshore, you must understand the region of the city you are buying in to. Each area will perform differently and will have differing long term prospects. Doing your homework is 10 times more important offshore than on… especially when there’s no MLS.

If you would like additional information on where to invest, I suggest www.liveandinvestoverseas.com. For more costs and rules related to taking your IRA offshore, please send me an email to info@premieroffshore.com. I’ll be happy to answer any questions you may have.