In this post, I’ll look at the top 10 reasons to move your business to Mexico in 2020. The current government is focused on bringing in new jobs and new businesses to the country. If you’re looking to set up a lower-cost international operation, an outsourcing team, call center, financial services or Fintech company, Mexico should be at the top of your list.

By way of background, I have operated this business from Panama, San Diego, CA, and Tijuana Mexico. We now have offices in Puerto Rico and Mexico City (in addition to TJ). I’ve been in the offshore industry since 2003 and can tell you from experience that Mexico has become a top tier offshore business jurisdiction.

If you ignore the political hype between the US and Mexico, you’ll find that the new President is pro-business and cutting red tape right and left to facilitate business in Mexico. This is especially true in Baja California, the state where Tijuana is located and where I chose as my home base. I like to say that we’re on the hard-working and fun side of Trump’s wall.

Here are the 10 reasons to move your business to Mexico in 2020

Cheap Cost of Labor

Mexico is a top tier business jurisdiction because of the availability of cheap labor. Costs are a fraction of the United States and English is readily available, especially in Baja California. The further south you go, the more difficult it becomes to find low-cost English speakers.

Note that I say, “low-cost” English speakers are more available in Baja. This is because English is common in the border region. However, if you’re looking for high-level English speakers, such as engineers and PhDs, they are more likely to live in Mexico City and Monterrey than Tijuana.

The average annual salary for an engineer in the United States is $85,663 dollars. The average annual salary for a mechanical engineer in Mexico is $298,500 pesos or the equivalent of $15,514 US dollars.

This means that an engineer without a specialty makes almost five times more than an engineer with a specialty degree in Mexico. This is just one of the many professions were salaries are substantially lower.

You can save a lot of money if you move your business from the United States to Mexico, and thanks to the excellent universities that they have in the country you won’t struggle in finding quality employees for your business.

Cheap Cost of Living

Living in the United States has become increasingly expensive in the past few years, especially in California. Americans are dropping their dreams of living in a big house with a big garden for living in a small crowded apartment.

Mexico is a very cheap country to live in. The cost of rent in Mexico is nothing compared to one you can find in the United States. You can live in an excellent apartment for less than $800 dollars a month. I am talking about a two bed and two bathroom place.

For this reason, it might come as no surprise that many Americans are choosing to live in Mexico, bringing their portable businesses with them or commuting to the United States as necessary. In fact, thousands of Americans live in Mexico and commute to the United States every day.

This is what I do… live in Tijuana and drive into San Diego or Los Angeles for meetings. If you have a Sentri pass, border wait will be about 15 minutes. If you don’t have Senri, the wait will be hours if you drive. But, you can walk across and take a trolly into the city in a few minutes.

You’ll find that the number of Americans in Mexico has pushed up the costs of living in cities like Tijuana, but it remains a fraction of San Diego. If you don’t need to commute to the US, the cost of housing and the quality of life is better further south.

Strength of the US Dollar in the Country

As I mentioned before, Mexico offers American entrepreneurs the cheap cost of labor, living, and rent, and all of this is very accessible to American entrepreneurs because the US Dollar has been going upwards in the country.

One US Dollar equals approximately 18.50 pesos and this is probably going to go up. Because of the proximity between both countries, and the economic relationship, movement in the dollar has an impact on the peso.

Luckily, the American economy has been doing great, meaning that the US Dollar has been very stable in Mexico. The US Dollar is accepted in most businesses around the country and sometimes they will even set their prices in dollars.

Investing using American currency in Mexico is a great benefit that you won’t be able to find in many countries. What better way to manage your portfolio than to do so with the currency of your own country.

Entry into the Latin American Market

Mexico is the largest Spanish speaking country in the world and the second biggest country in Latin America. By investing in Mexico you building a base from which you can sell into the Latin American market.

There are many different treaties between Mexico and many countries in Latin America that are not shared by the United States. If you decide to open a company in Mexico you can use those treaties to your advantage.

Latin America is a large and great place for an American to expand their portfolio. There are so many opportunities in that market that you won’t be able to find in the United States such as the vast natural resources found here among many other things.

Similarities Between the US and Mexico

Culturally, Mexico and the United States could not be more different. Despite this, the way that business is done in Mexico is very similar to how it works in the United States as Mexico adopted many of its practices from the American economy.

It is a blessing for many American investors when they come to Mexico and realize that they do not have to make any changes in their business plan as the business and market strategy tend to be the same.

The Mexican stock market also works quite similar to how the American does. Even to the point where if there is a drastic drop in Wall Street the whole Mexican stock market will feel the impact.

Vast Natural Resources

One of the many attractive things about investing in Mexico that you will find is that there are a huge number of vast natural resources in the country. Meaning that you can establish a company in Mexico with the sole purpose of exporting natural resources back to the United States or anywhere else in the world.

Thousands of American companies are already doing this and are thriving in great ways by doing so. Mexico might have a big number of natural resources, but they lack the machinery to exploit all of these.

American investment is widely accepted because of this reason, as the country and the company benefit hugely. Just like in the United States a good proposal needs to be approved in order for you to continue operating in the country.

There are 31 states in Mexico and every one of them has something different to offer depending on your needs. I would recommend a great deal of research before you decide to invest in Mexico’s vast natural resources.

Promising New Presidency

Two years ago Mexico had a very polarizing presidential election, quite similar to the one that happened in the United States. A great number of Mexicans support the new president and hail him as a hero of change, and others loathe him and consider him the worst thing to happen to the country. As I said, very similar to the United States.

Mexico’s new president is promoting innovation and the creation of new jobs in the country by cutting red tape and inviting foreign investors to consider Mexico. This has not had the quick reaction that his political party might have hoped for, but it is slowly gaining traction.

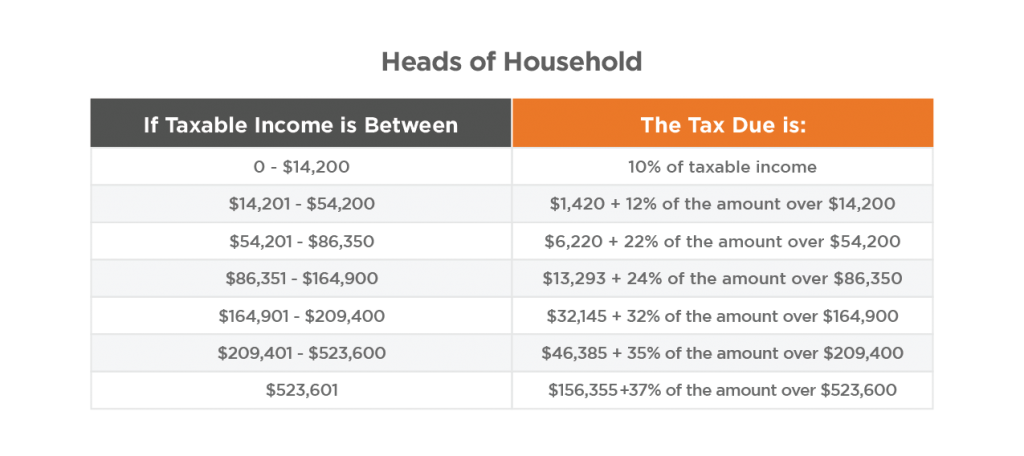

Many of the changes will apply to small businesses, new and more efficient structures, and great opportunities for FinTech businesses under the Mexican SOFOM. In my opinion, the best changes are related to financial services, crypto exchanges, money transfer and remittance businesses, etc.

His presidency is still very young and we will have to wait to see if he fulfills his promises, but right now things are looking bright. His political party does not want to be a one-trick pony so they are doing whatever it takes to please the people of Mexico. Creating new jobs through foreign investment is a great way to have voters on your side.

Growing Economy

Mexico’s economy continues to grow despite its change in the presidency and the impact that the American economy has on the country. Mexico has been growing at a rate of 0.3% for the past decade.

That number might seem small, but it gives an insight into what is happening in the country. Small nonrisk investments govern the market at this moment and will continue to do so in the long run.

Financial institutions all over the country have benefited greatly over the growth of their sector and will continue to do so. If your idea is to start a financial institution outside of the United States I recommend doing it so in Mexico.

Proximity to the United States

The main reason why you are probably considering to invest in Mexico is because of its location. Mexico is attached to the southern part of the United States share one of the biggest borders in the world.

Even though the United States has another neighbor, Canada, Mexico is very different in many respects to both of those countries to make it a very interesting and promising option for investment.

All of the major American Airlines have direct flights to Mexico City so you can be in the country in less than 5 hours, depending on your location. Also, thanks to its proximity to the United States residents of Mexico already know how business is done in America so you will not have to alter your business plan in the slightest.

From my office in Tijuana, I can walk to the border and be across in 15 minutes. The wait time and the pedestrian crossing is less than 5 minutes on weekdays and less than 30 minutes on weekends. The line to drive across is a different story unless you have a Sentri pass.

The proximity is a great advantage as you can take care of your business without leaving the United States. It’s also excellent for nearshore outsourcing and those, like me, who need to go to meetings in San Diego and Los Angeles regularly.

Complete Control

The tenth reason to do business in Mexico is that you can now have complete control over your operations. In most industries (not including banking or financial services), you no longer need a Mexican partner. Likewise, you don’t need a “bankers trust’ fideicomiso to hold real estate investments.

For Fintechs and financial services companies operating through a SOFOM, all you need is a local representative. You give them a few non-voting shares and give up no control. This is a great improvement from when a Mexican person had to own 25% to 50% of these businesses.

It’s become much easier to set up and control businesses in the country. Back in the day, doing business in this country was a real challenge. Ease of business has improved greatly in the last two years and every sign is that this will continue throughout 2020.

For more on setting up a company in Mexico, see Step by Step Guide to Incorporating a Business in Mexico

For these reasons, and improved quality of life, I have chosen Mexico for my business. I plan to continue to expand and invest in Mexico. I highly recommend this country as an efficient option for international expansion.

I hope you’ve found this article on reasons to move your business to Mexico to be helpful. For more information, or for assistance on investing in Mexico, contact us at info@premieroffshore.com or call us at (619) 483-1708